Massive Supply Chain Issues

The May manufacturing PMI increased slightly from 60.7 to 61.2. We believe the 64.7 reading in March was the cycle peak. However, that might not be valuable information. It depends on how much you value the Markit PMI which has since hit higher levels. Either way, the manufacturing sector is doing very well. This PMI is consistent with 5.2% GDP growth. The ISM PMI is above the 1 year average of 58.4.

The new orders index was up 2.7 points, while the production index fell 4 points to 58.5. The employment index fell 4.2 points to 50.9. This is in line with expectations for 29,000 manufacturing jobs created in May. Last month’s reading was way off from the BLS’s reading of 18,000 manufacturing jobs lost. The BLS report was worse than most reports indicated which is why we expect a modest positive revision.

Huge Supply Chain Woes

The stars of the report were the prices and inventory readings. They were absolutely insane which matches the supply chain & inflation issues facing companies. The supplier deliveries index was up 3.8 points to 78.8 which is the highest reading since 1974. We are still seeing the effects of the pandemic 15 months from when it started. As you can see from the chart below, the customer inventories index fell 0.4 to 28 which is a record low. There’s a shortage of almost everything. This isn’t an ideal situation.

🇺🇸 May ISM #Manufacturing | The highest reading on record for order backlogs (70.6 vs. 68.2 prior) and lowest for customer inventories (28.0 vs. 28.4 prior) suggest that production is likely to rise an extended period.

— Christophe Barraud🛢 (@C_Barraud) June 1, 2021

*Chart from Bloomberg ⬇ pic.twitter.com/Q4Ifmz5rCT

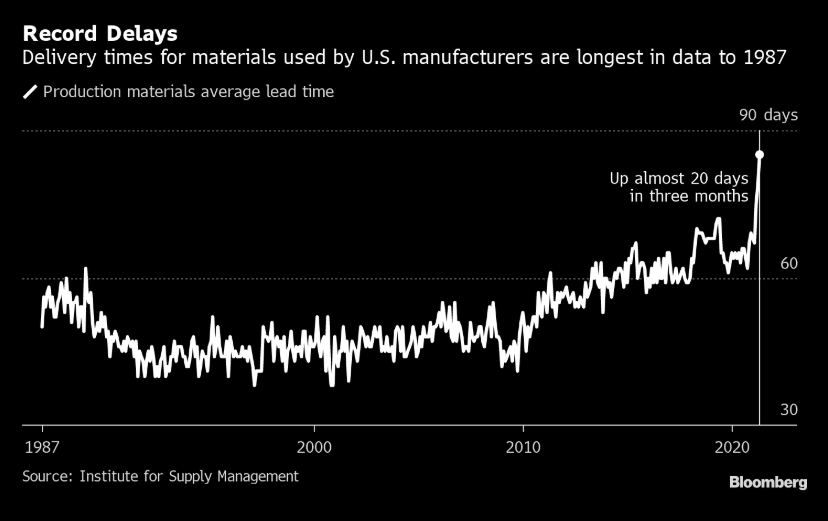

The prices paid index fell 1.6 points to 88 which is still an extremely high reading. In fact, all commodities were up in price accept acetone. All commodities were in short supply. The backlog of orders index was up 2.4 points to 70.6. As you can see from the chart below, the delivery time for raw materials rose to 85 days (up almost 20 days in a quarter). This is a record high using data that goes back to 1987. Demand is spiking and the weakened supply chain can’t catch up. This stress should be alleviated sometime in the next few months. We need to get through the peak of pent-up demand.

Business Quotes

As you’d expect, firms expressed worries about the supply chain in their ISM comments. A computer and electronic products firm stated, “Supplier performance — deliveries, quality, it’s all suffering. Demand is high, and we are struggling to find employees to help us keep up.” This the exact opposite of last year when inflation and demand were low. Now companies can’t find enough workers to fill open positions.

A fabricated metal products firm stated, “[A] lack of qualified candidates to fill both open office and shop positions is having a negative impact on production throughput. Challenges mounting for meeting delivery dates to customers due to material and services shortages and protracted lead times. This situation does not look to improve until possibly the fourth quarter of 2021 or beyond.” It’s interesting that they are trying to fill office jobs because workers haven’t gone back to the office at scale yet. Maybe that’s why they can’t find workers. We are excited to see the April JOLTS report to see if there are still millions of openings going unfilled.

Main Street Homebase Report

Homebase has shown great up-to-date data on the labor market especially since the pandemic began. As you can see from the chart below, businesses grew employment by 2% in May. That’s despite no improvement in businesses open. We aren’t sure why that indicator didn’t increase. Hours worked also increased sharply. In the past few months, we’ve had a few readings of record hours worked per week. Employers need to hire more workers instead of overworking employees. All but 7 states had employment improvement in May. The hospitality and entertainment industries have grown employment by 45% since January.

Homebase data shows a steady pace of employees working into May. Hours worked is separating slightly, suggesting businesses are trying to get more hours out of the workers they have https://t.co/JeT6kvn7wu

— Daniel Zhao (@DanielBZhao) June 2, 2021

From April 17th to May 17th, year-to-date growth in employees working rose from 10.3% to 12.6%. Those are the survey weeks in the BLS report. As we mentioned previously, there should have been over half a million jobs added in May. As of May, there has been an 18% decline in employees working since the pandemic. That’s up from a 20% decline in April. Hospitality increased employment by 12% from mid-April to mid-May. New England is experiencing the hottest labor market; the Southeast is experiencing the weakest labor market compared to mid-April.

CEOs Are Very Confident

We remember last year when bearish investors used weak CEO confidence to support their argument. That was a bad idea because CEOs didn’t know the future of the pandemic. It was smart to be cautious. Investors needed to get ahead of the curve, while business leaders needed to keep their employees safe. As you can see from the chart below, CEO confidence just hit a record high. It’s not time to fade their confidence. Optimism isn’t bad news. However, it is already priced into the market.

CEOs: cost inflation, cost inflation, cost inflation

— Sam Ro 📈 (@SamRo) June 1, 2021

also CEOs: pic.twitter.com/rs0jgZbYfI

Some investors don’t understand this concept. Good news isn’t bad for the stock market. Instead, it is expected. Some investors always look for a crash following a big move higher. However, crashes are rare. This is a hard strategy to execute mentally since the market has been so strong. The better bet is to expect a sideways market. Good results will make the expensive market look fairly valued if stocks go sideways. Bearish investors are encouraged by the speculation in meme stocks, but that has nothing to do with the rest of the market which has strong companies.

Conclusion

The May PMI report was one to remember because of the extreme supply chain issues. This caused low inventories and high inflation. It’s an ‘everything shortage.’ Businesses on Main Street hired more workers. Employees also worked longer hours. This should lead to a very solid May BLS report. CEO confidence hit a record high. Don’t use this as support for a bearish argument. This optimism justifies the stock market rally in the past 14 months. Now the market is digesting the good news. It’s not ready for a crash unless something unexpected occurs. Ignore the meme stocks which pepper the headlines. That’s noise, not a signal.

Disclaimer: The content in this article is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more