Michigan Consumer Sentiment: February Final Slightly Lower

The February Final came in at 76.8, down 2.2 from the January Final. Investing.com had forecast 76.5. Since its beginning in 1978, consumer sentiment is 10.9 percent below the average reading (arithmetic mean) and 9.9 percent below the geometric mean.

Surveys of Consumers chief economist, Richard Curtin, makes the following comments:

Despite a small gain in late February, consumer sentiment was slightly lower for the entire month than in January. All of February's loss was due to households with incomes below $75,000, with the declines mainly concentrated in future economic prospects. The worst of the pandemic may be nearing its end, but few consumers anticipate the type of persistent and robust economic growth that restores employment conditions to the very positive pre-pandemic levels. The recent revival in spending has been driven by drawdowns in precautionary savings. Interestingly, those with a college degree were more cautious about prospects for the national economy until just a few months ago (see the chart). In contrast, those with less than a college degree recorded the least favorable economic prospects in this month's survey, indicating the high cumulative toll of the pandemic. It is a common occurrence that groups that had suffered the least in a recession are the first to propel the economy forward, although it is true that those whose jobs were in the hardest hit sectors will be the slowest to fully recover.

Perhaps the most attention has been garnered by rising inflationary expectations. The year ahead inflation rate was expected to be 3.3% in February, up from 3.0% last month and 2.5% in December. While consumers clearly anticipate a spurt in inflation in the year ahead, the overall evidence does not indicate the emergence of an inflationary psychology that makes the expectation of inflation a self-fulfilling prophecy. The key lesson learned from the last inflationary era is that it is easy to underestimate the strength of inflationary psychology, and correspondingly, it is easy to overestimate the ability of economic policies to bring an end to inflationary psychology. [More...]

See the chart below for a long-term perspective on this widely watched indicator. Recessions and real GDP are included to help us evaluate the correlation between the Michigan Consumer Sentiment Index and the broader economy.

To put today's report into the larger historical context since its beginning in 1978, consumer sentiment is 10.9 percent below the average reading (arithmetic mean) and 9.9 percent below the geometric mean. The current index level is at the 26th percentile of the 518 monthly data points in this series.

Note that this indicator is somewhat volatile, with a 3.0 point absolute average monthly change. The latest data point saw a 2.2 point decrease from the previous month. For a visual sense of the volatility, here is a chart with the monthly data and a three-month moving average.

For the sake of comparison, here is a chart of the Conference Board's Consumer Confidence Index (monthly update here). The Conference Board Index is the more volatile of the two, but the broad pattern and general trends have been remarkably similar to the Michigan Index.

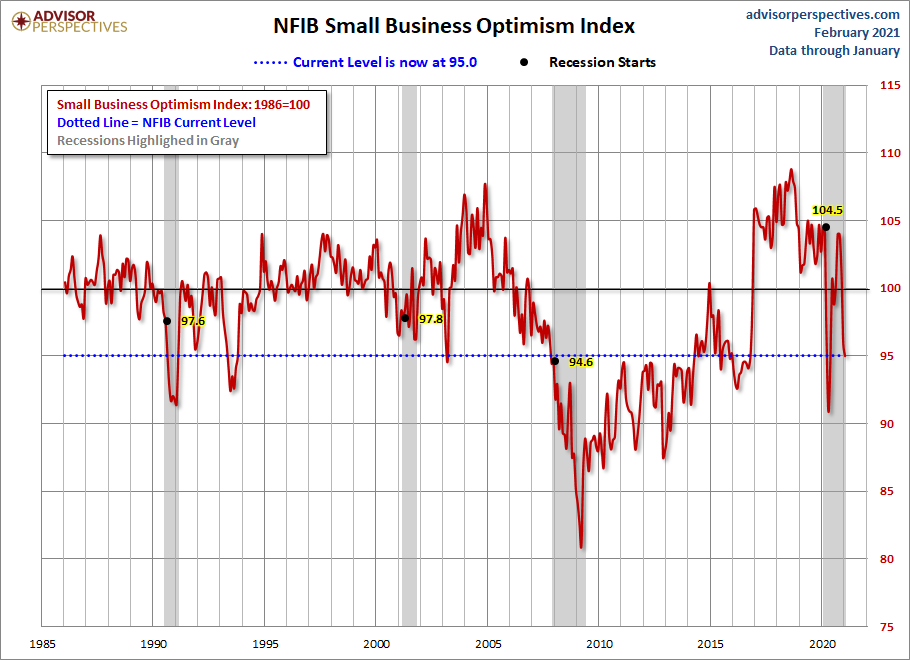

And finally, the prevailing mood of the Michigan survey is also similar to the mood of small business owners, as captured by the NFIB Business Optimism Index (monthly update here).