Market Briefing For Thursday, May 19

Lack of resilience has been an overhanging suppressant on economic and geopolitical activity for a long time.

Ironically the events currently upending all elements almost across the Board, are helping companies and leaderships of countries (as well) to grasp what has to be done to get a handle on matters.

It's recognition not merely of a bubble, but an unsustainable internal rebound from pandemic (I'm describing our forecast move off the March 2020 lows as it matured later that year and in 2021) .. all that contributed to a move borne of 'fear not confidence' that concentrated money manager interest in the old FANG theme stocks, or slightly wider mega-caps in general. Violent churning is psychologically unnerving even to professionals (maybe especially), given the nature of the cracking today, especially in so-called safe-haven plays.

Weak demand is out there, even as people say everything's active. Multiple compression is the key to valuation, slower growth in this changed world, and finally this is being priced-into the 'un-crashed' or big cyclical stocks. That's a sort of good news, which doesn't mean there's not more to go. Much of this is what we've termed 'demand destruction', and it doesn't ensure inevitability to having recession, or having had one, or to the stagflation we've envisioned.

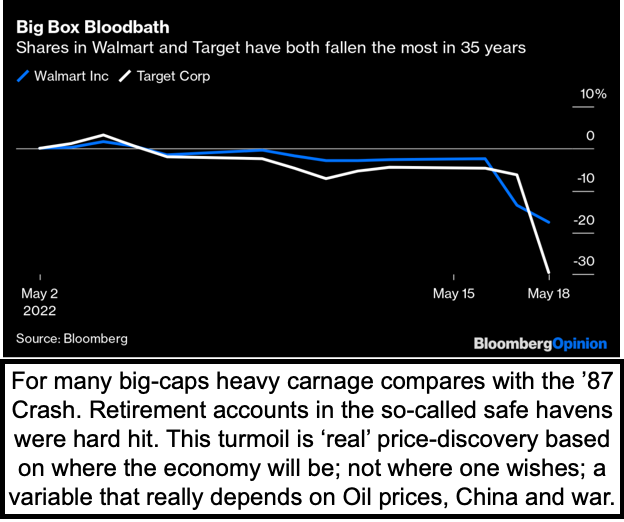

I mentioned big-cap risk often, as similar to recent activity, where analysts and pundits encouraged buying 'only' dividend-paying major companies, shunning already-bargain-basement priced (presuming solvency and business models that work over time of course) stocks, that have little room above zero prices. Now they're creaming the big 'safety' stocks with little movement in others.

I don't believe I emphasized it enough, as Tuesday I spoke to the Walmart (WMT) hit as likely 'not' reflecting mere poor management at that major retailer, but more likely symptomatic of the profit-margin squeeze all the major retailers faced. In that regard I viewed Costco (COST) as likely better-managed in the Retail sector, but all of them were vulnerable to profit-margin pressures.

That relates (as noted yesterday) not just to supply-chain issues coming from far-away (China mostly) sources, but to wages and even diesel fuel costs. For sure none of this was unknown before today, but somehow Target's (TGT) sober as well as dubious reflections (given they would have known all this sooner) very quickly stunned 'the Street', again even though there was nothing new in this, aside the obvious: Target could no longer absorb most of the cost increases. It relates to wages and fuel and the end of stimulus, again all pre-existing.

So I find that part interesting, as the shift to more spending on essentials than on typical 'discretionary' items, not only reflects the obvious in tighter times by Fed decree (or simple absence of 'free' money from stimulus) but my belief I'd stated before, that this has to hit Transports (not just trucking, or shipping, a segment that is already seeing lower carriage rates by the way), but Airlines in the fullness of time, as consumers gradually will tire of pricey fares or hotels which are trying to offer less service at higher prices, or sneak-in resort fees.

In-sum:

The catch-up by the Fed is not likely to resolve the inflation issue, as their efforts trail actual price levels, and pressures. The Fed -not just stocks- needs to capitulate a bit, instead of how Chairman Powell again presented it: as he said the Fed has no interest in saving markets or presumably people as well, until they break the back of inflation.

The continuing problem is that much of inflation isn't 'demand-pull' but 'supply-push' inflation, which are causes beyond the simple movements the Fed can take. Nevertheless, even when the Fed 'wanted' inflation (and I said 'careful what you wish for'), they were looking at higher wages and someone high Oil prices, not the thinly-veiled and fragile supply-chain issues.

Then there's the other aspect, that this inflation is dangerous (fine line for the majority) and well-beyond the mandate of the Fed for 'price stability', but does make it easier for Washington to 'service U.S. debts' with depreciated Dollars.

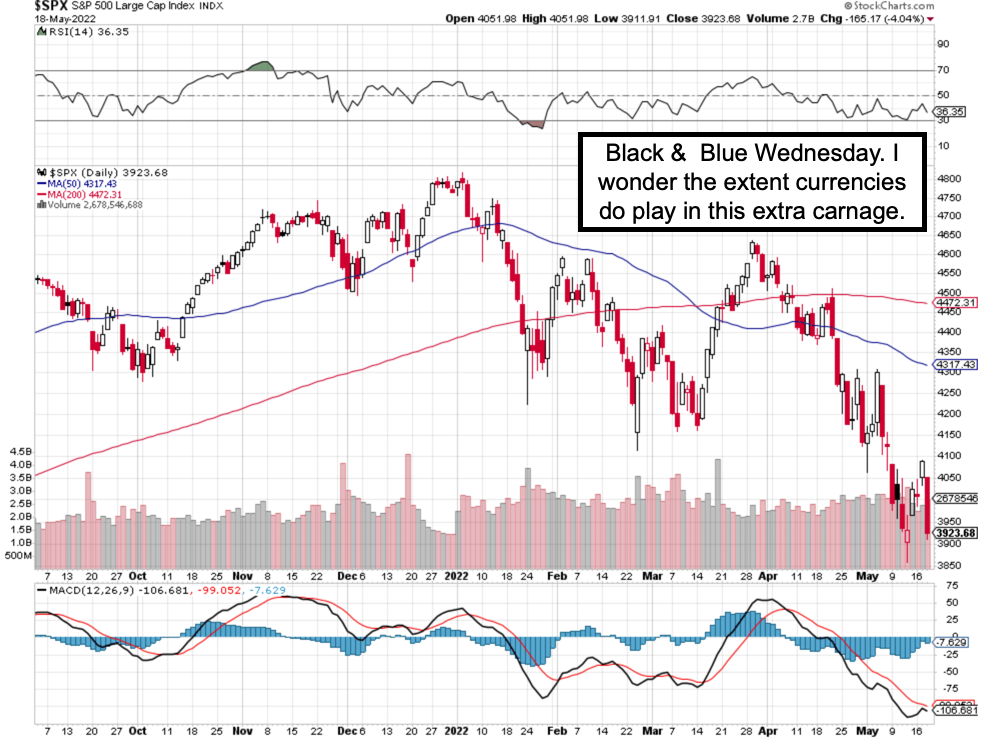

More follows, fear may be overblown as relates to the 'real' economy, while it is true the market is saying 'things will get worse'. Consumers are not 'yet' so affected by Quantitative Tightening, as it really hasn't impacted anything yet. I suspect this is reflective of the broken trading system too, algo-domination as reflects chasing strength and liquidating into weakness (stop the machines?).

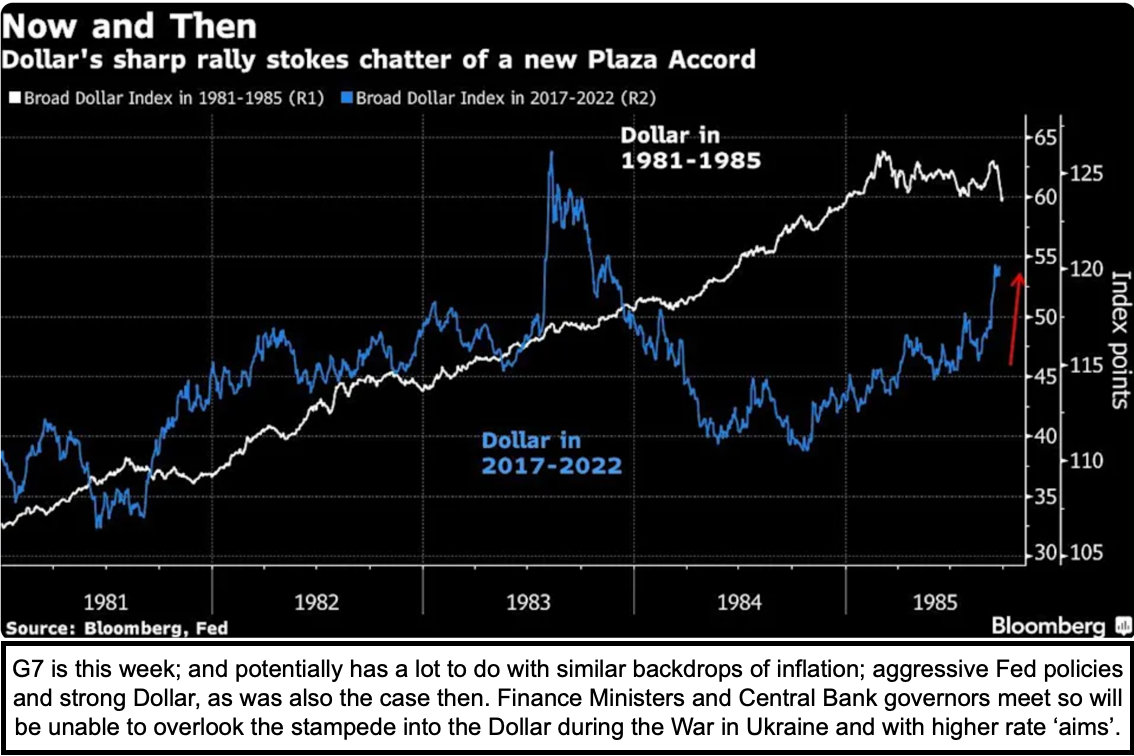

Also keep in mind China's concerns (they are a large Treasury holder) and of course what happens if foreign currencies keep crashing versus the Dollar. I know everyone's focused on 'consumer staples', I'm thinking of currencies.

Wednesday saw stocks like Target (and include Walmart from yesterday) off by about as much as during the last crash. Again, these big-caps catch-down and that burns a lot of fund managers, but it also can be toward latter stages of decline. The majority of smaller stocks already crashed, so it's hard to get a concurrent purge/capitulation such as some in history, given the bifurcation.

This characteristic is something I've talked about for over a year. We simply got a relief rally that I would have like to see perpetuated a bit longer, but that became impossible the moment the Target story followed the Walmart miss.

Now, technically, you ended a 'relief' rally looked for, and there is low odds of a successful 'secondary test' of the high 3800's S&P (SPX) low of a week earlier. We are open-minded to this process either continuing (extensions to 3600/3400 or depending how much panic can even be engendered in this set-up given a slew of compelled liquidations preceding) or suddenly ending.

Bottom-line:

The relief rally ended just a bit shy of measured goals, but we'd not been too optimistic given that everyone was 'fighting the Fed', which saw that and came off the mat with a vengeance to remind investors this week.

One other thing worth noting: 'consumer discretionary' stocks ranging from a cheapo Dollar Tree to Autozone to Best Buy, to Campbell Soup, to Kraft, to General Mills...all these even Kroger, were defensive stocks getting killed. So that begs the question: when these favorite hiding places of those who try to be fully-invested all the time get clocked, isn't that sometimes late-stage in the sequence of hits.

And then there's Cisco Systems (CSCO), warning that lost business in Russia as well as Belarus, will likely cost them more than 5% lost revenue for the year. That's in-addition to lost business in China, for now. It's off about 8 this evening.

The problem is everything big has been too expensive, and doubly so if one views all the guidance predicated on a world that's really not existing, at least for the moment. Most small stocks already killed, but old news. Now you need lower guidance on 'multiple and margin' compression, a factor that squeezes profits and helps drive stocks to a level where our central bank might take note, and recognize that they can't string this out for duration 'that it takes' to break inflation. It's a perfect storm, but much of it has passed.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more