Netflix Reports Weak Guidance As It Ramps Content Spending

Netflix - Another Rally: The Froth Bubbles Further

The stock market rallied again on Thursday. S&P 500 was up 0.76%, the Nasdaq increased 0.71%, and the Russell 2000 increased 0.86%. The stock market is very overbought.

Stocks rallied on the report in the Wall Street Journal that America would lower tariffs on China to get a trade deal. Even though the U.S. Treasury denied this rumor, stocks only gave back some of the gains that were catalyzed by the rumor. I don’t know what to make of this situation because I could see either possibility being correct.

Sometimes reports are wrong; however, this could be the government not wanting to discuss secret plans.

It’s worth pointing out that stocks will probably rally if a trade deal is done. According to Bank of America’s analysis, the stock market has rallied this year because of lower trade tensions.

It is impossible to prove what is causing stocks to rally. My instinct is to believe the rally won’t be as strong at these levels as it would have been at the low on Christmas Eve.

VIX fell 5.15% to 18.06. CNN fear and greed index is at 44 which is near the high end of fear. One more rally will push it to neutral or greed. The market is extremely frothy as the economic and earnings reports look weak. But stocks continue their uptrend. The S&P 500 is up 5.15% year to date; it is now above the high end of what I consider the best case scenario for stocks this year.

Netflix Tells Us About The Market

Netflix (NFLX) is the best signpost for the level of speculation in the stock market because its business is highly leveraged towards growth.

Specifically, Netflix spends money on content to grow its subscription base and watch time. The firm never stops spending which pressures free cash flow and profitability. This extremely aggressive positioning has allowed it to have explosive subscription growth domestically and abroad.

However, a few mistakes can bring the company crashing down.

There was extreme anticipation for this quarter because the firm recently announced it would raise prices in the next few months, because it announced “Bird Box” had 80 million views, and because its stock had rallied 51.01% since Christmas Eve.

Personally, I think Netflix somehow fudged the number of people who saw the movie. Maybe it is counting people who watched it for a few seconds. However, this announcement was great marketing because it was reported by the media as fact.

When consumers hear a movie did extremely well, they become motivated to watch the movie to see what the hype is about.

Netflix Beats EPS & Misses Revenue Estimates

Netflix reported EPS of 30 cents which beat estimates for 24 cents. The firm slightly missed revenue estimates as they came it at $4.19 billion instead of $4.21 billion.

It added 1.53 million subscribers domestically which beat estimates for 1.51 million. It also beat international subscriber additions as they were 7.31 million instead of 6.14 million.

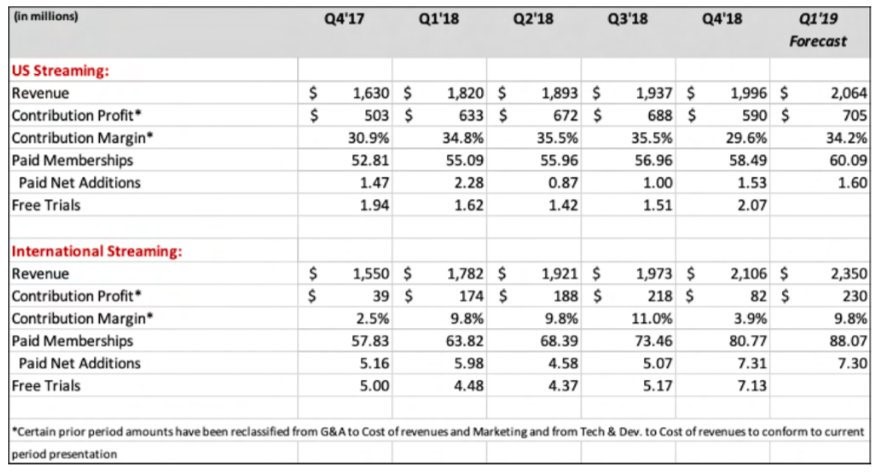

As you can see from the table below, contribution profit fell from $688 million in Q3 to $590 million in Q4. EPS fell 66% sequentially and 27% year over year. The contribution margin on international streaming fell from 11% to 3.9%. Q4 revenue was up 28% year over year.

Netflix - Spending To Grow

Netflix is a very unusual company because it is a growth firm with declining earnings. In other words, it is a growth firm without profit growth. The company has been trading off the number of subscriber additions for years, which explains its meteoric rise.

Just because the stock is rallying, doesn’t mean we should ignore the decline in cash flow and the increase in spending. This doesn’t mean you should short the stock, but it’s definitely worth considering this risk factor.

As you can see from the chart below, non-GAAP free cash flow fell to $-1.3 billion. The firm has had negative free cash flow since June 2014. In the long run, investors are betting the firm can raise prices quicker than it grows content costs. To be fair to Netflix, its service is very sticky.

Netflix - Millennials love Netflix’s content.

It is the leader in the cord cutting phenomenon. That’s where people stop paying their cable bill, and just pay for over the top services like Netflix, Hulu, and YouTube.

The worst part of the report was that the firm guided for $4.49 billion in Q1 revenue and 56 cents of EPS. That missed expectations for 82 cents in EPS and $4.61 billion in revenue.

Considering the weak guidance, slight revenue miss, and huge run up into the quarter, the stock’s 3.82% decline after hours is meaningless. We’ve seen the stock fall much more on weak guidance. Profitability guidance miss occurred because the firm is investing heavily in content. T

he good news is the firm stated its negative free cash flow would stabilize at $-3 billion in 2019 and recover after that.

Netflix Thinks Differently About Competition

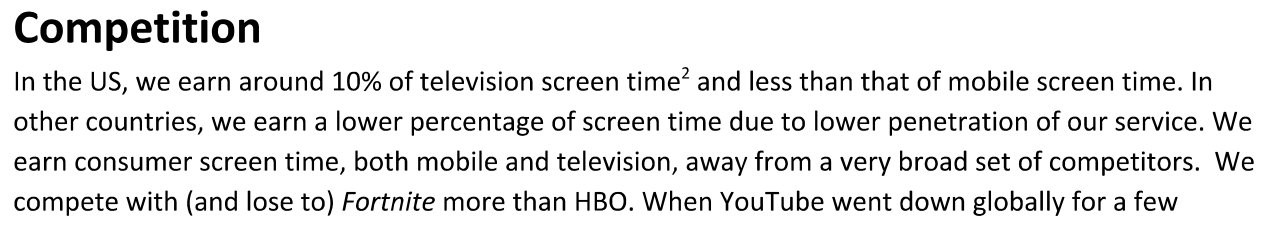

Netflix has always thought differently about its competition. I think this is a big reason for its success. As you can see from the firm’s statement below, it thinks it competes with Fortnight more than HBO.

That’s because Netflix views any form of entertainment as competition. This broad understanding should make investors feel less squeamish about Disney’s streaming platform that will be released late this year. I think that by viewing itself as an entertainment company instead of a streaming company, it opens itself up to try new things instead of sticking to the industry standard.

That mindset is how it got away from physical DVDs and into streaming.

Netflix - Conclusion

Netflix’s rally in the past few weeks tells about the current froth in the market.

If it doesn’t sell off hard on its guidance miss, it means the optimism remains. I don’t have an opinion on Netflix because I love the platform, but don’t like its valuation. I think whatever opinion you have on the stock, it is always a trade and never an investment.