Mutual Fund Ratings: The Best Approach

We came across a MarketWatch.com article recently that posed the question “Why won’t your mutual fund tell you what it owns?” This article raises some very good questions, not only about mutual fund reporting, but also the manner in which investors should analyze mutual funds.

The article points out that investors too often overlook the most important driver of mutual fund performance: the holdings. It’s time to set the record straight on mutual fund ratings. It’s long overdue that investors receive mutual fund research that gets to the bottom of the true drivers of mutual fund performance.

Performance Driver #1: Quality of a Fund’s Holdings

The first and most important driver of mutual fund’s performance is the quality of its holdings. Backward-looking technical measures are helpful, but we think investors deserve more.

PERFORMANCE OF MUTUAL FUND’s HOLDINGs = PERFORMANCE OF MUTUAL FUND

This fundamental fact is why New Constructs rates nearly 7000 mutual funds, not by past performance or manager’s tenure, but by the ratings of their holdings. We aggregate our models on the fund’s holdings to provide the same earnings quality and valuation analysis of funds that we provide on the 3000+ individual stocks we cover.

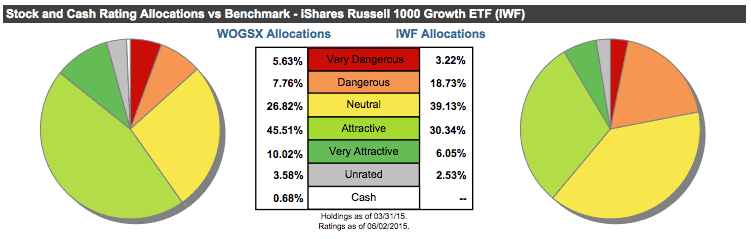

For example, one of our highest rated Large Cap Growth funds, White Oak Select Growth Fund (WOGSX), allocates 56% of its assets to Attractive or better rated stocks and only 14% to Dangerous or worse rated stocks. This transparency allows investors to know exactly what they’re buying into when investing in a mutual fund.

Figure 1: WOGSX Stock Allocations vs. Benchmark

Sources: New Constructs, LLC and company filings

Performance Driver #2: Expense of a Fund

The next driver, and second aspect of our mutual fund ratings, is costs. Expense ratios often misrepresent the true costs of investing in a fund because they are only one, often the smallest, part of the costs investors incur. This misrepresentation is why New Constructs looks at total annual costs, the true total cost of being in a particular fund over a 3-year holding period. Our research reveals that expense ratios can sometimes understate fund costs by as much as 5.75 percentage points as in the case of our most expensive mutual fund, Rydex Series Real Estate Fund (RYREX), which receives our Very Dangerous rating. RYREX’s 7.85% total annual costs are well above its stated expense ratio of 1.65%. In addition, RYREX’s total annual costs include over 4% in transaction costs, based on the fund’s 600% turnover.

A Better Rating System

After rating a fund’s holdings and determining its total annual costs, we assign a fund an overall rating from Very Dangerous to Very Attractive. The top ranked funds not only allocate to quality stocks, but also charge competitive fees. On the other hand, the worst ranked funds not only allocate to bad stocks, but also overcharge investors in the process.

As we know, past performance in no indicator of future success so why should mutual fund research focus so heavily on past performance? In addition, less than 1% of managers actually deliver alpha so why should investors put a large focus on the manager of the fund? The answers to these questions are clear. Investors need to look past traditional fund research, and seek out ratings based upon the two main drivers of fund performance: fund holdings and fund expenses.

Photo Credit: Simon Cunningham (Flickr)

Disclosure: New Constructs staff receive no compensation to write about any specific stock, sector, or theme.