Nasdaq Breakout At The End Of Last Week

Friday was a clear victory for the Nasdaq with a breakout to go along with higher volume accumulation and a close above the 200-day MA.

Nasdaq technicals retained their net positivity and it will take a sharp loss Monday or Tuesday to undo this positivity. Step-by-step, this nascent cyclical bull market grows in strength.

The S&P (SPX) has edged closer to a breakout of its own. It now finds itself up against resistance and close to negating the 'black' candlestick from December. Technicals continud to improve, although the index is still underperforming relative to the Russell 2000.

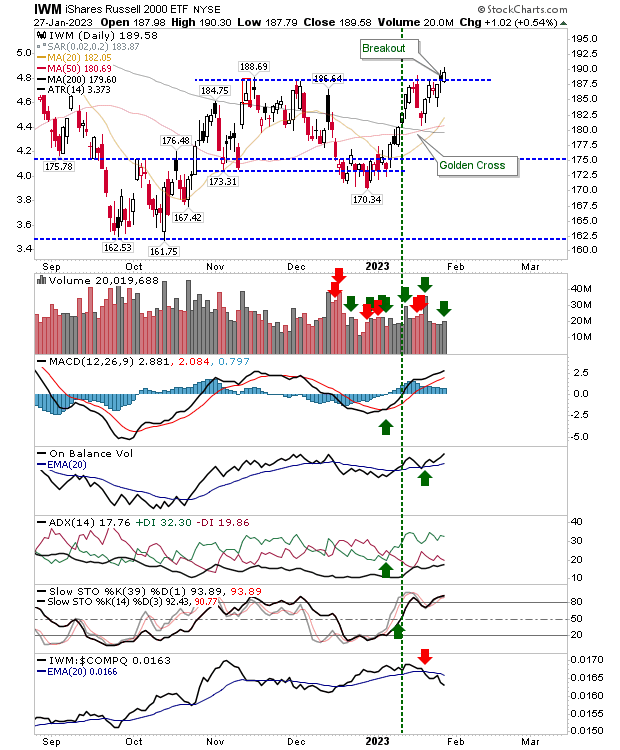

The Russell 2000 (IWM) retained its breakout, this time, doing so with a candlestick which negated the bearish implications of Thursday's 'black' candlestick. Volume rose to register as accumulation, although the index lost further ground relative to the Nasdaq. Despite this, growth stocks look to be in good shape.

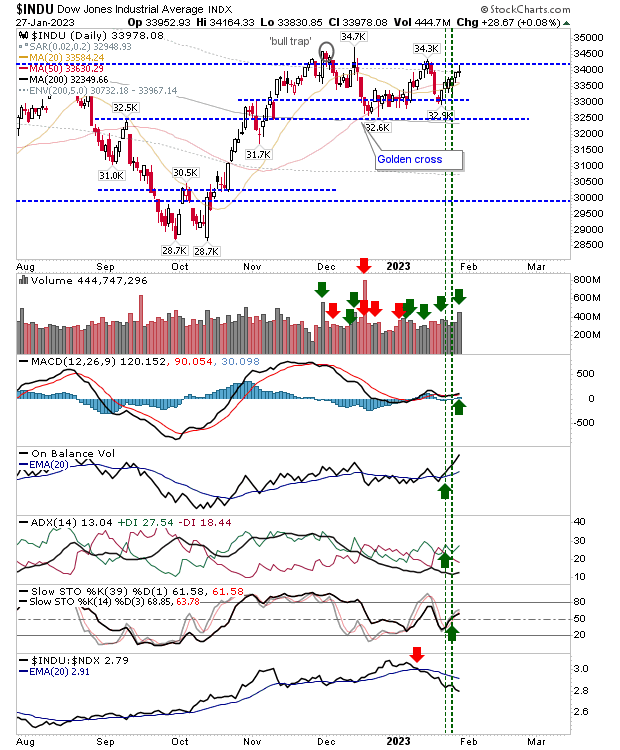

With the Nasdaq and Russell 2000, the once leading Dow Jones Index has slipped back a little. The index remains range bound, but technicals are net positive and Friday registered as an accumulation day. Should the Russell 2000 and Nasdaq continue to gain, then I would expect the Dow Jones (and S&P) to follow suit.

With the Nasdaq performing strongly, we have the Semiconductors (SOX) in assistance. Attempts by sellers to reverse the breakout have so far, failed. Technicals are net bullish and semiconductors are outperforming the Nasdaq 100. It's a solid setup and has the added benefit of a 'golden cross' between 50-day and 200-day MAs.

With markets continuing to improve the one thing to watch for are 'bull traps`; i.e a reversal of recent breakouts with a close below breakout support. Until this happens, bulls remain in control as new - larger bases (building off all-time highs) - take shape.

More By This Author:

Russell 2000 breakout?

Buyers Build Momentum Towards Resistance Challenges

A Tick In The Calendar As Today's Non-Event Keeps Markets On Track For Breakouts

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary ...

more