McDonald's: A Solid Business But Fully Priced

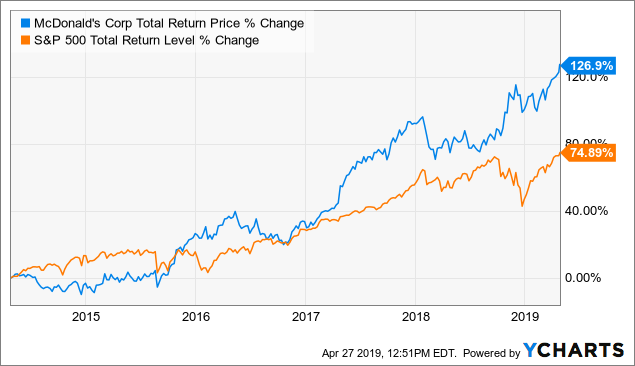

McDonald's (MCD) stock has performed remarkably well in the past five years, gaining almost 127% on a total return basis versus a cumulative total return of nearly 75% for the S&P 500 in the same period.

Data by YCharts

This impressive return has been sustained by solid decisions by management and strong financial performance from the business.

However, investment decisions should be done by looking through the windshield as opposed to the rearview mirror. At current prices, McDonald's is not necessarily overvalued, but valuation is not particularly attractive either.

A Solid Business

McDonald's has made an impressive turnaround under the leadership of CEO Steve Easterbrook since 2015. To begin with, the company refranchised more than 4,000 locations, and it's planning to have 95% of its stores operating under the franchise model.

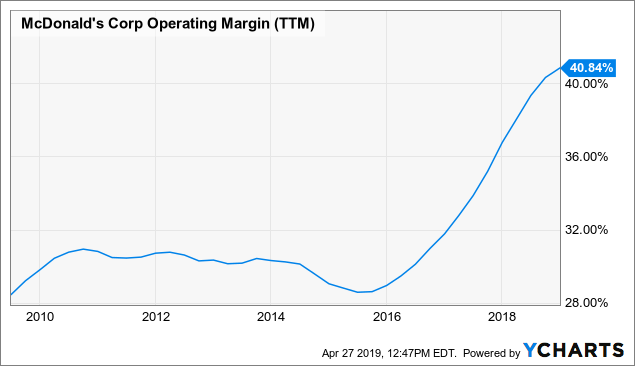

This business model significantly reduces operating costs, and the company has eliminated $500 million in net annual expenses. The positive impact on profit margins has been remarkable in recent years.

Data by YCharts

In addition to this, McDonald's has implemented a series of initiatives such as revamping the stores, menu customization and improved technology in areas such as mobile ordering, among several others. These initiatives have been well received by customers, and the company has produced growing comparable sales figures in recent years.

Delicious Dividends

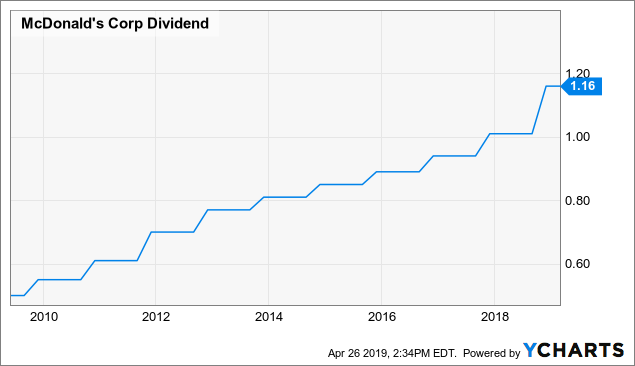

Dividend growth investing is a massively popular strategy, and for good reasons. Growing dividend payments in the long term reflect that the business is solid enough to generate more cash than it needs to retain through all kinds of economic environments.

In the case of McDonald's, the company has raised payments every year since making its first dividend payment in 1976, so it has 42 consecutive years of consistent dividend growth under its belt. This includes a vigorous dividend increase of 15% announced in September of 2018.

Data by YCharts

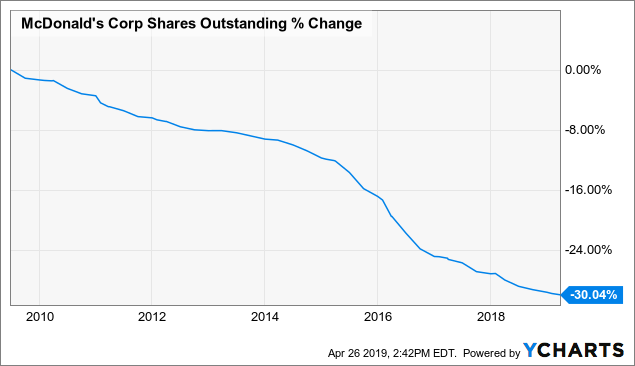

In addition to this, McDonald's has an active share buyback program, and it has reduced the number of shares outstanding by nearly 30% in the past decade

Data by YCharts

On a trailing twelve months basis, McDonald's produced $4.2 billion in free cash flow, while dividends absorbed $3.2 billion of that money and share buybacks $5.2 billion. The company will need to accelerate free cash flow growth if it wants to maintain the current rate of share buybacks in the long term, but the dividend is comfortably sustainable with internally generated funds.

The Stock Is Fully Valued

The business fundamentals are clearly solid, but McDonald's stock does not look like a particularly attractive purchase at current prices. The table shows valuation ratios such as price to sales, price to earnings, and price to cash flows for McDonald's in comparison to average valuation levels for the company in the past five years to the average company in the S&P 500 index.

| McDonald's | Mcdonald's 5 Yr AVG. | S&P 500 | |

| Price to Sales | 7.4 | 4.74 | 2.05 |

| Price to Earnings | 26.25 | 23.1 | 19.4 |

| Price to Cash Flows | 22.32 | 18.3 | 12.63 |

Data Source: Morningstar

Since the company has enjoyed improvements in both profitability and revenue growth, we can say that the stock deserves to trade at higher valuation levels than in the past. From such a perspective, the stock is not necessarily overvalued.

Nevertheless, McDonald's is a leading player in a mature and highly saturated market, and this carries important limitations in terms of growth potential. It won't be easy for the company to grow rapidly enough to deliver market-beating returns from current valuation levels.

Dividends are one of the main strong points in McDonald's as an investment. The company is well positioned to continue raising payments in the future, but the dividend yield of 2.2% is uninspiring. In fact, the dividend yield currently stands at its lowest levels over the past decade.

Data by YCharts

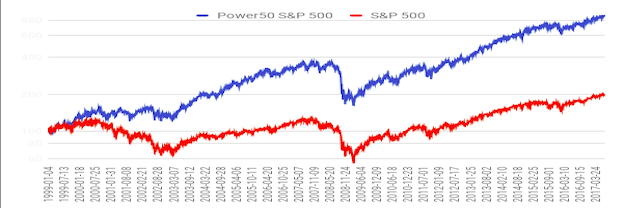

The PowerFactors system is a quantitative investing system available to members in "The Data Driven Investor." This system basically ranks companies in a particular universe according to a combination of factors such as financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

The backtested performance statistics indicate that companies with higher PowerFactors ranking tend to generate superior returns over the long term, and stocks in the higher quintiles tend to outperform the market.

McDonald's stock currently has a PowerFactors ranking of 67.7. This is above-average, but the stock is still not in the highest quintile, which includes only companies with a PowerFactors ranking above 80.

In other words, McDonald's is a solid business, and management deserves recognition for driving accelerating revenue growth in recent years. But at current prices this is already reflected on valuation levels to a good degree. The stock is not necessarily overvalued, but it's not cheap enough to outperform the market by a wide margin right now.

The Bottom Line

Looking at the main risk factors, price competition can be remarkably aggressive in the fast food industry. This can have a negative impact on profitability levels if companies in the sector struggle to pass on rising costs to consumers through rising menu prices.

Besides, consumers around the world are increasingly conscious of the importance of healthier nutrition. McDonald's has made a lot of progress in terms of offering more variety on its menu, but there is only so much a fast-food giant can do in that area. If consumers continue gravitating towards healthier and more natural foods, this will ultimately hurt McDonald's over the long term.

Those risks being acknowledged, McDonald's is still one of the top operators in the industry, with outstanding competitive strengths and a high-quality management team. The stock is particularly attractive in terms of cash flow generation and capital distributions via dividends and buybacks.

At current prices, there is no reason to rush into buying McDonald's stock, though. Waiting for a price pullback could provide a better opportunity to buy a strong company at a more attractive valuation.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in ...

more