Netflix Selling Another $2 Billion In Junk Bonds To Fund War With Disney

Exactly six months after Netflix sold $2 billion in junk bonds, just as the market was starting its Q4 turmoil, the company on Tuesday announced it was selling another $2 billion in high yield debt in what has become a bi-quarterly tradition, in order to fund its cash-burning business and help it expand its already massive content offering as the company comes under growing pressure from media giants including Apple, AT&T and now, the biggest challenger of all, Disney.

While terms of the offering have yet to be disclosed, it will be interesting to see if Netflix has to give generous concessions as it did back in October, when the online streaming service had to offer yields "at the high end" of its price expectations - the first time it has had to do so in its history - mostly as a result of the rout in junk bonds at the end of 2018.

Just like last time, the streaming company said it was selling $2 billion of bonds in a two-part offering denominated in dollars and euros. The proceeds will be used for general corporate purposes - read investing even more in content, production and development as the war with price-indiscriminate market entrant Disney is about to turn nuclear.

It is also worth noting that 6 months ago, some investors - those crazy enough to be worried about fundamentals - reportedly passed due to the company’s growing debt load. Well, after today's offering, Netflix's total debt will rise above $12 billion...

(Click on image to enlarge)

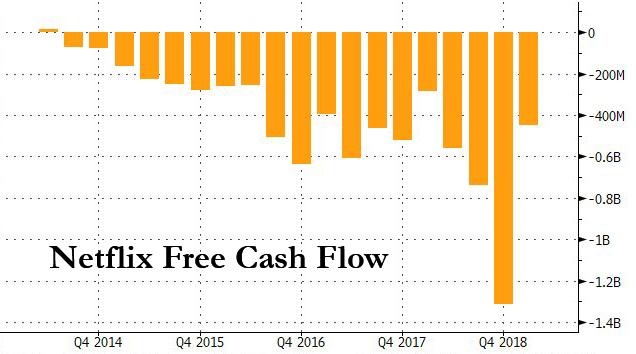

... which would represent a 4x multiple of the company's projected $3.1 billion in 2019 EBITDA (and is a rather generous 7x multiple of NTLX' LTM EBITDA). Of course, the only metric that matters for Netflix is its cash flow, which has been negative for 21 consecutive quarters.

(Click on image to enlarge)

It is worth recalling that just before Netflix announced its last debt offering in October, S&P upgraded the company's credit rating to BB-, saying the streaming leader should see its revenues and profitability grow in 2018 and 2019. So far either has yet to happen, and we wonder if S&P will resume its downgrades of Netflix which will have added $4 billion in debt in the past 6 months.

Meanwhile, as we reported last week, Netflix is coming off a quarter in which its forecast for new subscribers fell short of analysts’ estimates; in response to growing competition and investor demands for profitability, Netflix has been raising prices in its largest territories, trying to shift toward profitability when the competition among other streaming services is mounting. Worse, with Disney now full intent to lose billions over the next few years just to steal Netflix's market share, today's bond offering will be a closely watched litmus test of whether the company's halo among the investing community is starting to sour.

While CEO Reed Hastings recently said the company's traditional semi-annual bond issuance may not last much longer as it "will soon be able to fund itself", that moment isn't coming any time soon as Netflix actually increased its cash burn forecast for 2019, and now expects to burn through $3.5 billion of cash this year, up by half a billion from the prior projection.

It is unclear as of yet which banks will manage today's offering: last time, the lead underwriters were Morgan Stanley, Goldman Sachs, JPMorgan Deutsche Bank, and Wells Fargo. We expect many of the same names to reappear this time as well.