Nestle: Can This Defensive Stock Boost Your Portfolio’s Return?

I think it’s safe to say everyone knows Nestle (NSRGY). Whether it’s from their sweets or beverages, you probably had a taste of their doing. The company owns a multitude of performing brands and provides investors with sustained returns. The company recorded a 3% organic sales growth that showed through an increased dividend yield. Now in it’s 24th year of increase dividends, management also pursues a greener initiative with renewed environmental targets. Overall, Nestle seems to get a balanced growth and might benefit investors portfolios that are seeking a defensive stock.

Source: Pixabay

Understanding the Business

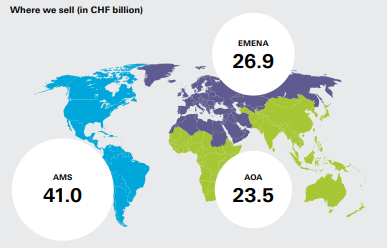

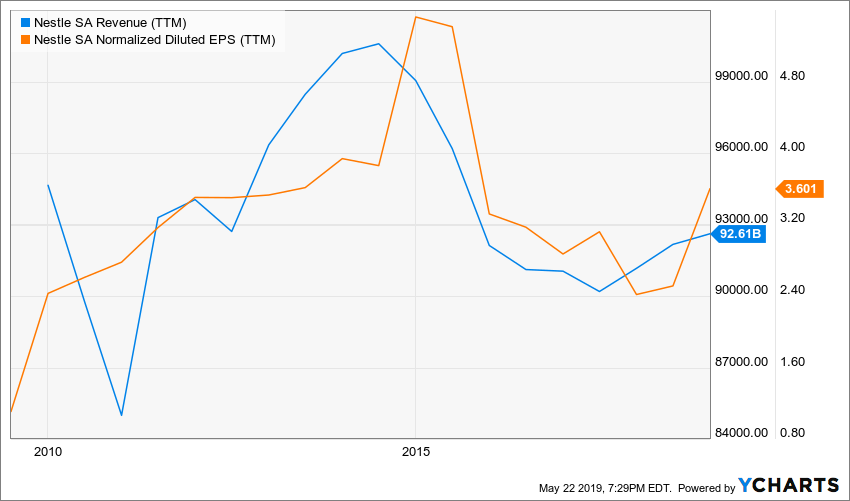

NSRGY has been around for more than 150 years now, offering a wide variety of food and beverages in 190 countries. Their brand portfolio is impressive, owning many well-known worldwide brands. Only to name a few, Nescafé, Perrier, Carnation, Kit Kat, Vittel and many more. NSRGY recorded sales of CHF91.4B in their 2018’s financial year. 24% came from powdered and liquid beverages, 18% from Nutrition and Health Science and 14% from Milk and Ice cream products. Another 14% came from Pet Care and the remaining split between prepared dishes, Confectionery and Water.

Source: Nestle’s 2018 Annual Report

The company now employs around 308,000 employees around the globe. Management relies on them to achieve their ambitious 2020 growth goals, as well as their community commitments. The company also wishes to reduce their greenhouse emissions and waste disposal level.

Growth Vectors

Having many segments, NSRGY created growth strategies unique to each of them. On a broader level, management wishes to focus on food, beverages and nutritional health products. Sustained investment in high-growth categories like coffee, pet care, nutrition and water are to be expected. Management also sees potential growth through innovation, which will help them to stay ahead of their fast-paced environment.

Acquisitions are also to be expected. Non-organic growth was an important factor in 2018, delivering high returns all across their investment portfolio. Acquisitions of Starbucks licence of packaged goods, along with Atrium Innovations, a vitamins and supplement leader, were huge contributors to their growth. Divestures in some businesses such as Gerber Life and their confectionery line also are part of future growth plans and strategic investment.

Dividend Growth Perspective

On a dividend perspective, NSRGY does deliver strong numbers. Annually declared dividends, the company has been handing out dividends since 1873. The company is now in its 24th year of increased dividend with the most recent one being of CHF2.45.

Source: SeekingAlpha

NSRGY’s dividend yield reached 2.54%, placing the company on top of its competitors, with an average of 1.69%. This 2.5% yielder is in a good position to sustain such yield. Although it may sound low, the food and beverage industry doesn’t usually offer much higher than this. If you look at the complete DSR consumer defensive stock list, you will find many great companies offering yield below 2%.

The company’s payout ratio now sits at 82%, which can be seen as high for a defensive company. Looking at management’s growth plan, we might see that figure go down slightly. While this can make concerns rise, this might actually be a good thing for value-seeking shareholders.

Potential Downsides

As it is often the case with food businesses, a major potential downside relies in their products themselves. Health concerns, low quality and food safety remain the main avenue of potential risks for NSRGY. Built on a strong brand recognition and quality products, their production and distribution chain must always meet the highest standards. Having such a strong brand portfolio also has its disadvantages!

Another source of risks for the company is within countries’ legislation. Whether it’s from health standards, environmental or products ingredients, they must abide and transform their operations in order to meet those requirements. These types of events can quickly put liquidity at risk, as well as their integrity as a major food manufacturer.

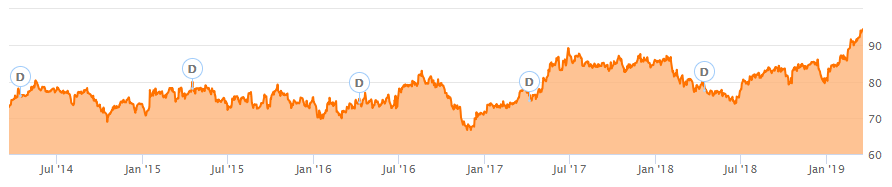

Finally, as the stock rapidly surged in the past few months, Nestle could be a good candidate for profit taking. Entering a new position at the current price could expose you to additional fluctuations.

Valuation

Determining the right value for an international stock like Nestle is not an easy task. I’ve used the dividend discount model, but I considered a dividend paid in USD. Therefore, depending on the time of purchase and the current exchange rate, your calculation could be completely different.

| Input Descriptions for 15-Cell Matrix | INPUTS | |||

| Enter Recent Annual Dividend Payment: | $2.44 | |||

| Enter Expected Dividend Growth Rate Years 1-10: | 5.00% | |||

| Enter Expected Terminal Dividend Growth Rate: | 5.00% | |||

| Enter Discount Rate: | 10.00% | |||

| Discount Rate (Horizontal) | ||||

| Margin of Safety | 9.00% | 10.00% | 11.00% | |

| 20% Premium | $76.86 | $61.49 | $51.24 | |

| 10% Premium | $70.46 | $56.36 | $46.97 | |

| Intrinsic Value | $64.05 | $51.24 | $42.70 | |

| 10% Discount | $57.65 | $46.12 | $38.43 | |

Please read the Dividend Discount Model limitations to fully understand my calculations.

Unfortunately, Nestle doesn’t seem to offer a buying opportunity at the current price. Shares have been rising for several years now with little pauses. As the stock gets closer to $100, there is definitely no deal here.

Final Thought

NSRGY has built an impressive business that is now known worldwide. Their food and beverage segments are doing well and still show growth for the upcoming quarters. As it is often the case in a mature industry, acquisitions are to be expected as management mentioned it in their latest annual report. A balanced growth between organic and external is something the company has been looking for.

The company isn’t offering a high yield (~2.5%), but the stable increase is interesting. Still, you can find similar businesses such as Procter & Gamble (PG) or PepsiCo (PEP) in your own North American backyard. You can find more reasons why I think you don’t need to pick international stocks here.

Disclosure: We do not hold NSRGY in our DividendStocksRock portfolios.

Disclaimer: Each month, we do a review of a specific ...

more