Market Briefing For Tuesday, April 21

|

Executive Summary:

Oils not well - and won't be swell anytime soon. That's a revealing factor for months now about the heaviness in economic activity (first most so for Asia, and then Europe, and thereafter here). That's why I mentioned OIL as far as hints about future recovery (for now the 'contango' reflects the break in the economy with demand for oil basically almost nothing for now).

Aside oversimplification of the issue, storage is absent and if I had storage tanks in the Oil Patch these days, I'd probably gladly pay trucking costs to fill them (if anyone would actually pay me to take the oil). Of course these are futures markets and distorted from reality. If anyone can 'actually' be paid $37 or more 'to take the oil', sure I would... but that's delivery not the futures market. Everyone asks who makes money on this?

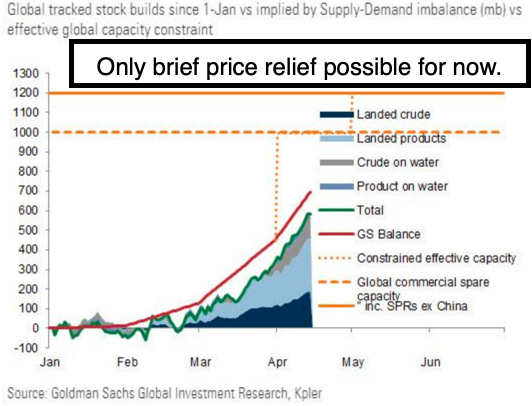

Storage tank holders; such as Goldman Sachs (GS) who has tankers (mostly offshore) who are probably happily going to hold the oil, if they have space for more deliveries, hoping to sell higher if they've got enough absorption capacity. For most people this just exemplifies how the Oil commodity has dislocated from the 'energy' sector; but the group remains toxic to touch.

It won't be this way always, and reflects market dislocations as eventually will change (in a sense value investor ultimately find stocks of interest, but not as urgent as some think). Mostly, like our economic future, this comes down to 'duration' of the crisis; as few can hold-out for very long. Tuesday should see turnaround attempts. Daily action - featured sobering drama related to oil storage primarily, of course reflecting the lack of need for physical products 'for now'. Low price will carry-on for awhile as there is virtually no demand. The later Summer or Fall, 'at best', will see absorption of already-stored oil rather than giant demand, and perhaps some will see this as what OPEC+ really intended to do, hurt the American oil industry while the nation was already down. Whether there was a Chinese quid-pro-quo or not hasn't of course been discussed anywhere, though they benefit from cheap oil and are not at all in a leveraged situation like those 'actually' in the business.

To try to simplify this again: it's an historic 'contango', which occurs when a further-out oil (June in the 20's but will drop), is more than the front month (spot delivery). Goldman Sachs owns the largest number of storage tanks and tankers and likely is holding all they can (and hoping for fees) until not just oil, but economic matters stabilize. The June WTI will likely rollover after this as well, not right away however. It's all about the 'duration' of the economic struggle, not the Government stimulus which cannot be sustained for long. It all goes back to a medical resolution to the coronavirus, before pent-up anxiety throws up backward. The actual May WTI Oil contract trades were closed days ago by traders, this below zero pricing reflects those compelled to take delivery, not likely related to traders who never want to take physical possession. Perhaps it is those traders desperate and without storage facilities that got creamed.

So does this effect the stock market? Absolutely. Banks and hedge funds heavily loan to various oil or related companies, and commercial property developers too. Aside the glut with nobody driving or flying, it will crush our domestic oil industry even more, leaving us with a shortage of oil a year or two from now when the economy revives reasonably. And hurt lenders not just investors and workers in the oil industry. Short-sighted consumers like cheap gasoline. This kills jobs, so assures them of expensive gasoline later by putting America behind the 8 ball yet-again, with OPEC calling the shots. It's very much 'Depression-like' behavior; again 'crisis duration' key.

So, as I say: watch oil ... and look for an oral antiviral pill to be affirmed as a treatment for Covid-19 without going to the hospital. Social distancing and a lot of debate about other areas is sort of less key or wishful thinking, as again one needs to take 'death off the table' as a fairly significant risk and that is going to help the nation open-up widely 'if' we can get a oral pill to take care-of it, relegating Covid-19 to the status we need. Then vaccine. Conclusion: the duration until opening up and consumption creates what in-retrospect will appear to be an opportunity, though at the costs of lives, and jobs, and fortunes. It's about duration of the emergency and finding a quick antiviral drug that stems the acute nature of the crisis. |