Trading Observations On E-Mini S&P 500

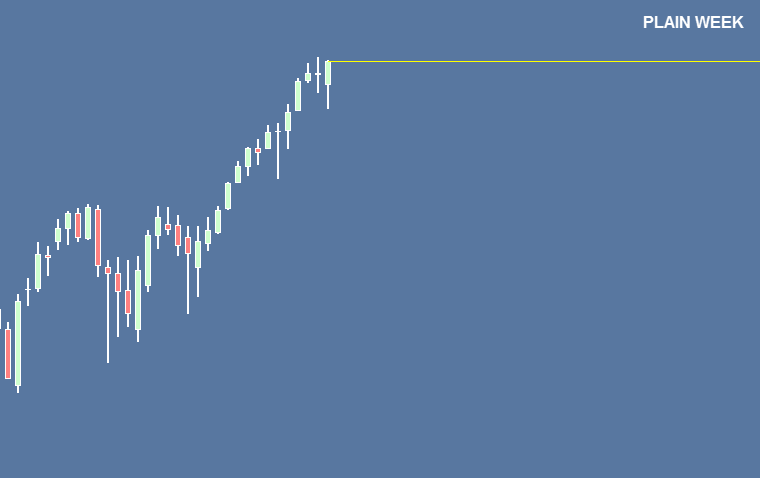

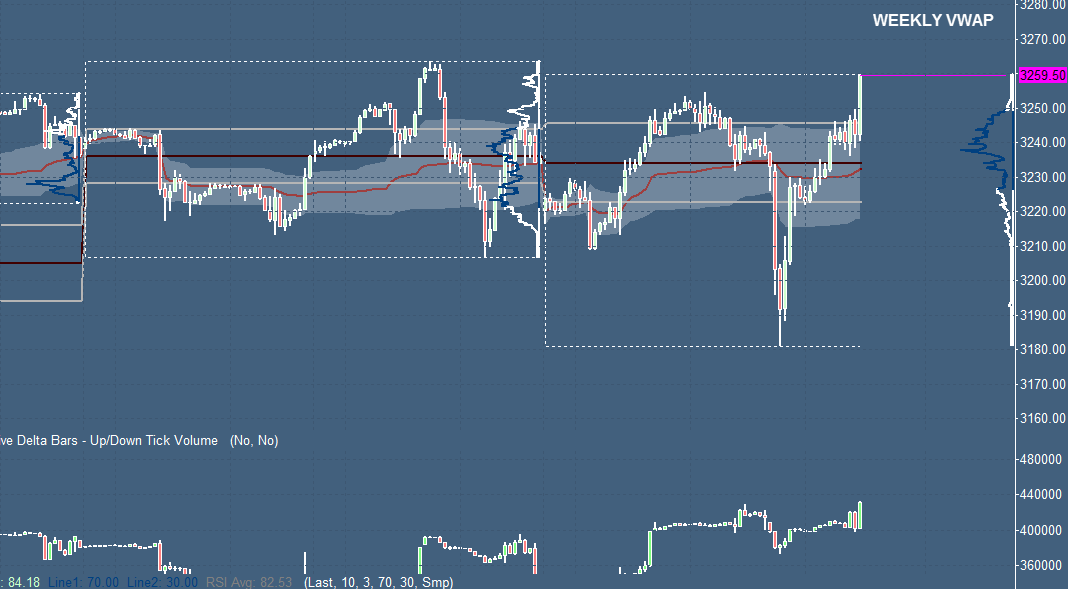

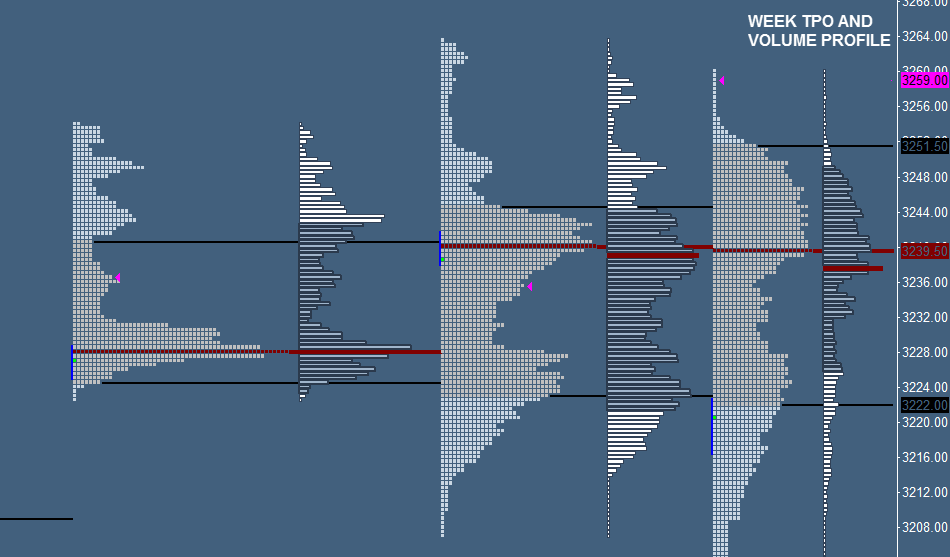

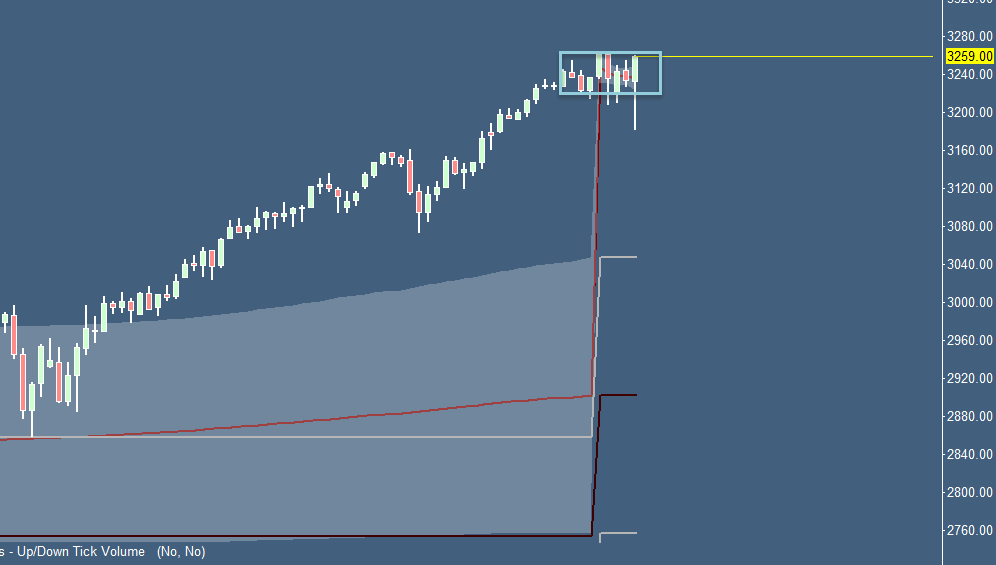

The E-mini S&P 500 futures contract dropped lower in the overnight session but later got a repair on the whole move. The mentioned outside bar on the weekly plain perspective which is a sign of a possible change in the overall market context as well as an inside day failure on the daily perspective prepared us for a bearish behavior. To be noted is the unsecured high from the previous session which has been taken out and cleared. However, the market found some support at the lower NVPOCs which brought the market back into the daily balance area to repair that sell-off move to lower prices/points. Currently, the market heading towards the higher balance extreme and could close as a swing failure day. Price ranges are also getting wider in this rotational market.

For now, the market trends higher and we should await some reaction around the week's higher extreme for a possible pullback. The market already moved through the whole VWAP value close area from the previous week. Simply awaiting some pattern on the lower timeframe to get a clue about a new possible scenario, combined with glare on the Footprint chart to follow the current bullish order flow.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Please visit our trading community to learn a more indepth analysis process with various tools such as the VWAP or Footprint ...

more