Small Cap Best And Worst Report - July 3, 2014

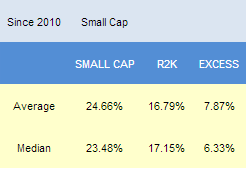

Since 2010, the average return for our weekly best scoring small caps has outpaced the R2K by an average 787 bps in the following year. The top performers from our report one year ago include DYAX up 151%, JAZZ up 110%, UEIC up 64%, and MNKD up 60%.

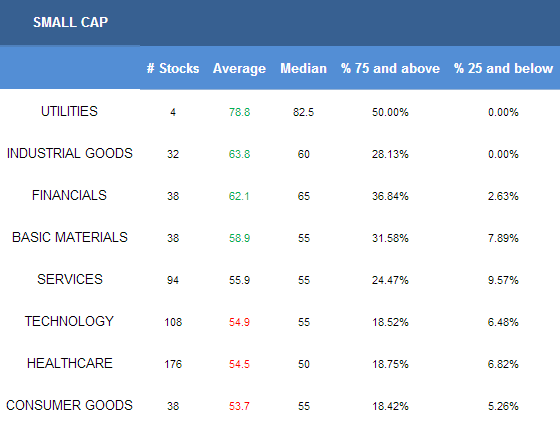

- Utilities are the best scoring sector in small cap.

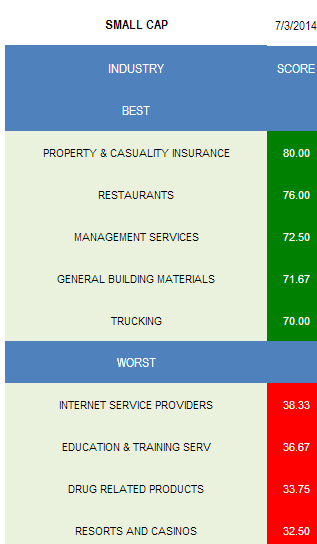

- P&C insurers are the highest scoring industry.

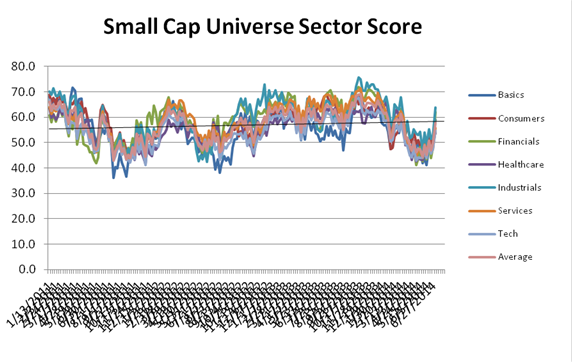

The average small cap score is 56.39 this week, above the four week moving average score of 50.54. The average small cap stock is trading -23.24% below its 52 week high,

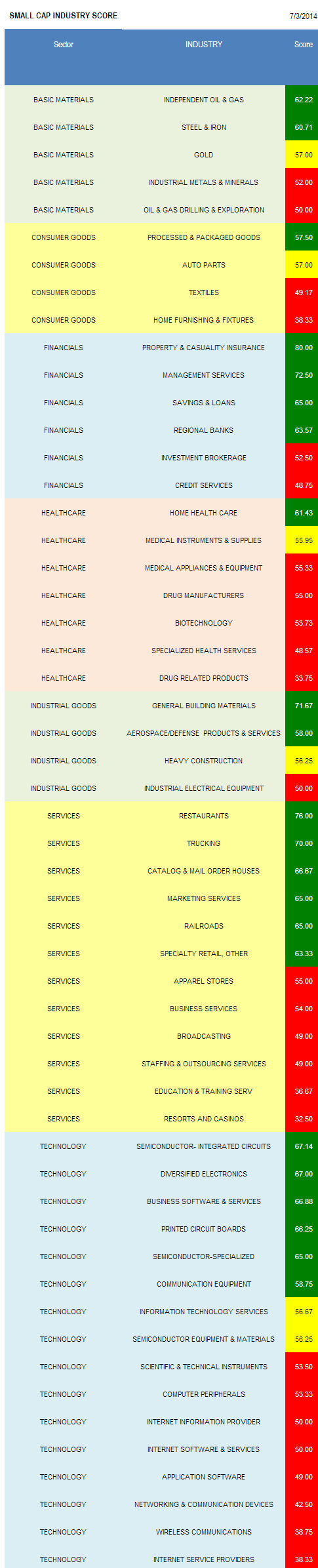

Utilities, industrial goods, financials, and basics score above average. Services score in line. Technology, healthcare, and consumer goods score below average.

The following chart shows historical small cap scores since 2010.

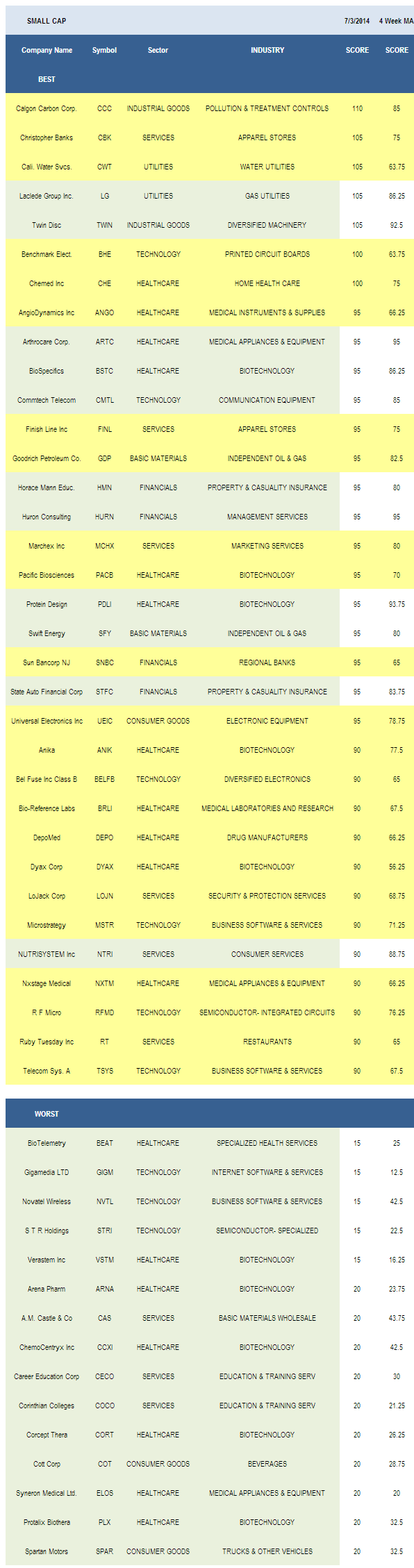

The best small cap industry is P&C insurers (STFC, HMN, MIG). P&C insurers tend to benefit from summer storm season, which supports rates. Restaurants (RT, SONC, RRGB) offer upside on improving foot traffic and same store sales. Management services (NCI) are strong. General building materials (HW) benefit from improving construction spending. Trucker (MRTN) volume and pricing continues to support profit growth.

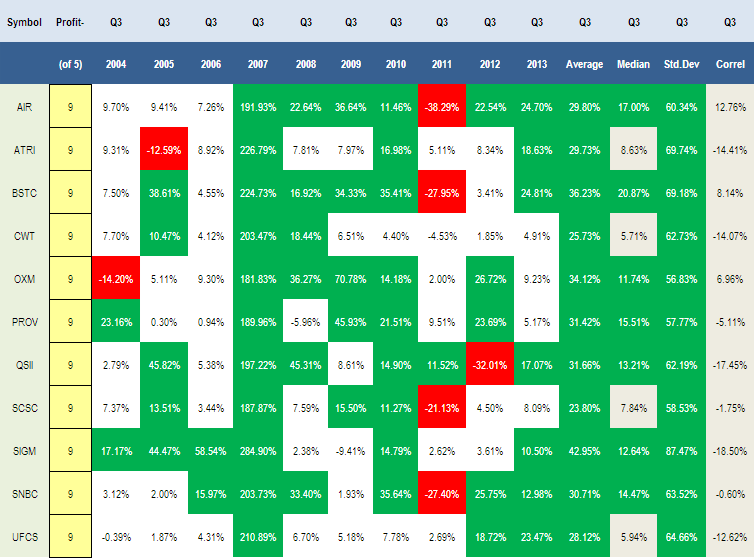

The following table breaks out small caps offering the best third quarter seasonality. All the stocks in the following table have posted gains in 9 of the past 10 years during the quarter.

In small cap basics, independent oil & gas (SFY, GDP, CRK) and steel & iron (AKS, NWPX) score best. In consumer, buy processed & packaged goods (DMND). In financials, concentrate on P&C insurers, management services, and savings & loans (BRKL, WIBC, PROV, BANR). In healthcare, buy home health care (CHE, GTIV, BIOS). In industrial goods, buy general building materials and aerospace/defense (ORB, AIR). The top scoring industrial baskets are general building materials and aerospace/defense. Restaurants, truckers, and catalogs (NSIT) score best in services. In technology, buy semi ICs (RFMD, DIOD), diversified electronics (BELFB, SIMO), and business software (TSYS, MSTR, NTCT).

Disclosure: None.