Market Briefing For Friday, Jan. 15

[Ed. note - We have backdated this post to its originally intended date. After it was written, he appended this note written the evening of Thursday, Jan. 14, 2021:

For me it's a nervous day; stocks working well, especially Sorrento at this hour it took-off and is over 8; technical breakout regardless as it's related to a forthcoming EUA for the Covi-Stix or not.

Yours truly had a plan depending on my own Covid test. Unfortunately it came back positive. I have both my primary and an Infectious Disease group on this but there's a problem. I woke up with the worst fatigue yet; and pulse oximeter low oxygen levels. With low oxygen they want me to go to the ER not infusion center for the monoclonal antibodies. I'm being very candid as I was trying to avoid hospitals; but may require oxygen. Once on oxygen or with low Q2, they won't do the monoclonal antibody infusion. So sort of a catch 22.

Looks like I'm headed to an ER this afternoon.. ugh... I wanted to let you know is obviously there will be no comments of Briefings for now; and hopefully I'll get a bit of help and return soon (a day or two?). I will take my MacBook Pro and hope it's not stolen so 'if' up to it I can work on it.

I will update through this only as soon as I'm able. I've tried to work all week but this is now requiring more attention with the test now and O2 declining.

Market Briefing For Jan. 15, 2021

For nearly a year - since projecting a similarly-timed S&P shakeout, for a late January/early February time-frame, so many market influences 'evolved' shall we say. As we got into last January I escalated warnings to a 'crash alert', as I heard first hand from investors who had been to China, or had relatives there, and that information came partially from attendees at my Florida Money Show presentation (the last in-person event). I'm updating this for new members or a couple apparently frustrated the market hasn't collapse I guess, because I rightly advocated 'against' shorting for quite some time.

My point is when I hear chartists comparing this year with last year entirely do omit the backdrop of COVID-19. Though it lingers, the prospect of emergence may limit the downside of the next shakeout, to nothing like what we got last year.

Executive Summary:

- The stock market continues relatively sanguine during not just my illness (not yet defined), but as suspected not heavily moved by political unrest.

- The President, via an email to Fox News, called for an orderly transition to the new Administration, and requested no violence or vandalism.

- Nevertheless the House moved forward with Impeachment, and with 10 Republicans voting 'yay', it passed, however no Senate action expected.

- IF we can calmly get through the next week, the influence on the market may well wane, but we'll still be looking for a shakeout in the S&P (SPY).

- Because the market (and corporations) are 'somewhat' adjusted to these pandemic business conditions, there is rotation from pricey super-caps to the infrastructure (or similarly under-priced sectors affirming a forecast of several months ago.

- It take lots of 'heavy lifting' from the broad market to offset big-cap 'sag' if that really arrives, however so far that area is holding together, thus helps the S&P to 'hang-around' in the low 3800's around our maximum target or measure for this overall phase of technical action.

- Ironically the increased demand for computers and cellphones has helped the backdrop even as growth outperforms value.

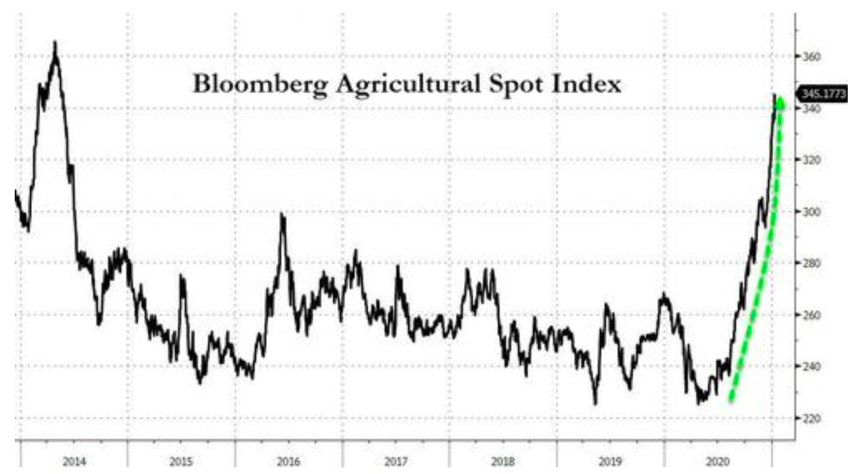

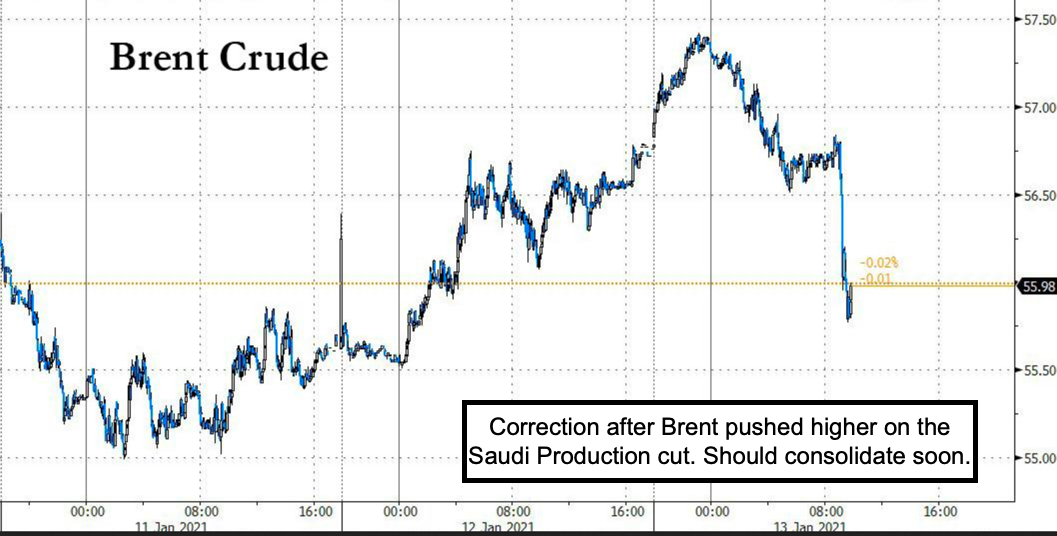

- The Energy Sector continues acting well, but many of today's new upside call hopefully are correct, but the optimal entry was when Oil was in the mid-30's and everybody hated it (I called for 45 but higher if geopolitics, in this case Saudi production cuts) occurred, optimistically simply hold (OIL).

- One other key forecast is starting to take form, that's a rebound in the US Dollar, while the 10-year also continues to firm a bit (UUP).

- On the COVID-19 front, there's one big story: the J&J single shot vaccine that in Phase 1/2 preliminary data looks great, more comment later.

- Well maybe there is second story: Ohio researchers said today they've discovered two new variants of the coronavirus, one of which has become the dominant strain in Columbus.

- And I suppose Moderna's CEO saying we may never get rid of COVID-19 fits in with arguments for Inovio's upcoming DNA vaccine, maybe superior as it allows boosting and cumulative better immunity without toxicity (maybe a new group in Washington will expedite that a bit?) (MRNA).

- The new strain prevalent in Columbus appears to spread more easily, and this new strain has the same genetic backbone as earlier cases, but it has three mutations that represent a significant evolution, and that's a concern pending testing to see how the existing vaccines do with it.

- Little LightPath also had a 15% rally which settle into about 12%, and on no news, which is more interesting (LPTH).

- And I suspected the market would be mostly neutral this week amidst the chaos leading to the plug being pulled on Donald Trump, who of course is taking no personal responsibility for what happened (he encouraged it).

- For now, policies have not impacted the stock market, which I suppose investors hope just hangs onto next week's post-Inauguration behavior.

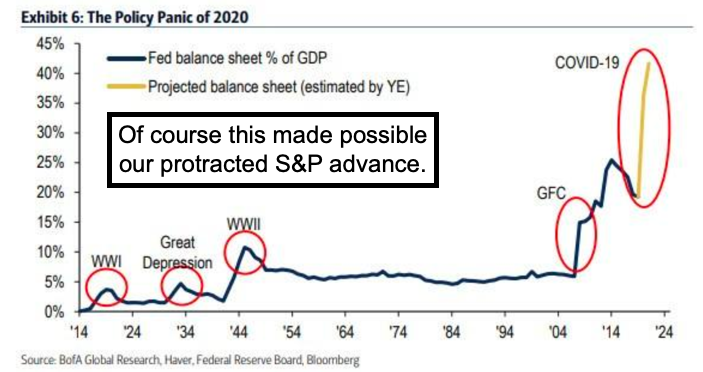

There's no way we would have dropped as much as S&P did if it were not for COVID-19, and the shifting fortunes and sector focus that resulted from pandemic. In fact, with money poured (excessively) into vaccines and not treatments but with the Fed statement underpinning Stimulus and a 'Fed Put' going forward, we not only nailed the March 23rd (Inger Bottom) low, but warned against the bearish case made by many prominent analysts, but all so far were 'off-base'.

Now we're going to get a correction, but ideally it will hold, and I suppose you could say I've been a 'centrist' on the market, not just politics. On the market it has been a realization that Fed policy must remain stable, that expectations of big spending later this year will help, and that the pandemic will be addressed a lot more aggressively, but without shutting-down the economy. It's touch for sure, but ideally will be contained as the sector rotation won't deny retreat, but temper it. Plus it's not a shock to the system.

Finally the President called more formerly (but not a National Address) for the maintenance of peace and sanity, and perhaps the images of National Guard, with weapons issued, itself becomes a deterrent to radical militia actions etc. I am still stunned that some Trump supporters do not grasp the significance of the SCOTUS decision on the Election, which is the final word.

In-sum:

Politicians grapple with 'how to come together' or remain largely split. Nevertheless 10 Republicans voted with the House Majority for Impeachment, at the same time it is presumed the Senate won't convict in a future trial.

Now this market, contrary to what some say, remains married to 'stimulus' and to progress against COVID-19, as those are the primary issues for the moment. In fact our basic high level S&P neutrality call this week reflects much on-hold.

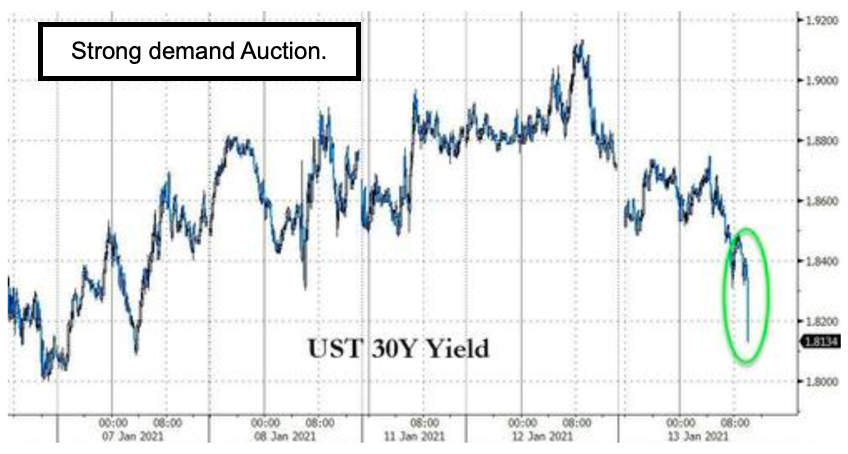

Daily action - notes we're still in an uptrend on 'yields', and now prepare for another speech by the Fed Chairman tomorrow.

S&P continues mostly sideways and relatively unimpressive, really it is stable based on expectations of major infrastructure or other spending. At least until now, with the political overtones having coming to a boil so maybe simmering.

PS: The author was diagnosed with Covid as this post was in progress and publication was delayed. As of Feb. 23 the author is still hospitalized, but recovering. For more info see updates here.