Market Briefing For Wednesday, July 8

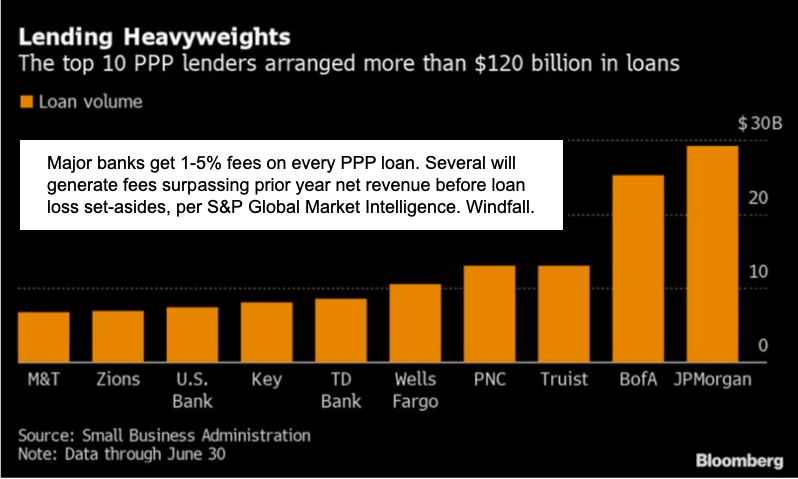

Tensions ramping-up again - across a broad front of contentious issues as we move towards new challenges on the geopolitical, domestic political, pandemic, and even financial funding (need for more stimulus or impossible situations) as we migrate through July. Few are pleased with where the funding got directed.

Executive summary:

- A drawn-out economic recovery is a bleak prospect, but likely the only one that exists for now; unless we suddenly encounter an anti-COVID-19 pill.

- However a 'one-legged' revival is better than a 'no-leg' recovery, so there's that, and all we need to do is muddle-through the pre-treatment interval.

- COVID-19 is actually more significant than the virtualized political alternatives for now, though politics become more polarized (unnecessarily likely) soon.

- The 'pace' of recovery is of course threatened by renewed closings, and it is pretty widely-accepted that we'll have to live with the virus along the way.

- n in most states) to proceed gingerly;

- That applies except in those places where they abused the reopening relief so badly, that there's really no alternative but to shut-down again for now.

- The general idea remains (among discussions) that efforts with the antibody treatment procedures, will buy some time, but that is all, as it's likely they do not provide longer-term immunity (perhaps enough until vaccines or effective antiviral drugs arrive, as we all wish from therapeutics for now).

- 'Great expectations' implied by 'super-cap' equity prices are really not profits or revenue-based (for now), but fueled by the TINA structure, which again is calling upon too much from the Fed's delegating bond (or equity) buying as well as sustaining it, which also builds bubbly-behavior in those sectors.

- Now sectors benefiting from the 'new normal' continue attractive (pausing to refresh also), whether in technology, medical care and related, sure, periodic consolidations or corrections will occur in these areas too.

- Also: big industrial, material or comparatively boring areas will do well, 'if' we get infrastructure deals, related to post-election projects, whether bipartisan reconciliation occurs or not, as if 'such' stocks gain, that helps S&P later.

- So much of that is speculative for now, that it might not obviate against S&P correcting in the interim, so again the market becomes vulnerable in several areas that are simply overdone in-terms of further potential (but so many are shorting those stocks, and have for months, that they hang-in a bit longer).

- As far as 'Federal Stimulus', that seems essential to muddle-through and to moderate social discord perhaps (debatable), there is no alternative really.

- I realize many 'real conservatives' won't prefer rolling-over to more debt, but politicians (even if 'conservative') generally will roll-over to get re-elected and hence basically try keeping their jobs.

- We all have our views of whether politicians will mostly move in the interest of the citizens, their own constituency, or whichever way the wind blows, it's likely some of the dramatic swings in recent weeks reflected this more than a devotion to principles of fiscal responsibility or constitutional principles.

- The United States has withdrawn from the World Health Organization, this is likely a mistake, increases Chinese influence on the WHO, rather than just working to restructure the leadership of WHO, which is heavily US-staffed, I note that this 'withdrawal' was reported earlier today, then vanished..so.

- For now we had a solid pullback and expect more erratic July behavior.

Just a thought about tourism and travel, which is increasingly retarded by states enforcing quarantine measures. That is manifesting itself domestically, not just internationally. I personally wanted to visit New York to see-off relatives returning to France (after years at the UN Security Council), but simply can't do that now. (So hopefully I'll be able to visit Paris again, albeit not in the immediate future.)

The point is this impacts not just JetBlue (JBLU) (mentioned that before as their primary routes are New York centric) but most carriers, hotels, and of course open-ended concern about cruise ships. I know they talk about social-distancing and so on, when the eventually resume, but let's face it, they were floating petri dishes for a slew of pathogens even before COVID-19, and with their older-design AC systems they remain incubators for COVID-19, regardless of new filters (exceptions in just a couple of very new ships, like Virgin's Scarlet Lady, but that's still close quarters as regards mingling). But I'm unwilling to short Royal Caribbean (RCL) simply as all it's going to take is a 'pill' announcement to effectively treat COVID-19, and up it goes (of course that may not be justified due to passenger density limiting profit margins in the future, but it could still move the stock), so I just avoid these sectors.

Today Secretary of State Pompeo said the United States is looking 'into banning' the social 'App' TikTok. It's not public (yet) with evidence sketchy as to whether it is malware-in-disguise. You'll recall I mentioned this just last week, suggesting to not let kids use TikTok on 'any' computer or phone that you use for business or financial transactions. The Secretary is likely exploring just the same suspicions I had heard. Again it's not entirely established, but now that he says that, I'm sure a couple IT guys will quickly ascertain if it actually is a threat intended to 'harvest' data from people's computers or not. The TikTok folks say they do not turn-over data to the Chinese Government, and would not even if requested. Really?

Finally, today was 'Facebook Day' with potential regulations; boycott concerns; possible antitrust action (spinning-off Instagram maybe; but that would be a plus perhaps for investors), and then there's the over-concentration in ETF's and so on; but that risk impacts a lot of stocks if that becomes a major market issue in the future; or even if 'social' investing becomes an emerging concern. From my own viewpoint I was not pleased that State Street (STT) put Facebook (FB), and Google (GOOGL), into a 'Communications ETF', the XLC; as not doing so may have allowed earlier stocks like AT&T (T) and Verizon (VZ), to progress without the volatility that those giants bring to the equation. Of course Wall St. wanted to juice ETF trading, investors for the most part would want (dividend-floor-based) telco's to behave normally.

In-sum: While I'm on the topic, it may be a reflection of this whole market, where a handful of 'super-cap' stocks have been sprinkled-around or 'injected' into such ETF's, in-order to spike interest, and give an illusion of broader strength. It's part of why I've contended for months now that the market was not as overbought as 'it' (the broad market or even the S&P) appeared superficially.

That "Federal Stimulus" money is doing two very bad things to us. First, it is adding to the very huge burden on those folks not even born yet, and right now it is fueling a boost in INFLATION as it throws more money towards bidding up the prices of fewer goods. The fewer goods part is obvious to anyone who has been to a grocery store, and the bid up prices are clear to any who have paid for those groceries. This is happening at a time when more folks are needing to live off of their savings, which inflation is eroding the value of. And the whole purpose of the inflation is to hold share prices and profits up.

So here is a warning: We will not forget this when eventually the nation recovers, and those guilty will be out of jobs. OR possibly MUCH WORSE!