Do Long-Short Equity Mutual Funds Pass The Smell Test?

Around the turn of the century, the first wave of mutual funds trying to replicate hedge fund strategies started rolling off the financial industry’s assembly line. With more than a decade of results in hand, we can begin to assess how this experiment in publicly traded funds has fared. As you might expect, the results are mixed. But that tends to be true for active management generally. Let’s dig a bit deeper and focus on so-called alternative investing categories for mutual funds, as defined by Morningstar, starting with long-short equity strategies. In follow-up pieces, I’ll look at other alternative categories.

The first thing to know about long-short strategies is that results vary… a lot. They’re also pricey, with expense ratios approaching 3%–nosebleed territory compared with what’s available for plain-vanilla indexing. Yet the concept of going long and short has obvious appeal… in theory. Looking for stocks to short as well as buy doubles the opportunity set. Advocates of this strategy insist that the broader focus offers a tailwind for enhancing performance vs. what’s available in a conventional long-only context. Maybe, although you can find plenty of dogs in the long-short space, which is a reminder that a fertile investment idea by itself is no short cut to success.

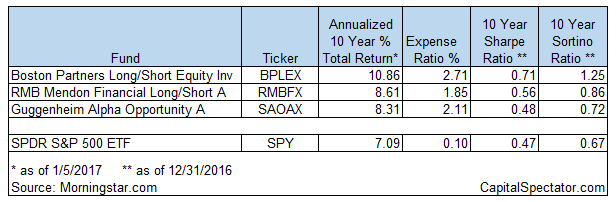

But if there’s any substance to the long-short concept, we should see some evidence in the top-performing funds. As a preliminary search, let’s use Morningstar.com’s screening tool to cut to the chase. The criteria: identify long-short equity funds with at least 10 years of history, with initial investment minimums of no more than $10,000, and a five-star rating from Morningstar. Three names survive, shown in the table below.

Based on total returns for the trailing 10-year period through yesterday (Jan 5), this trio looks pretty good relative to a passive US equity benchmark—the SPDR S&P 500 ETF (SPY). But when we look at risk-adjusted results, two of the three long-short funds lose some of their luster.

In particular, note that RMBFX and SAOAX post Sharpe and Sortino ratios that aren’t that much different than SPY’s. As a quick reminder, Sharpe ratio measures excess return per unit of volatility (standard deviation). Ditto for the Sortino ratio, with a key difference: this metric “differentiates harmful volatility from volatility in general by using a value for downside deviation,” according to Morningstar. By contrast, the Sharpe ratio makes no distinction between upside and downside volatility.

These two risk metrics suggest that RMBFX and SAOAX, after adjusting for volatility, have only a slim edge over SPY. By comparison, BPLEX’s results look stronger. Indeed, the fund’s Sortino ratio is nearly double SPY’s. In addition, BPLEX’s 10-year return is well above SPY’s, boasting a substantially wider margin of outperformance vs. the results posted by RMBFX and SAOAX.

But one fund with what appears to be a decisive edge over an index fund still leaves room for debate. Skeptics, for instance, will point out that a single winner could indicate little more than luck. With dozens of long-short funds trying to beat the market, someone’s bound to post impressive results.

Does that suffice to confirm that presence of genuine alpha-generating skill? It’s hard to make that claim based only on the results above.

We could expand the analysis and review funds with shorter histories, but we run into the problem of trying to draw robust results from, say, three or five years rather than ten.

Meantime, how do the other corners of alternative investing strategies compare? Long-short equity is but one test. Stay tuned for part deux for deciding if there’s any value in trying to export hedge fund strategies into the mutual fund realm.

Disclosure: None.