Market Briefing For Tuesday, Dec. 6

'When the going gets tough' - 'the tough get going'. Old Football metaphors don't suffice to divine what comes next for stocks, which can be choppy in this December 1st half (possibly the opposite toward month's end) as noted, but at the same time for some reason bulls & bears alike call for renewed declines in the wake of a year of mostly defense. They might get it, but not catastrophic.

We identified it as a complex erratic low combining the June and October low points as optimal to commence accumulation, not distribution (that was 2021's admonition, under-cover of superficially buyback-bolstered strong S&P then).

As an old wag once quipped about markets, 'when your offense is on the field, you call your offensive plays'. Perhaps the majority of pundits fighting this last move all the way up (as they also did from the June lows) not only worry they may have to chase prices higher, but since they want to buy lower having so clearly missed the move up, that helps limit the duration if not depth of a dip.

I don't disagree that some stocks have more to go in existing directions, just a for-instance would be Boeing (BA) moving higher or Amazon (AMZN) lower. Special picks like AEHR and SKYT are still in early fundamental development cycles, but it seems any consolidation would presage higher prices later.

I've generally suggested S&P could be defensive in December's first half, with a possibly revived year-end rally thereafter, and with small stocks having what has been a yoke of suppression chaining them near their year lows, lifted-off, at least for some revival into early 2023, and for the more-solvent prospects, conceivably doing better almost regardless of S&P's alternating swings. Sure, that's a tough call because so many are in 'indexes' or ETF's and thus barely can move on their own (the 'baskets' of stocks influence them), but as a trend toward 'active over passive' investing takes hold, several will indeed do better, as you already saw where fundamentals are simply compelling (AEHR's one).

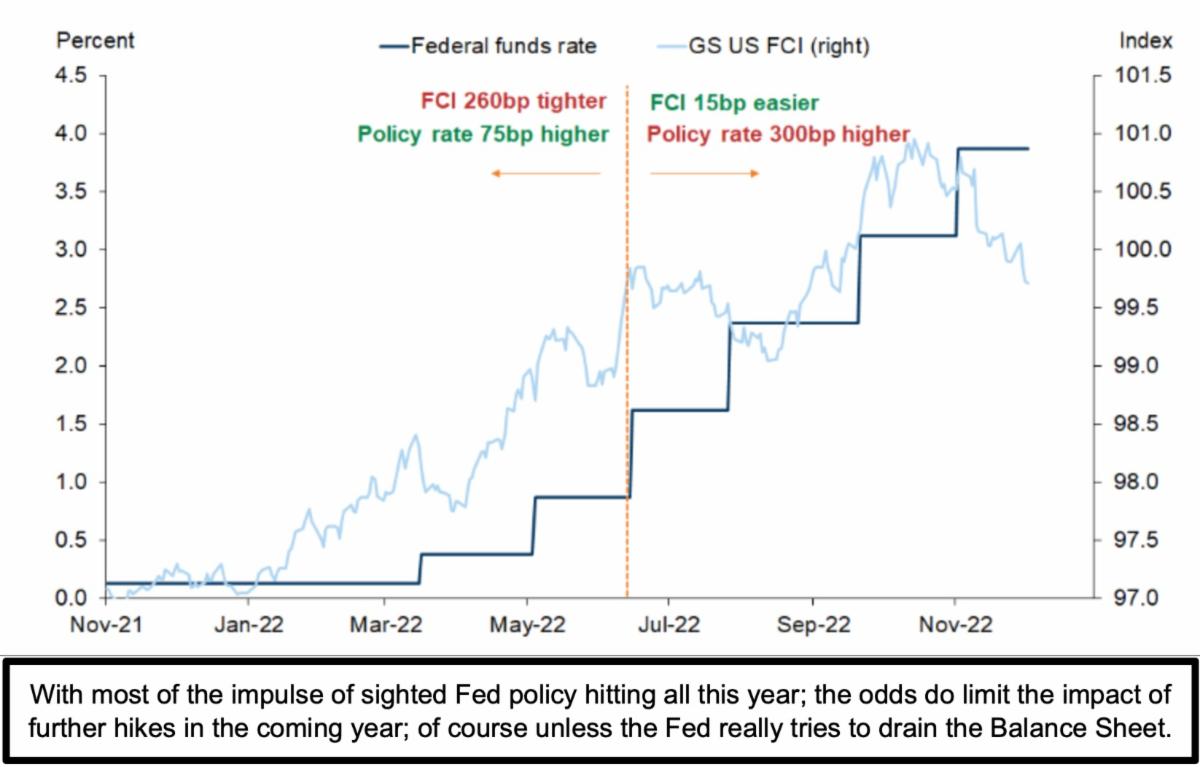

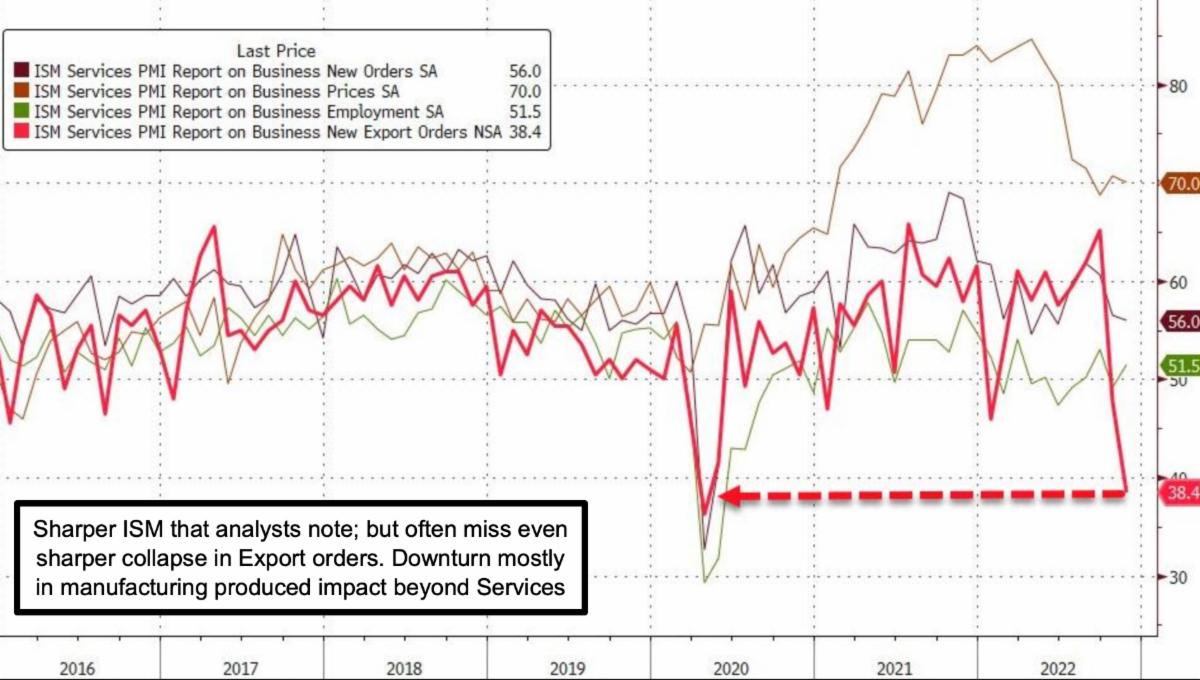

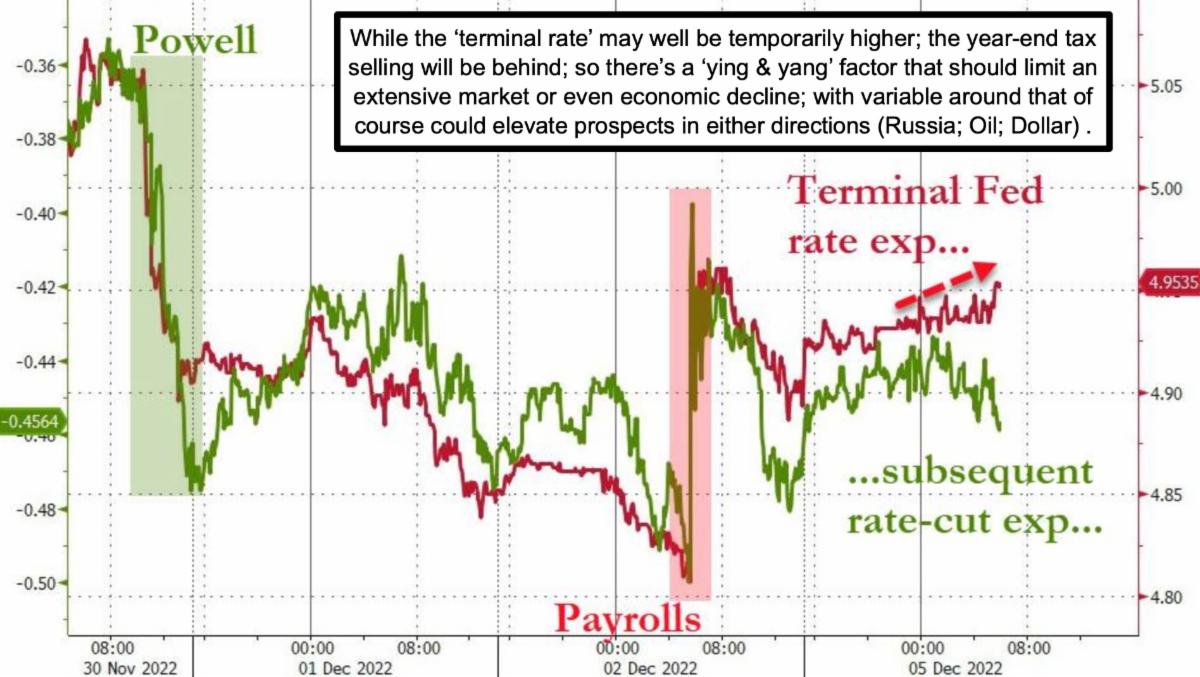

It's not only about the Fed, and as these charts showed, the Fed's action took a bigger slice out of the S&P than it did the economy during the year so far. It is likely part of why more analysts believe the Fed will go 'higher for longer' in 2023, but also why I suspect the huge Federal spending mitigates rate impact that the Fed intended. The Administration and Congress on on 'defense' sort of defending the economy from onslaughts, while the FOMC is trying to call plays for the 'offense', sort of opposing the growth of jobs and prosperity.

In-sum:

Some pundits think the market can crash from here. Not likely, as it's already crashed, first the 'troops' and then the 'generals' Can the U.S. enter the worst recession in American history. Nonsense, not happening with much spending sustained from Government, regardless of rates. Obviously that's a viewpoint presuming no black-swan calamity.

But can we have more sluggish economic activity outside of infrastructure or similar projects? Sure, but such environments usually sees accumulation on dips, not distribution (value stocks to the fore). Finally can our entire financial system be about to collapse. Hell no. Especially not in wartime with the very instruments antagonist bears hearalded as the savior (crypto) crashing instead.

More By This Author:

Market Briefing For Monday, Dec. 5

Market Briefing For Thursday, Dec. 1

Market Briefing For Wednesday, Nov. 30

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more