Should You Invest In Index Funds?

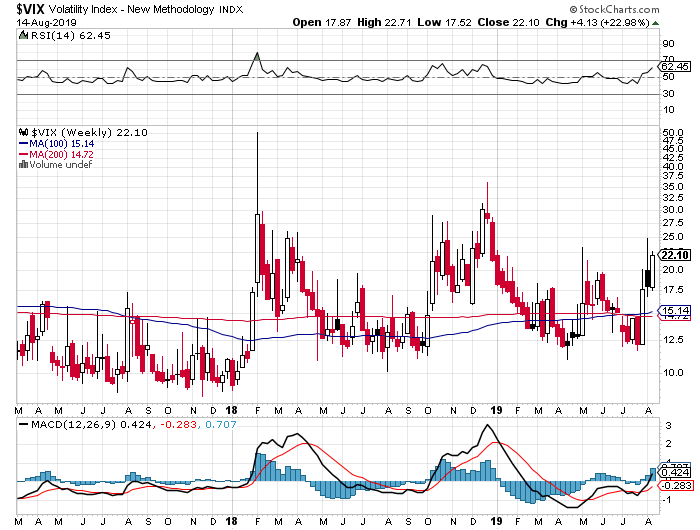

Volatility in the stock market spiked towards the end of last month as investors prepared for a rate cut in August. And since the start of the month. CBOE Volatility Index (VIX) has gained further topping the 25 points mark before pulling back to stabilize at around the 22 points level.

As demonstrated using the CBOE Volatility Index chart below, the VIX appears to have spiked significantly since the start of 2018. In 2017, the VIX oscillated between 9.5 and 11.5 basis points, with an average of about 10.5 points. However, dynamics have since shifted as uncertainty continues to grow in the market with the raging US-China trade war playing a part.

In 2018, the CBOE Volatility Index made two major spikes, the first coming in at the end of January and the second arriving towards the end of the year in December. This year has been a little calm, witnessing a couple of spikes, first in May and then this month.

This makes investing in individual stocks tricky for investors, which is why diversification is key. For retail investors with limited investment capital, it can be more challenging to diversify investments by investing in individual stocks. This is why investing in index funds can be crucial, especially for those who would prefer using a passive investment vehicle.

And while volatility has gone a notch higher thereby making it more interesting to stock pickers than long-term investors, the intricacy of picking the right stocks at the right time can be very challenging to inexperienced investors. The good thing, for now, is that even with the current market turbulence the general trajectory of stock prices remains positive, which makes index funds ideal for passive investors not interested in the short-term trading opportunities created by volatility. To get investors started, here are a couple of index funds that stand out for various reasons.

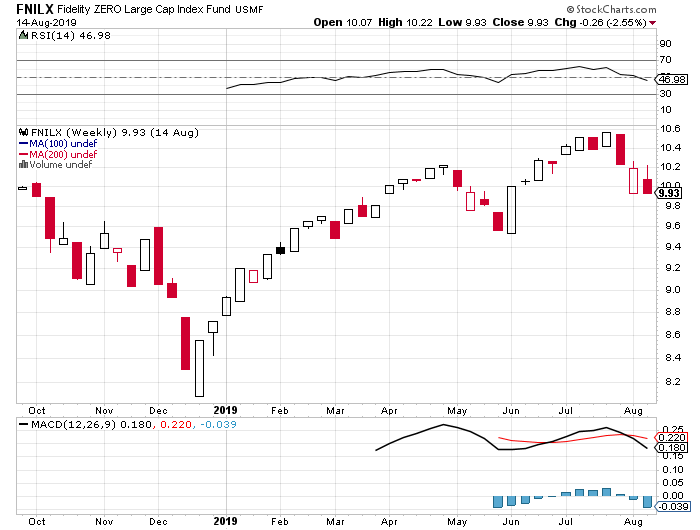

Fidelity ZERO Large Cap Index Fund

As the name suggests, the Fidelity ZERO Large Cap Index Fund (FNILX) has no expense ratio, which means that if you invest $10,000 in it you will incur $0.00 in expenses at the end of the year.

Other Index funds have varying annual costs for similar investment which range from as low as $2.00 to $9.00 or even higher. Therefore, the Fidelity ZERO Large Cap Index Fund is one of the most attractive index funds to invest in if you are a retail investor with limited capital.

And as demonstrated in the chart above, the FNILX has performed quite well since the start of the year gaining more than 20% between January and July before pulling back slightly to settle at the current level of 9.93 basis points, which reflects a year-to-date gain of about 12.5%.

This is an impressive return given the fact the current 3-month and 6-month Treasury yields are just hovering above 2%. Therefore, the Fidelity ZERO Large Cap Index Fund could make a good addition to the portfolios of low-income investors looking to capitalize on the stability of blue-chip stocks that they could otherwise not afford if they invested in each individually.

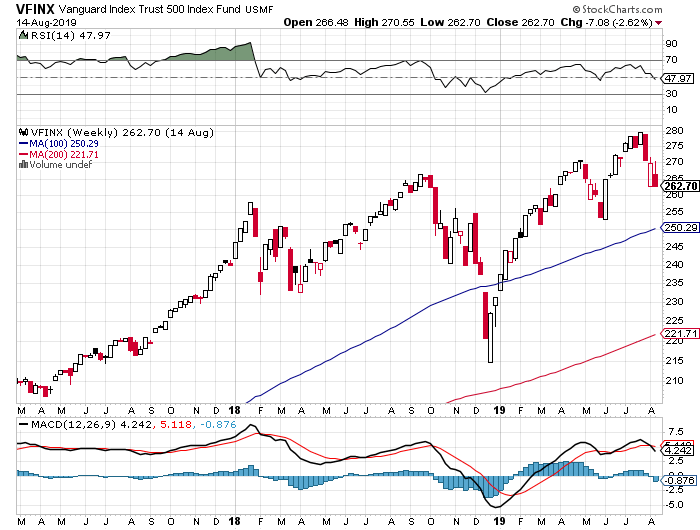

Vanguard Index Trust 500 Index Fund

The Vanguard Index Trust 500 Index Fund is one of the most popular US stock Indexes to invest in. It invests nearly all of the capital in equal distribution across the S&P 500 member stocks at a cost of 0.14%. This index is ideal for long-term investors that want to invest in a fully diversified portfolio of blue-chip stocks.

The VFINX is also one of the most costly Indexes to invest in with investors paying about $14.00 for an investment of $10,000 annually. However, this is a relatively small amount compared to what investors would incur if they chose to invest in individual stocks.

The Vanguard Index Trust 500 Index Fund has bounced back this year after plunging towards the end of last year to bottom at around 215 basis points. It has now recovered to top 280 points but recently pulled back to settle at about 262 points. Since January, the VFINX has gained about 12.75% making it one of the best performing Index funds in the market.

Conclusion

In summary, index funds provide an attractive avenue for portfolio diversification to investors with limited capital. And while market volatility might make things a little tricky in the short-term, those investing with a long-term view are bound to realize steady returns.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more