My Best Advice For Millennials To Get Ahead

I have two Millennial children at the very youngest end of that generation's age range. So, this is really the advice I am giving to my own children. I hope the rest of you find it useful, I think you should.

First Things First

There is a lot of shade thrown at you Millennials. Why? Because frankly, you seem a little aloof and lazy from lookers on. I actually know that's not really true, at least not for most of you, but clearly, there are some slackers, so what? I'm an older Xer and slacking was sort of our thing as we carried our latch keys. It works out for most as we get bills to pay. Anyway, the slackers aren't reading this, so let's move on.

There is also an idea that you are hard to work with. I think that carries some weight. I talk to dozens of managers and business owners every year, a common refrain is that you require a lot of hand-holding early on and then demand independence and some authority shortly after "getting it."

Here's advice number one - you're smart, so find a way to bridge the divide between how you learn and how older folks teach. Remember, they didn't grow up on the information superhighway, they rode their bikes. You are the junior person in most cases, so be understanding and humble, but keep forging along, gain experience, hone your skills and build connections in person. There's going to be a lot of opportunity for you as the Boomers finally retire over the next decade.

Here's something else I hear from others and experience in person. You sure do need a lot of affirmation.

I played that video because it's old SNL and old SNL is the best SNL. Why is old SNL the best, because I'm getting old. Remember that. And remember not to grab people without some sort of real permission, it'll get you kicked out of Congress.

If you get a chance to read Beyond Reason, you'll understand a lot about what folks need emotionally and figure out that there are ways to build win-win situations. And, you'll also realize what the one personality trait that creates the most jerks is; hint, it's folks that need to be acknowledged as the big dog over and over (don't be that person, just earn other's respect). #2 is find the time to read Beyond Reason.

Here's the thing that makes older folks a little more uncomfortable with you than older folks usually are with younger folks, you live your lives differently than older folks have and are. Not just a little differently, but very differently so far.

You don't buy as much stuff. You rent. You switch jobs a lot (good for you, chase the money because most corporations don't have a lot of loyalty to you, but stay in most jobs a year or two, it shows commitment and that you had enough time to learn something). When you do find a great job, that pays you about right, that you like, be very careful about that next switch.

You travel a lot and that probably creates some jealousy (keep traveling, it's educational, but don't be in awe, be a student having a good time). Myself, I'm adopting a nomadic lifestyle. I'm going to do my research on the ground around the world the next decade or two or three. I'll stop by to visit though.

Most of you can't cook and grandma especially is concerned. Learn to cook. It's social, family building, therapeutic and will save you a ton of money. And at least plant a pot full of herbs even if you don't have room to garden yet, although, once you have a yard, learn to garden, dirt is cool.

Finally, and most importantly I think, that you live differently is very disconcerting to older folks because it doesn't validate the rationalization of their own existence. That's tough. After survival and sex, self-validation is probably the next highest human instinct. Find a way to be nice about being different, rather than throwing it in people's faces - there's a really long conversation that could go a lot of ways there, I'll trust you to think it through.

This first section was really about investing in you. That's your best investment, do it early, often and forever.

You Want To Get Rich, Fine, Here's How

I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful. - Warren Buffett

Ok, we're done here. Thanks for your time.

Oh, you want a bit more than that. Sure, I have an hour before I take grandma to eat (hang out with older folks more, they're older you know).

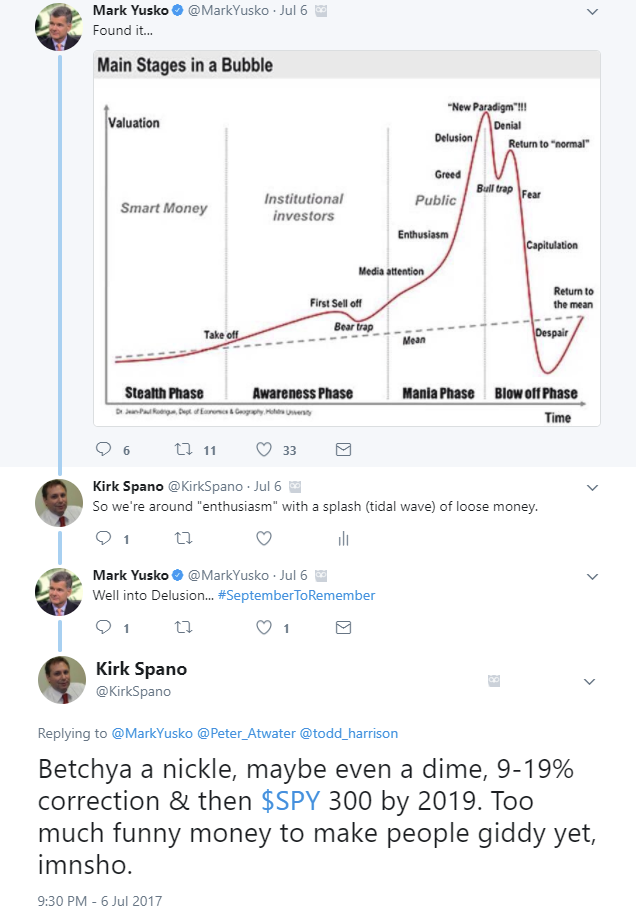

The stock market is approaching very rarified air. We are on the cusp of what is deemed "euphoria." We got a bit of that in January's cryptocurrency (most are going to zero by the way) mania driven stock market incline.

Here's a conversation I had last summer with a bigger shot than me. So far, we've had the correction in the range I said we would and now the stock market, represented by the S&P 500 (SPY) is climbing towards 3000.

I'm not sure we get to 3000 plus on the S&P 500, but I think the stock buyback bubble will probably carry us there by next year sometime. That last 10-20% upside is a crapshoot though, given politics, tightening liquidity as indicated by bond markets and the "slow growth forever" global economy (read the article at that link if you read anything else, it's really important) {C} After that though? I'll just say "uh-oh."

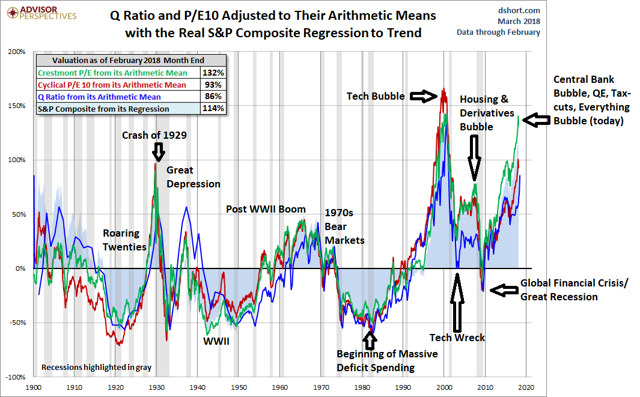

Here's a chart that shows how overvalued the stock market is even if you don't really know anything about the stock market.

(Click on image to enlarge)

You can learn more about crashes and bull markets here on the Wiki superhighway.

Your Retirement Plan at Work

In your retirement plans (401k, 457, 403b, SIMPLE, SEP...), change the asset allocation on your plan balance to be 50% in a stable value, short-term U.S. bond or money market account. Keep it safe. At some point, you'll get a chance to shove it into a lower stock market.

The other half, leave in diversified equities with about a quarter international. If this market does get to about 3000, then move another 25% to the safe account you have picked out.

For your contributions, put 100% into the safe account that you've picked out. There's no point buying more at these valuations. When the market has taken a digger, down 30% or more, then change your contributions to be more aggressive.

Yes, this does require some tactical trading and for you to pay attention. The really good news is that this takes about 20 minutes a few times per year. These are asset allocation changes that once you get back into the stock market, you'll leave in for years as you ride the next recovery and whatever bubble comes next.

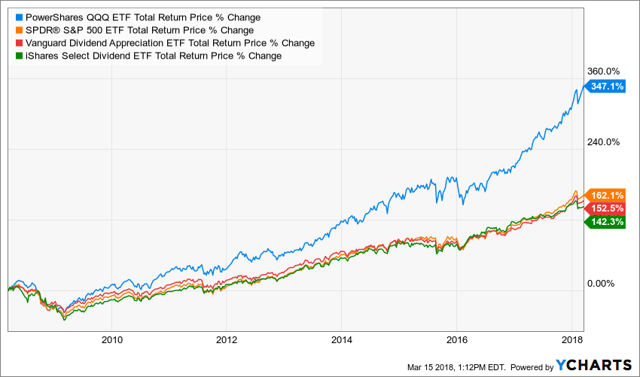

That article focuses on the PowerShares QQQ ETF (QQQ), which is based on the Nasdaq 100 index. The top holdings in that fund are:

| Name | % Assets |

|---|---|

| Apple Inc (AAPL) | 11.64% |

| Amazon.com Inc (AMZN) | 9.28% |

| Microsoft Corp (MSFT) | 9.21% |

| Facebook Inc A (FB) | 5.41% |

| Alphabet Inc C (GOOGL) | 4.92% |

| Alphabet Inc A (GOOG) | 4.19% |

| Intel Corp (INTC) | 2.94% |

| Cisco Systems Inc (CSCO) | 2.82% |

| Comcast Corp Class A (CMCSA) | 2.15% |

| NVIDIA Corp (NVDA) | 1.87% |

It's asset allocation heavily favors the "change economy" and has favorable capital characteristics. In other words, it's a better index than the S&P 500.

(Click on image to enlarge)

I included a couple popular dividend stock ETFs, the Vanguard Dividend Appreciation ETF (VIG) and iShares Select Dividend ETF (DVY), just to tweak some old-timers who value dividends over better companies with better finances.

For the moment, note that we've suspended investing more into the stock market as we accumulate cash. This is a rare occurrence that we do this, but right now, it's the right thing to do, as you should be able to see from the chart in the last section that shows how overvalued stock market assets are right now.

Don't Be The Greater Fool

The stock market will confuse you and take your money if you let it. That money usually finds its way to guys like me who are better at this than you are (that's not cocky, that's just the way it is 98% of the time).

We know from studies that most investors don't beat inflation with their investments because they panic at the bottom and sell, then get a case of FOMO (fear of missing out) near the top and buy.

From Wikipedia again:

"The greater fool theory states that the price of an object is determined not by its intrinsic value, but rather by irrational beliefs and expectations of market participants. A price can be justified by a rational buyer under the belief that another party is willing to pay an even higher price."

Here's another way to think of it if you've ever played poker. "If you don't know who the sucker at the table is, then it's you."

The next wave of money into the stock market will come from you Millennial investors. Don't let FOMO, laziness (take an hour or two a week to learn about YOUR money) or arrogance (seriously, you aren't going to beat me or the superbrain computers controlled by the biggest piles of money - the little computers we can beat, I do it by using little computers to beat other folks using little computers).

Disclosure: I am long Intel (INTC).

Disclaimer: I own a Registered Investment Advisor - https://BluemoundAssetManagement.com - however, publish separately from that entity for self-directed ...

more