Fund Flows Remain Feeble

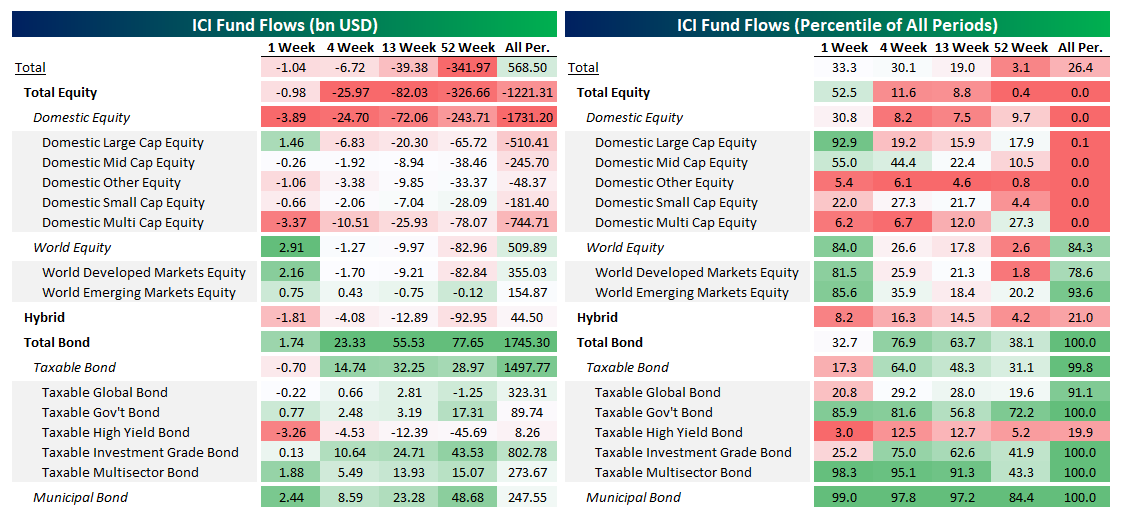

Yesterday, the Investment Company Institute updated its weekly report on the net cash available to mutual funds. These flows of cash in and out of the mutual fund industry have tilted very hard against the equity market in recent months, and that didn’t change much this week. While domestic, large-cap equity funds had a pretty decent week ($1.46bn in net buying, larger than 92.9% of weeks since 2007), other categories were extremely weak. Similarly, equity-correlated fixed income in the high yield space saw massive $3.26bn outflows, weaker than 97% of weeks since 2007. Fixed income in general, though, continued to show massive inflows including $2.44bn into municipal bond funds. That’s in the 99th percentile of all periods while rolling 4-week and 13-week fund flows are in the 97th percentile of all periods.

(Click on image to enlarge)

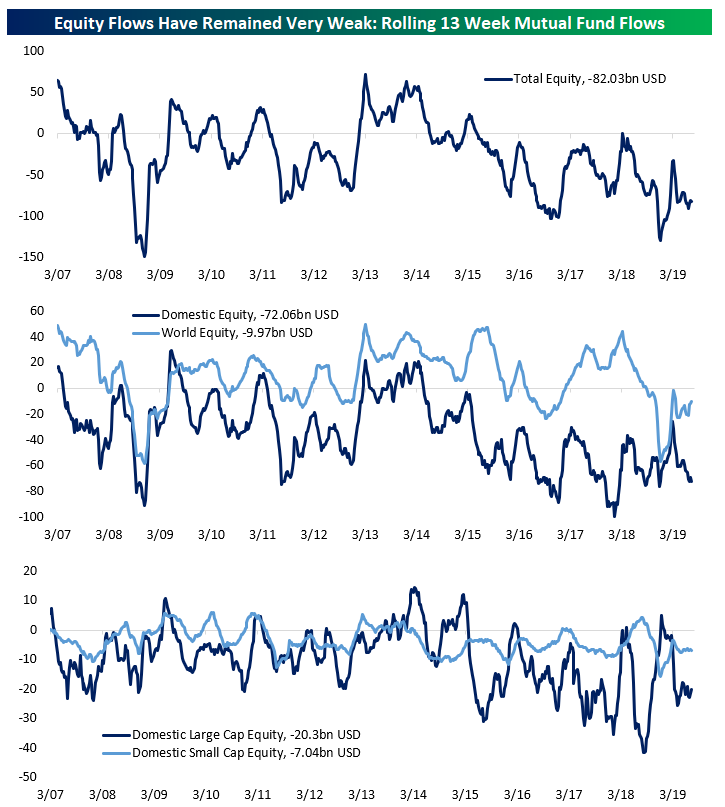

Below we show the rolling 13-week fund flows into various types of equity mutual funds since 2007. Only one week since 2015 has seen mutual fund flows into equities positive on a rolling 13-week basis. That’s obviously driven in large part by ETFs stealing market share but even by the standards of the last few years, investor flows into mutual funds have been very, very weak. It’s hard to call market sentiment excessive when retail is so desperately avoiding equity mutual fund allocations.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s ...

more