More Pain Ahead For Cincinnati Financial

Cincinnati Financial (CINF) has a problem. As businesses across the country comb through their Business Income / Interruption (BI) policies in the weeks ahead, the majority of CINF customers are going to arrive at a welcome realization: CINF does not, for the vast majority of BI policies, have a specific virus exclusion. We believe that the absence of virus exclusions is going to put CINF at a disadvantage to other insurers as litigation commences in the months ahead. CINF may well find themselves in the unenviable position of having to pay up - or having to pay more to defend themselves from lawsuits - while other insurers, like Travelers (NYSE: TRV), hide under the umbrella of a virus exclusion. We believe that this creates a unique opportunity for risk-tolerant investors to establish and benefit from a medium-term short position in CINF.

The Landscape

There has been a lot of debate in the insurance industry in recent weeks surrounding the tremendous influx of BI claims being filed across the country by businesses large and small impacted by the coronavirus. Shut down for weeks, these businesses are desperately hoping to get some relief from the insurance companies they have been paying premiums to for years.

For claimants, there are two major stumbling blocks. First, in order to trigger BI coverage, the claimant must prove that there has been physical damage to the building. This is a complicated question that involves what your definition of physical damage is. Lawyers are already making the case that contamination of the premises by the virus certainly meets the definition of physical damage.

In one of the first lawsuits filed concerning this issue, Cajun Conti LLC, Cajun Cuisine 1 LLC and Cajun Cuisine LLC d/b/a Oceana Grill v. Certain Underwriters at Lloyd's of London and Governor John B. Edwards, the attorney for Oceana Grill restaurant in New Orleans argues that "It is clear that contamination of the insured premises by the coronavirus would be a direct physical loss needing remediation to clean the surfaces of the establishment."

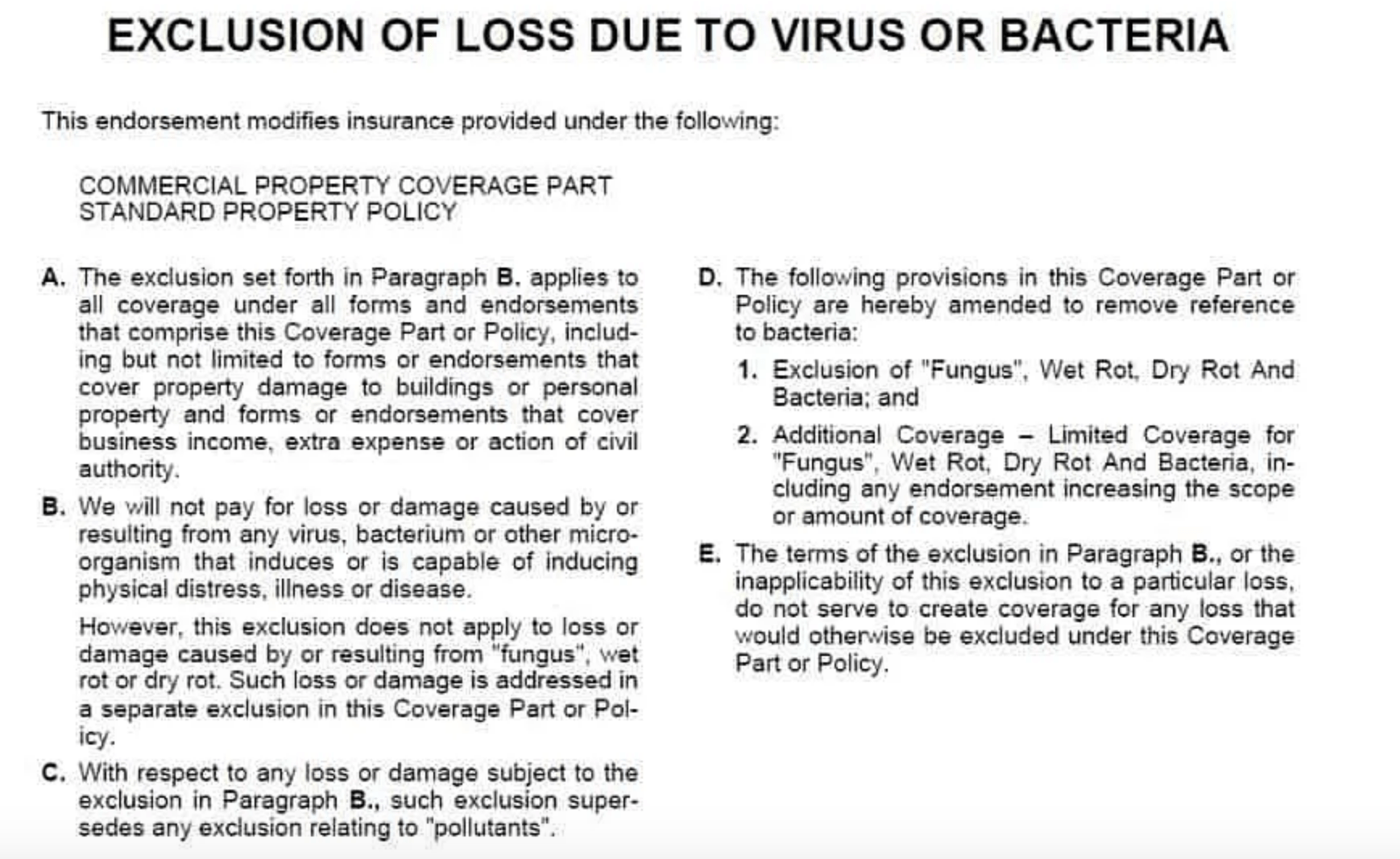

The problem for most claimants is that the debate about physical damage may be a moot point due to the second stumbling block: specific virus exclusions baked into policies. Claimants are finding that insurance companies are one step ahead. Buried in the hundreds of pages of their commercial property policies is a half-page exclusion that imagined just the type of crisis that is impacting America today.

(Click on image to enlarge)

Standard ISO virus

.

Our take? Absent unprecedented government intervention into the private contract space, insurance companies with specific virus exclusions in their BI coverage won't be forced to pay. This is a view shared in recent days by Standard & Poor's. In recent prepared remarks, Tracy Dolin, S&P Global Ratings analyst noted that "[w]e are taking the initial standpoint that these political efforts to retroactively change policy language will not materialize."

But what happens when there is no "policy language" related to a virus? We believe that litigation will be an uphill battle with claimants arguing, as in the Oceana Grill suit, that since they will need to clean and sanitize their buildings, the virus did, in fact, cause physical damage.

President Trump on virus exclusions

If Cincinnati is looking for sympathy, they can forget turning to President Trump. In a press briefing in early April, President Trump specifically noted that insurance companies without virus exclusions should pay up.

Referring to policies that do not have specific virus exclusions, Trump noted that, "I'm very good at reading language," Trump said. "I did very well in these subjects, OK? I don't see pandemic mentioned. Now, in some cases it is; it's an exclusion. But in a lot of cases, I don't see it. I don't see a reference that they don't want to pay up."

Trump went on to note that in the case of these policies without specific virus exclusions, "I would like to see the insurance companies pay if they need to pay if it's fair. And they know what's fair. And I know what's fair. I can tell you really quickly."

CINF's Earnings Call

The very first question in the Q&A portion of the CINF's earnings call was about the fact that CINF does not have a virus exclusion in the vast majority of its BI policies.

Mike Zaremski with Credit Suisse began by noting that "most of [CINF's BI policies do not have] a specific virus exclusion." While Zaremski did acknowledge that the debate over physical damage will certainly be a thorny one, he was left with this important question: " [a]re your customers filing business disruption claims, trying to kind of stating that the policies don't have the virus exclusion, basically is there more risk of potential litigation because of that?" CINF replied simply that it was confident in the language in its policies. The point that CINF does not have a virus exclusion continued to be brought up by analysts during the Q&A portion and it is our belief that this is a bigger problem than CINF wants to acknowledge.

Since the earnings call, CINF's stock has sunk more than 16% and we believe that there is more pain to come.

The Trade: Pain Ahead for CINF

There is no question that the insurance companies are all going to fight coronavirus BI claims tooth and nail. We believe, however, that the fight will be a substantially easier battle for insurance companies that have specific virus exclusions in their policies. We believe there is a lot more room for debate when it comes to whether you can prove that the virus caused physical damage.

CINF does not have virus exclusions in the vast majority of their BI policies and they are the most vulnerable to litigation in the months ahead. While CINF slid during the past week as earnings came into focus, significant pain could continue during the balance of 2020 as the first of these lawsuits reach courts. Risk-tolerant investors should consider taking an early stance and get short.

Disclosure: I am/we are short CINF.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more

Hope we see more by you Don, it's been a while!