Micron This Week Was The Poster Child For This “Bull-Trap” Lunacy

From Crescat Capital

Thursday had the feel of a blow-off top for the bear market rally. We are near historic valuations for US stocks across at least eight fundamental measures and at a record late stage in the business cycle. Equity markets appear more stretched relative to underlying deteriorating fundamentals than ever.

Micron (MU) this week was the poster child for this “bull-trap” lunacy. Investors bid Micron’s stock up 10% on Thursday after the company released earnings. The move sent the semiconductor index to a record high on Thursday. The truth was that Micron gave terrible forward guidance on the conference call forcing analysts to slash estimates for revenues, earnings, and free cash flow for 2019 and 2020.

Friday the market started to wake up to the real world as global stocks reversed back down. Both of Crescat’s hedge funds were up over 3% net on the day due to our steadfast net short positioning nearly erasing all MTD losses in both funds. Emerging market currencies and stocks fell hard on Friday with US stocks following just as global investors had poured into emerging markets hoping to outperform versus and aged and expensive US market. But all is not right with emerging markets. EM currency declines tend to foreshadow China yuan devaluations as they did in 2015 and 2018. We think it is poised play out again. We haven’t seen anything yet in terms of the Chinese yuan devaluation that we are expecting.

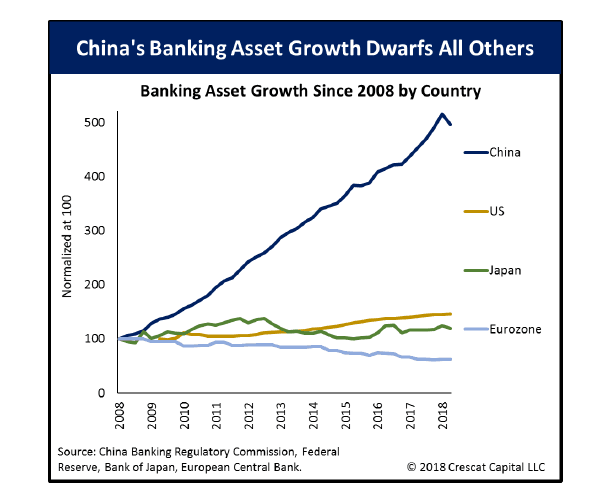

With record debt-to-GDP bubbles today around the world, and China first and foremost among them, we continue to forecast a downturn in the global economic cycle. We think investors at large are clueless about the financial and economic risks coming from China and how an impending China credit bust will negatively feed back to US and global financial markets. We strongly encourage you to view a new brief video from Tavi Costa, our macro analyst, where he outlines the China risks in a deck of macro charts.

The global stock market (likely bull-trap) rally YTD has resulted in a pullback for Crescat’s hedge funds given our steadfast net short positioning. We believe Crescat’s hedge funds are poised for another run like we had at the end of 2018 when we finished among the top performing funds in the world.

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get ...

more