Market Briefing For Tuesday, Dec. 29

Anxiety relief suffices to describe the market's response to the President's shift late Sunday, by signing the 'relief' bill, while lobbying for the $2000 check to each qualified (?) individual anyway. That was doable by reverting to a law from the 1970's that actually allowed the President to 'red-line' any item in the bill that he didn't like, or wanted reviewed. I presume someone familiar with all these rarely-used provisions called that to his attention, and swayed him.

Or it was just Trump's realization that he'd risk closing the Country or tanking stocks just to appear more interested in providing more funds to Americans as they try to continue bridging the gap to greater comfort in mingling (I'm not at this point saying 'herd immunity', because it doesn't seem that's probably for at least a year, or until better vaccines are available, that don't trigger a fairly high percentage of people, especially in some communities, boycotting what's out there now and soon available to more people).

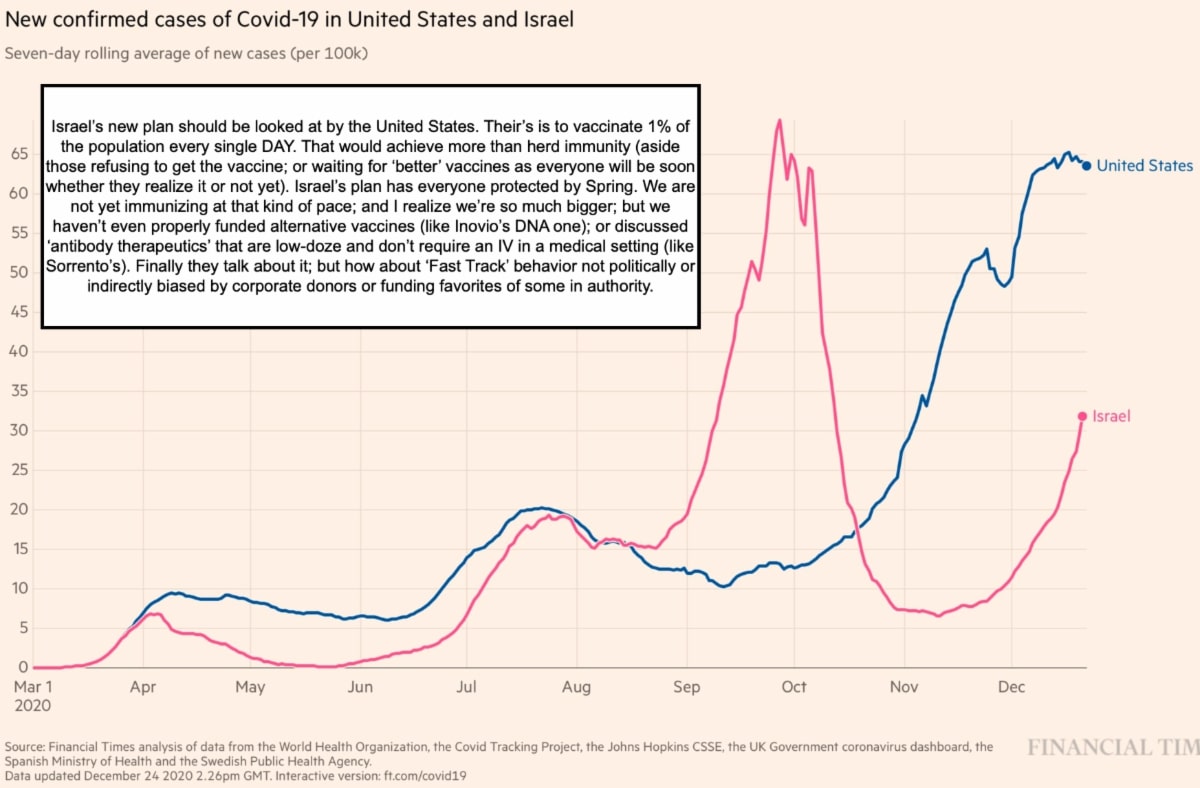

The pace of vaccination is such that it would take 5 years to inoculate every citizen (and non-citizen), and we're not organized (but could be) to propose a solution such as Israel has, which is to vaccinate 1% of the population daily, a pace that would have the Country entirely covered in 3 months 'if' they don't encounter opposition. Then there is Europe, where a typically more provincial population in Eastern Europe (the Balkans and Poland in-particular) distrusts their governments typically, so as they are pressed to 'take' it, they rebel.

It's the same in Spain, where Madrid wants to create a list of everyone who's refusing to take the shot, in-order to deny them the right to travel or attend all sporting events, the 'metro' or so on. Now that's called pressure. I hesitate to even reflect on China, where they just sentenced a woman journalist to 'jail', for 4 years. What did she do? She told the truth of how bad 'WuFlu' really was in Shanghai and reported on the numbers of 'actual' evacuees from Wuhan as well as the level of illness showing up at hospitals. Instead of a medal, jail.

Sorrento (SRNE) and Inovio (INO) . . are both defensive in the wake of passage of the 'bill', which aside relief does fund lots of testing and vaccines of course. However it is the lack of recognition that the existing tests (most are problematic) as well as the vaccines (also more problematic even if advisable for most people) are not likely to be the dominant vaccines a year hence, that suppresses basically the whole sector. That presents a better entry opportunity for those wanting to 'bet' on either of these speculative stocks gaining credibility in 2021.

For Sorrento you know the story: lots of pending Trials and even an EUA for a potentially big-demand 'test', but the proof will be in the pudding, so even as it is not the absence of pudding, but the skepticism about proof, that remains. If it is forthcoming (a test EUA could come at any time), it will at least bounce. If there were news on the STI-2020 front (the antibody therapeutic, that would be another story. Perhaps both of these companies (aside year-end tax loss selling that typically would have occurred before now), are perceived as not in the running due to cynicism suggesting only big-pharma are hooked-up to the FDA, and that's a controversial topic we'd rather not opine on, although there definitely is a history of skepticism about regulators and pharmaceuticals.

As to Inovio, it also (now) has some DARPA support funding as noted, but the vaccine is something that will take months to be evaluated, unless sped-up in ways the DoD and FDA could presumably, but we have no idea about that.

INO-4800 (vaccine) Phase I results were 'very promising,' per the Lancet as I wrote about on the weekend. INO-4800 is stable at room temperature for over a year and up to 100 degrees for over a month. Not needing freezing during transportation or storage should facilitate global distribution versus 'current' Pfizer and Moderna mRNA-based vaccines that require cold-chain logistics.

According to The Lancet, INO-4800 was immunogenic in 100% of vaccinated subjects with "excellent safety and tolerability". However, the competitive FDA regulated nature of the vaccine landscape or uncertainty about the direction of evolution for the vaccine field overall, or the pandemic itself, has skepticism it seems tending to think nobody will worry about this 'soon'. I doubt it, and with the already-known aspects of 'duration', most people will want a different type (or newer version) of vaccine a few months or a year from not (probably).

So Inovio likely has a viable 2nd or 3rd generation vaccine. Its potency levels aren't really known as yet. However a lack of side effects and longer duration matters (if proven). A BofA analyst offered a thought that we 'won't need' an annual COVID vaccine well that's interesting (but probably incorrect).

Of course he likely means SARS-cov-2, which causes it. I wouldn't disagree about 'COVID' being around for years, but I would dispute the idea of no need for vaccine, again relating to the Spanish Flu over 100 years ago being the basic 'Influenza A' we still get protected against yearly in the 'annual flu' shot. The failure to recognize to need to protect (with better vaccines) might be part of the lethargy among what are considered by many as 'secondary' vaccine candidates, but might turn-out to be at the helm a year hence. Speculative.

Over time INO-4800 may prove to be a preferred third-generation or a booster vaccine but again, it's too soon to know that. That's why it's speculative, and it is probably why both Inovio and Sorrento having so much 'pending' and little in play at this moment to actually treat people, tends to keep upside prospects in the 'show me' stage, pending additional FDA actions or clinical validations. I again emphasize that with Inovio that's perhaps months away (more attention if they get more funding), but sooner for Sorrento, with approvals pending.

Executive summary:

- S&P was satisfactory simply with relief that the President signed the relief bill, apparently once Trump learned that he could red-inline the specifics.

- A sell-off in the S&P continues to be 'out there' but forestalled as is typical this time of year by the way, and probably into early 2021 barring shocks.

- The House is voting to increase the 'stimulus check' and it like happens, and then we'll see if enough Republicans go along with Trump's desire, at this point aligned with Democrats that wanted this degree of help earlier.

- The catch might be down the road as candidly a portion of the population truly struggling to get by needs more help, and many small businesses won't make it to the 2nd half of 2021 at the pace things are going.

- Crosscurrents do prevail, somewhat focused on tax shifting, which has been going on for weeks, some of the beaten-down rising as you already noticed, while most super-caps hold together into 2021.

- Generally 'COVID' stocks were on the defensive, 'as if' the few vaccines out or about to be, are somehow a panacea, which they clearly are not, but a step in the right direction.

- Too many analysts dismiss the need for newer vaccines an therapeutics, and it's hard to say why, they must know that any of these vaccines gives a finite amount of protection measured in months not years.

- I would like to believe the FDA is not in the pocket of lobbyists or pharma influence, but history suggests being a bit skeptical, without inferring any knowledge of anyone specifically trying to keep-out smaller biotechs with very promising approaches.

- I'm not being politically correct, I'm just think it's pathetic if anyone puts an involvement or relationship with any pharma, for treatment or testing, well ahead of the interests of the Country.

- Yes big pharma is doing great stuff, but that doesn't mean money wasn't thrown at them 'to' develop treatments or tests that smaller firms already had on the shelf essentially, and just need(ed) a hand to get things going.

- Sure, Inovio and Sorrento exemplify this, but they're not alone, I focused on them but there are others, and in 2021 all this should sort-out a bit.

- In other areas, leisure and travel stocks are not very exciting, people now are starting to realize we'll not be out of this overall situation for months.

- This may increasingly set-up the S&P (SPX) for a shakeout or outright decline, at the same time (for the moment) that could be some weeks from now.

- If we take another hit, what real estate and home-building stocks, they've had a good run, but are not only expensive but might become at-risk.

- Although Apple (AAPL) was up, despite analysts suggesting any 'Apple Car' will be years later than last week's speculation, while 'autonomous driving' or Lidar companies generally corrected.

- Ironically any delay by Apple probably helps the mainstream car firms as well as Tesla (lack of even more competition), so may enhance interest in the sector, and ironically Tesla commented about updating software soon to support Apple 'CarPlay' which links your iPhone (nav. etc.) wirelessly.

- A supplier to potentially any happens to be LightPath Technologies (LPTH), at least as far as infrared and/or visible-light lenses.

- Finally AT&T (T) suffers today from lack of comprehension by some users, as the targeted building in Nashville was a regional hub essentially, they are using temporary cell towers and so on, but there was a lot of damage, so service in the entire Southeast has been impacted to a certain degree.

- We presumed insured, turns out 'that' A&T center was a modern building, not a fortress like data-centers originally built to withstand nuclear attack during the cold war (I commented on one of those in Chicago I visited as a 'side-event' associated with giving a market seminar at the time).

- Also 'Wonder Woman' delivered a knockout blow to competition on HBO Max Christmas Day, and there will be a couple of sequels coming (no it wasn't exactly my kind of movie, but the 4k rendition was well done and I did have a moment when Linda Carter made a cameo appearance at the end, for any who remember her role in the original way before 1984).

- Stock market remains fairly thin in a semi-holiday mode, limited volatility but delicate, as you see with some stocks move in irregular fashion.

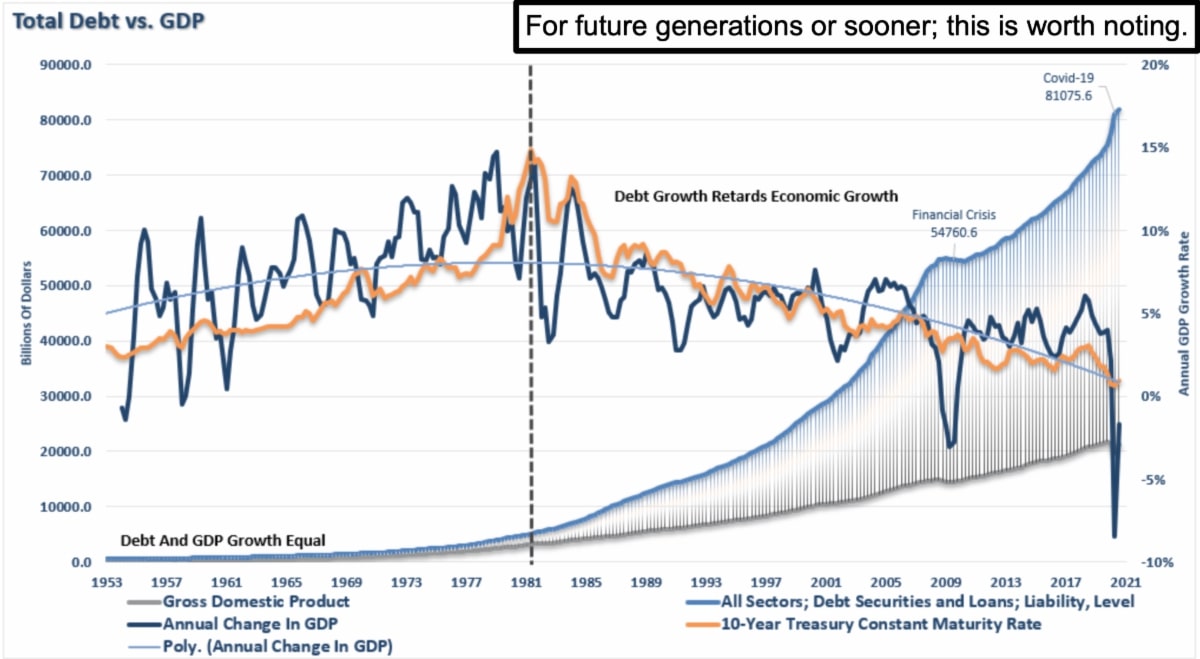

In-sum: S&P holds sentiment at extended levels. And the market is not at all as exciting as a superficial look at the DJIA (DIA) or S&P suggests (super-caps did a bulk of the upside, while breadth was barely positive on Monday). This likely continues into Tuesday, perhaps a little firmer 'if' Congress does for the larger stimulus request, despite where that leaves the overall debt picture.