The First Decentralized Finance "DeFi" Index Fund Is Here

With the rise in bitcoin over the last several months happening at the same time as the GameStop fiasco, there has been a lot of talk about the idea of decentralizing finance. In fact, we recently just wrote about crypto flash loans, which were a decentralized way to lend money to arbitrage coin prices.

Now, the Bitwise DeFi Crypto Index Fund marks the first index fund that offers exposure to companies and securities involved in decentralized finance, or DeFi. Decentralized lending is the lending of money to one another without the involvement of a third party.

The trend has "boomed in use," according to Bloomberg.

Bitwise’s Matt Hougan says the fund will help to smooth out some of the risk in picking names in a new space: “There’s going to be issues, not everything’s going to work out, there’s probably even going to be some blow-ups, but you want exposure to the theme. So a diversified, index-based approach can make all the sense in the world. You don’t have to monitor it, the index rebalances on a monthly basis, you don’t have to watch to see what new hot asset is emerging.”

And several names in DeFi have already blown up, including one exchange called SushiSwap, which saw its creator cash out only after luring "hundreds of millions" in user funds to it.

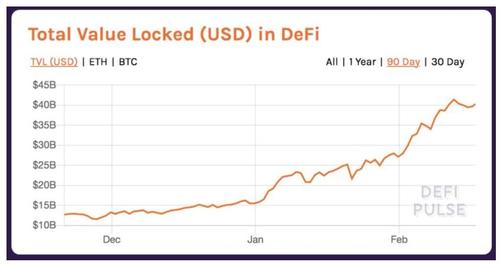

But U.S. dollar value involved in DeFi has rocketed - and is now up to $40 billion from about $11.6 billion in late November. Major crypto investors like Mike Novogratz are optimistic about DeFi's promise going forward. The new fund has an expense ratio of 2.5% and its holdings include Aave, Synthetix and Uniswap.

Recall, in writing about flash loans last week, we profiled the new service where borrowers can very quickly take collateral free loans from lenders and use the proceeds for whatever they want, before quickly paying the loan back - sometimes in seconds. The most popular use for these loans has been arbitraging coin prices on different crypto exchanges, according to Bloomberg. But what makes these loans different is that they are "bundled into the same block of transactions being processed on the Ethereum digital ledger and are executed simultaneously".

The loans sometimes take just seconds:

In the example, the transaction gets submitted to the network, temporarily lending the borrower the funds. If the trade isn’t profitable, the borrower can reject the transaction, meaning that the lender gets their funds back in either case. As far as the blockchain is concerned, the lender always had the funds. The user pays blockchain processing fees.“In a way, flash loans make everyone a whale,” said Nikola Jankovic of loan provider DeFi Saver. Another player in the flash loan space, Aave, says it has already processed $2 billion in flash loans just last year alone.

The outlook for the loans is robust, according to crypto investor Aaron Brown: “I can see them becoming big. The same thing exists conceptually in the traditional financial system. I can buy and sell things for many times my total wealth during a day, as long as by the end of the day everything nets out to a positive balance. It’s just with crypto there is no settlement delay, so to do the same thing you need flash loans."

“At the end of the day, flash loans are going to be everywhere,” Stani Kulechov, Aave's CEO, said.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more