Rousseff Coup Could Cause Fitch To Junk Brazil

When it rains, it pours for Brazil. The country's economy has been negatively affected by global deflation. Now comes political turmoil. According to Bloomberg, a group of high-powered lawyers have filed a request to impeach President Dilma Rousseff:

While at least two dozen impeachment requests already have been filed, this one is different because of who is submitting it: lawyer Helio Bicudo, a prominent former member of Rousseff's Workers' Party, and former Justice Minister Miguel Reale Junior. The nation's largest opposition party supports the petition. A previous request by Bicudo and Reale had focused only on alleged budget tinkering through last year, leaving legal uncertainty over whether a sitting president could be held liable for acts during a previous term.

Accepting the petition could take weeks and would trigger a protracted legal process. Nonetheless, the process could become a big distraction for the government at the worst possible time.

The Situation

Brazil in dire staits. State-owned Petrobras (NYSE:PBR) has been embroiled in a corruption scandal that has cost the oil giant billions and has been an embarrassment to Rousseff's regime. While executives reportedly profited from bribes and kickbacks, Petrobras is laying off workers and cutting supplier contracts in order to stem cash burn.

As global deflation has set in, prices for commodities and oil - two key export items for Brazil - have plummeted. Worse, during her regime, Rousseff failed to wean Brazil off its dependence on selling commodities to China. China's economy has slowed, meaning it will probably demand less export items from Brazil. Fears of a slowing economy have caused capital flight from Brazil to safe havens like the U.S. dollar. The Brazilian real has depreciated by about 38% against the U.S. dollar over the past year.

The sinking currency will make it even more difficult for Brazil's corporations and local municipalities to repay $300 billion in dollar-denominated debt accumulated when credit was cheap. In my opinion, potential defaults on such dollar debt could be a black swan for the U.S. markets.

S&P Downgrade Was A Wake-up Call

Last month, S&P downgraded Brazil's sovereign debt to junk levels. It cited, amongst other reasons, political wrangling and an unwillingness to submit a 2016 budget with "significant policy correction." Debt-to-GDP had increased from 59% at year-end 2014 to $65% in July. This came as the economy was expected to contract 2.3% in 2015. Secondly, the previous budget showed a deficit of 8-9% (including interest expense).

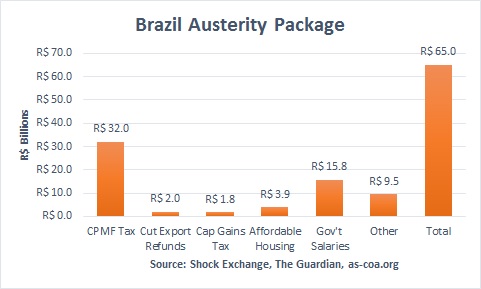

Finance minister Joaquin Levy later countered with a R$65 billion austerity package that featured a mix of cost cuts and tax increases; the plan is expected to generate a 0.7% surplus (excluding interest expense) in 2016.

The austerity package sounds nice in principle, but the caveat is that Brazil needs the support of Congress to get the plan approved. The government must execute the plan, which won't be easy given a populace upset that it has to bear the brunt of the government's mismanagement.

Fitch Could Be Next To Junk Brazil

Earlier this month, Fitch lowered Brazil's sovereign debt to "BBB-" with a negative outlook - one step above junk levels. Fitch cited Brazil's "complicated political backdrop" and weak fiscal goals. My interpretation was that it wanted to see: [i] an end to the political gridlock; and [ii] significant progress towards implementing the government's austerity package.

Facing another coup attempt, Rousseff could spend months fighting for her political life. That means she could have less time to sell Congress on the austerity plan, and less time to spend on executing it. If either one of those scenarios plays out, Fitch may be next to junk Brazil.