New Oriental Education & Technology Is Regaining Strength

This week we are looking at another of the Investor’s Business Daily (IBD) Top 50 List companies. We use this list in one of our options portfolios to spot outperforming stocks and place option spreads that take advantage of the momentum.

After a brief dip following the latest earnings report, New Oriental Education & Technology is showing renewed upward momentum. The technical charts suggest that the stock is ready to move higher and the Investor Business Daily recently published an article along the same lines: Stock Upgrades: New Oriental Education & Technology Gets High Marks For Relative Strength.

Technicals

New Oriental Education & Technology (NYSE:EDU) has been trading in an upward trend channel since it bottomed at the start of last year. The recent decline that followed the earnings report was held higher by the lower bound of this channel and while the trend channel remains in play, the technical outlook remains bullish. In the past week, the stock rallied above, $131 which was important resistance late last month. In the process, it’s made a sequence of higher highs and higher lows from the January low which supports the view that the stock has resumed within its broader uptrend.

EDU Daily Chart

If you agree there's further upside ahead for EDU, consider this trade which is a bet that the stock will continue to advance over the next six weeks, or at least a little bit.

Buy To Open EDU 20MAR20 130 Puts (EDU200320P130)

Sell To Open EDU 20MAR20 135 Puts (EDU200320P135) for a credit of $2.18 (selling a vertical)

This price was $0.02 less than the mid-point of the option spread when EDU was trading near $13.50. Unless the stock rallies quickly from here, you should be able to get close to this amount.

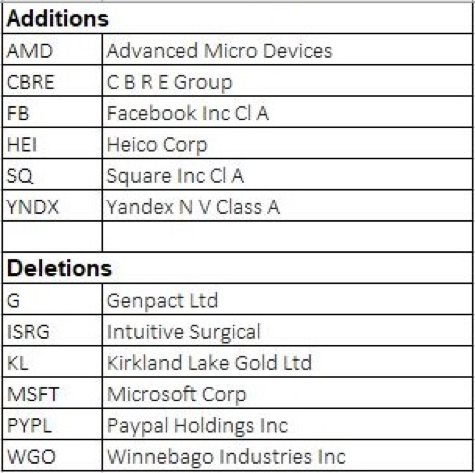

Changes to Investor’s Business Daily (IBD) Top 50 This Week:

Investor's Business Daily Stock List: Additions, Deletions

We have found that the Investor’s Business Daily Top 50 List has been a reliable source of stocks that are likely to move higher in the short run. Recent additions to the list might be particularly good choices for this strategy, and deletions might be good indicators for exiting a position that you might already have on that stock.

As with all investments, you should only make option trades with money that you can truly afford to lose.