Rates Spark: BOE Takes Centre Stage

As we expected, there were no new measures from the BOE today but a decision to add QE will likely have to be taken by July. GBP money market functioning has improved. It has also improved dramatically in the US. There are bills to pay though, as we saw from the $3bn Q2 financing ambition for the US. We see curve steepening from both ends.

BOE: no pressure to act, for now

The MPC met in a relatively benign market environment and decided not to change policy today. We would not blame its members for feeling satisfied with the way things have turned out in financial markets since they unveiled an unprecedented array of easing measures. This is all the more noticeable that, since the last meeting, the UK has overtaken other European countries as the most affected by the pandemic, and growth expectations have generally been cut dramatically.

So no pressure to add stimulus then? Well, not in the near term at least. As our UK economist pointed out, the committee used its forecasts to signal only a gradual recovery after the Q2 slump, and it resorted to scenario analysis to avoid taking a view on the length of lockdown measures. The prevalence of downside risks should make a strong case for keeping their finger close to the ‘ease’ button.

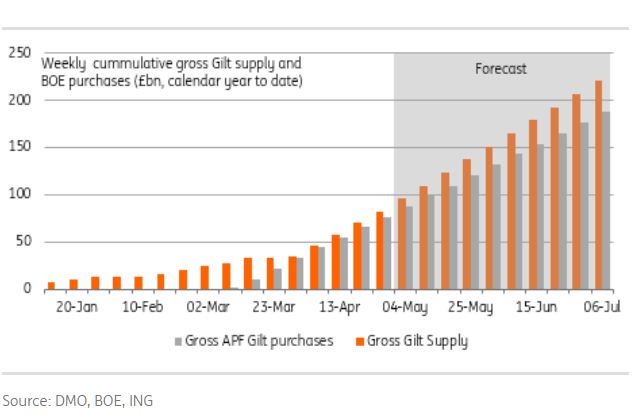

The BOE has bought almost all Gilts issued this year

Gilt and CP purchases at full speed

At the current pace, we estimate the BOE will spend the total £200bn envelope announced in March by early July. The speed at which purchases are carried out has allowed it to absorb the equivalent of all the Gilts that were issued since January. The question of an extension will arise quite quickly however. The BOE has the choice between tapering purchases to avoid a cliff effect in July, or to boost purchases. Given the additional borrowing planned by the DMO, we’re leaning towards the latter. This is also what the two MPC members voting for boosting QE by £100bn suggests. We're expecting this view to gain traction.

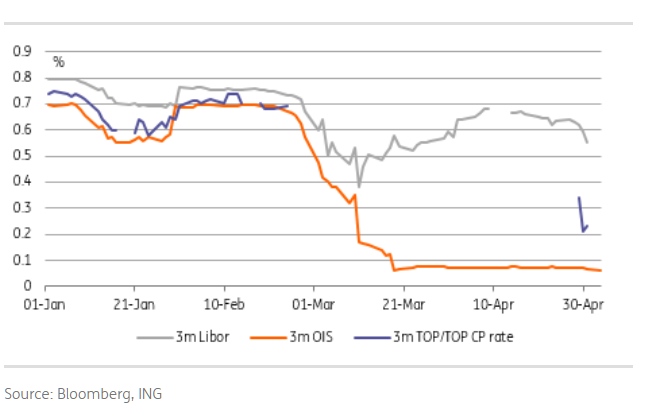

There have also been signs of improvement in GBP (FXB) money markets. The BOE commercial paper (CP) purchase programme was holding nearly £16bn as of last week which compares favourably to the £2.3bn peak reached in the first iteration of the programme in 2009. As we have written at the time of its launch, we think the design of the facility means it will continue driving CP rates lower and so help activity recover. The publication of TOP/TOP CP index rates after a two month hiatus is an encouraging sign.

And financial conditions have improved

US supply pressure - coming clean on what's needed

Late yesterday (European time) we sent out a note on the latest US refunding ambitions. See it here. There is a $3trn hole to fill in Q2. To get there, issuance in all guises will be increased, including a new 20yr, and greatest duration weighted pressure is on longer maturities. Hence the steeper curve. Helpfully, the Fed has said it will add the new 20Y tenor to its SOMA purchases. There is less intent to increase issuance in TIPS though, indicative of a dearth of demand there as a dis-inflationary inclination dominates (despite food-related supply pressure).

There is some ambition to look at SOFR-linked FRNs ahead, as an additional avenue from funds. But the biggest unspecified increase in supply will be in bills, as has been the case in the past month or so as the Treasury built up a cash buffer approaching $1trn. Thankfully, this is a very receptive area right now, as ample liquidity is likely to get parked there. Instructive that the 2yr yield continued to edge lower yesterday - the curve is steepening from both ends.

Today's other events: ECB before EU parliament, bond auctions

As if PEPP wasn't enough, the German constitutional court’s ruling on the PSPP has added spice to ECB VP de Guindos’ appearance before the European Parliament today. He will present the central bank’s 2019 annual report to the Economic and Monetary Affairs committee, and may well face questions on how the ECB plans to deal with the new situation, although the FT reported yesterday that some council members favoured not responding directly to the ruling, for fear of compromising the central bank's independence.

The strategy of recent communication appears to be that of reassurance, not just for a continuation of current policies but by even adding the pospect of more to come. ECB’s Villeroy stated yesterday that the bank likely has to do more to boost inflation, and it will be as “flexible” and “innovative” as necessary. He was the one who said last month that the period of low inflation ‘in the coming years’ will allow the ECB to keep rates low and liquidity abundant.

The auction volumes of today’s government bond sales come as a gentle reminder of the ECB’s important role in keeping mounting debt levels affordable. France will auction up to €11.5bn across four bond lines from 8Y to 40Y maturities. Spain will sell €5.5-6.5bn in 3Y to 30Y bonds and another €0.25 to €0.75bn in an inflation linked bond reopening. Yesterday, alongside a €4bn 5Y tap Germany also sold €7.5bn in a new 15Y bond via syndication, the first conventional bond to be sold by the German debt agency in this manner. It collected orders of €35.5bn.

Overall we expect the Eurzone (EZU) governments to issue around €1.1trn in bonds in 2020 as crisis measures need to be financed. That figure may still rise furter, but at the current juncture it is already close to a quarter of a trillion euros higher than what we had envisaged at the start of the year.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more