Market Briefing For Monday, Oct. 3

Note: A short supplement to Gene Inger's initial post can be found at the bottom of the page.

The Great Reset is a term being used to describe current market action. I'd say the reset has been a process ongoing for a couple years, with our 'Inger Bottom' of 2020 signifying a pandemic cycle low, with an urgent Fed 'pivot we based our down-up reversal on'. That allowed money managers a reprieve.

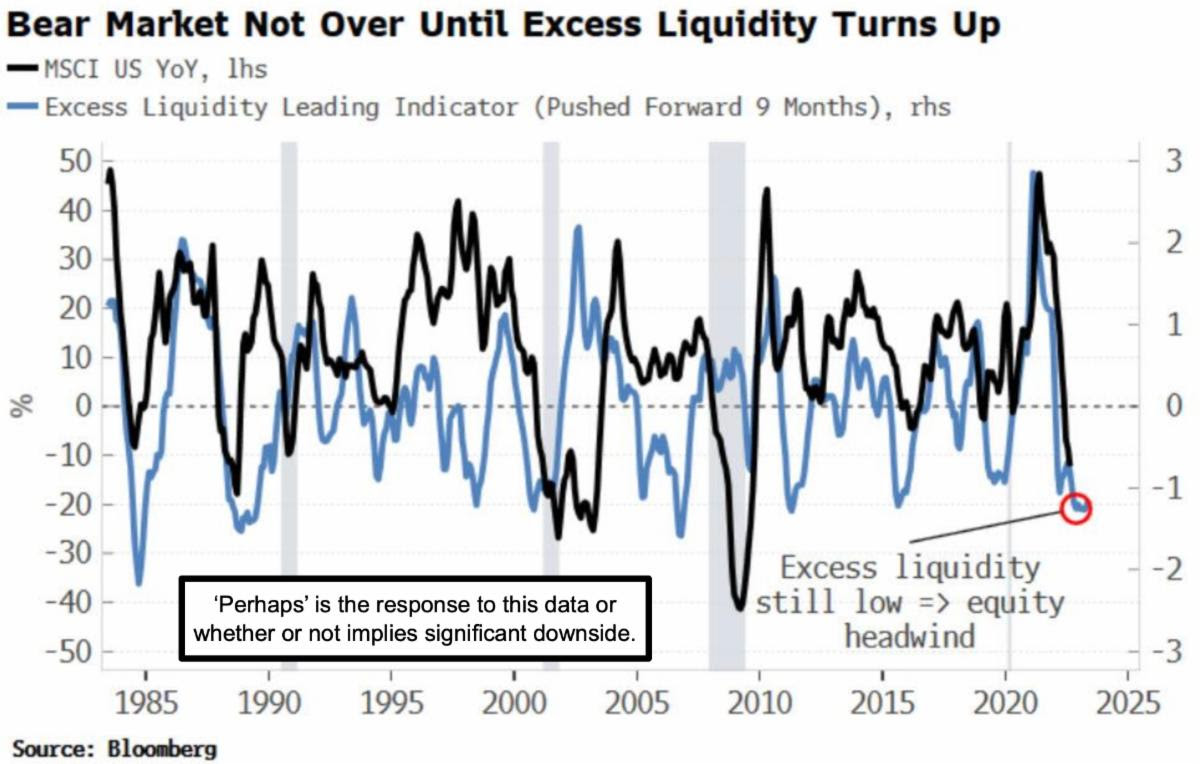

The 'current' reset differs from purges of the past, because it has been going on for nearly two years, as I again recently described, and has eroded most of the smaller and 'average' stocks (especially tech-related) more than typically in bear markets. Nothing much has been spared, so relative out-performance is almost irrelevant, and as those 'Grand Dames' surrender, you get nearer a low point, because everything else is already crunched, and here come those big laggards that money managers 'thought' provided them safer haven.

The mess is that a low is closer, risk gets reduced as bearishness increases, and the seasonal absence of liquidity allows rallies to be intervening bounces rather than meaningful turnarounds, in most cases. This drags on just a bit.

Geopolitical uncertainties should be near the top of considerations, and not just the obvious Russian/Ukraine risks, but the Oil component and Asian risks too. Oversimplify things a bit, and you might add 'tax-loss' selling as well as a propensity of dip buyers looking for 2023 rebounds to be gradual about that. It seems like there's every technical and fundamental reason not to be heroic.

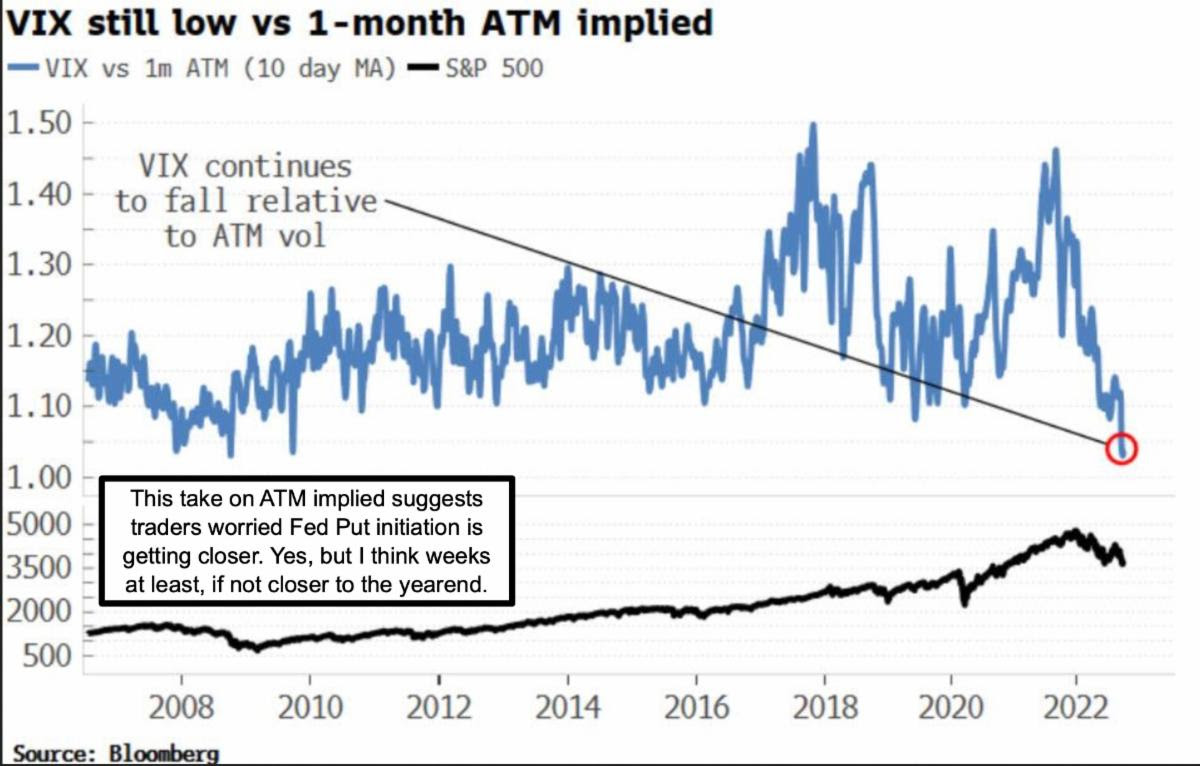

In sum: Little has changed with alternating S&P swings, while trades speculate on how low is low, with a presumption of another heavy-weight crunch ahead. While that may be the case, it's not entirely Fed-dependent, and actually we'd consider the unspoken: a more timid Fed (despite near-term actions) might be compelled to at least back-off a bit given the funding needs for 'Ian' recovery.

I hasten to add that will take months even here (and longer by the Florida Gulf Coast where devastation is catastrophic, and we don't know about the Carolinas yet in terms of overall cost burdens.. much less lingering storms into Virginia/DC).

While not noted in big media (shows extreme damage less the broad swath of damage that doesn't make tear-jerking videos, but is significant), we see lots of damage unreported (but personally conveyed) at Universal Studios (that's Comcast property), also within Disney World itself. Theme parks will open of course, but not everything, and they will minimize structural repairs needed.

The well-being of the market is always my concern, and that remains as it has over the past two years, generally defensive and slowly picking-up disasters that may recover, while entering some big-cap techs (like our AMD) again will be pending the action as the Fall's fall sorts out.

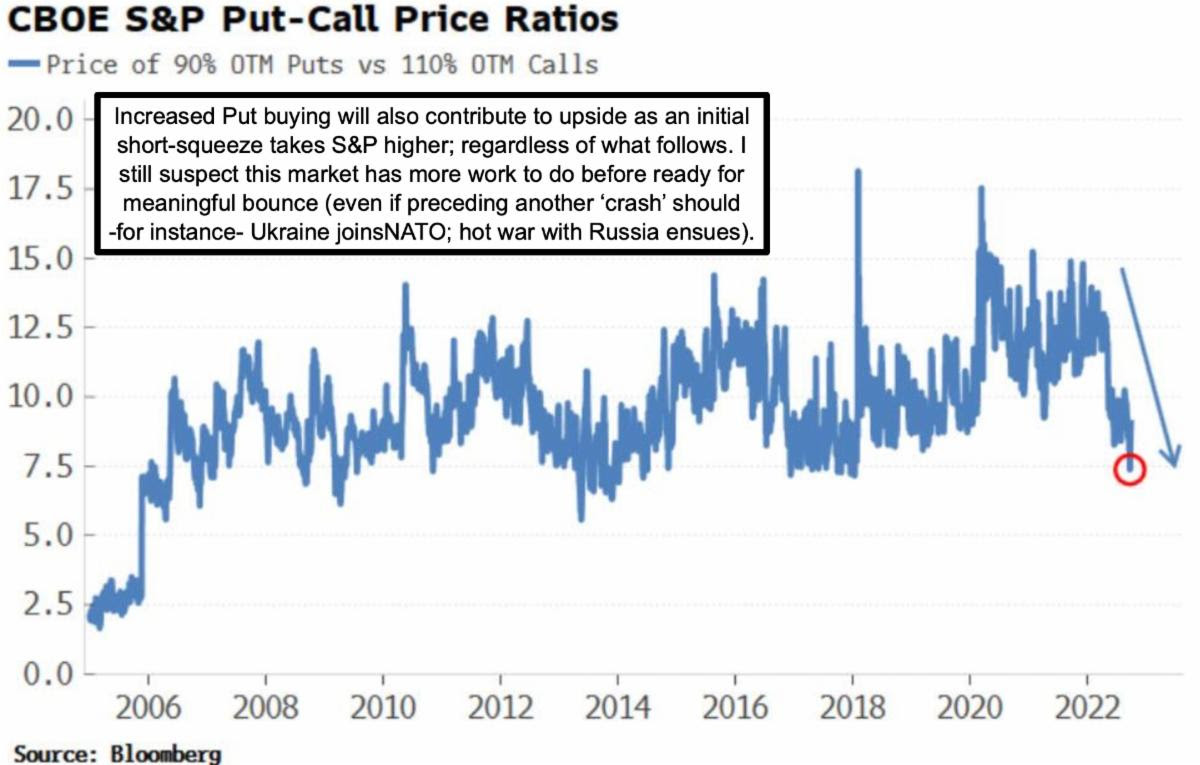

Are we awaiting a systemic break, or geopolitical event to rock that last huge stocks out of their resistance to collapse, not merely decline? Possibly yes. It is now October, but aside a 'crash', Octobers tend to structure a lower 'max pain' point after a negative September. And this was a heavy September with 'zero' re-balancing at Friday's close, unless it was to raise cash ahead of the 4th Quarter. That in itself is a negative omen, as money managers view a big stock (like a Nike, but really any of them) as 'source of funds', not hold.

I think everyone is atoning this year for buying all sorts of stocks prematurely, at the same time the greatest risk truly remains in the macro beneficiaries lest the Fed 'takes their foot off the brakes' of the economy within the new month.

The Generals 'in the trenches with the troops' are now in a ragged retreat. In a total slaughter of the 'mega caps', I'd be interest in Apple in the 80's if that is out there, or AMD somewhere near what we originally paid (~17) although I'm likely exaggerating the extent of decline, in the case of the latter. If you'll go back to the 'Epic Debacle', we were interested in Ford just over 1 but doubt it gets that low either. Of course we don't know specifically what might break. It is a 'hit parade', stocks get hit then the earnings guidance gets lowered, and they drop more, and then ideally they 'might' bottom, adjusted for 'news'.

It is also historically the case that when the psychology gets that negative you are closer to forming or capitulating into a low, unless of course it's WW3 and that is why I am very interested to know more about the drones intruding into NATO airspace, and if Russia targeted Oil (perhaps with drones built in Iran) as a tactical attack. By the way it's not WW3 based on Europe, only if China invaded Taiwan, which presumably they are not (crazy like Putin) to do that, just now. Again however, this is like the 1930's and it's not going very well.

The conclusion is more work to be done for S&P and as noted within the embedded text in the weekly S&P chart, allow for a washout and rebound to catch 'em, but that could be thwarted depending on exogenous events.

The absence of global policy coordination (or so it seems) has speculation of growing recession risks, just a bit nuts as I believe it's ongoing for months. In my view Europe 'is' in recession, the United States faces a double-dip which the Fed ignores, and Congress Friday passed stopgap funding to prevent yet another Government shutdown effort, which of course defies lower deficits.

I have argued that the lack of coordination between central banks might be a ruse, because they typically synchronize rate changes. However the absence of global policy 'grasping' the macro aspects can lead to excessive monetary hiking in the U.S., and in my view already has in the European situation. This backdrop should enhance odds of Summer lows not holding. This is basic.

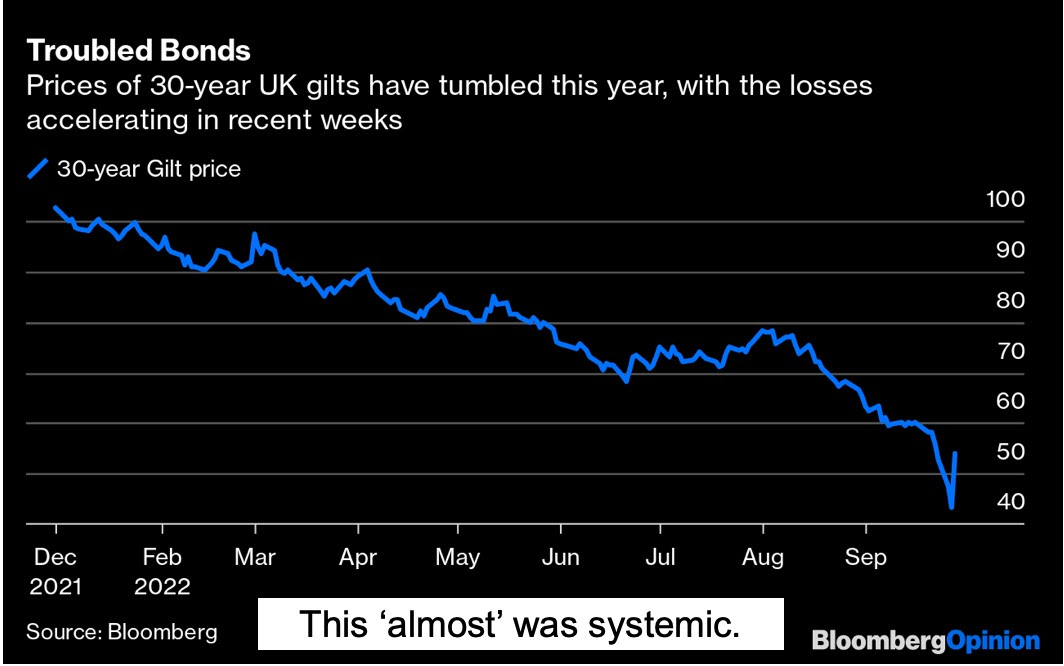

However, 'if' we get more tightening globally (a few like the U.K. and Turkey at this point have diverged from the insanity, rightly or not) things can go awry at least on a short-term basis. That's a reason for hesitancy, even a Fall 'crash', one would think, but a rub is that most smaller stocks already have crashed.

Norway is providing 'CAP' (Combat Air Patrol) over their energy facilities as well as offshore oil fields, and that's as Denmark spotted 'armed drones' that were overflying offshore Oil platforms. If those are Russian, it's an act of war.

This of course in the wake of multiple attacks on the Nordstream pipelines.

Bottom line: What lies ahead is tricky but most likely remains defensive for now. I realize there was NO re-balancing reflected at the Quarter's very end, unless actually additional lightening-up, presuming more downward behavior.

But that could result in excessive downside confidence early next week, and a rebound again within context of the downtrend. Meanwhile worries that central bank policy errors create risk are certainly valid worries (systemic risk as we'd briefly seen with the U.K. this past week), while we also have to view arrogant policy attitudes by certain monetarists who now over-tighten compounding the mistakes they already made by being too loose for too long in the first place.

Meanwhile our hearts are heavy for those lost or struggling on the West Coast of my State of Florida, after a hurricane that brought what any sensible human knew was inevitable somewhere along our coasts in this 'mad' climate era. In a financial sense this requires wrenching re-evaluating insurance matters and so on, but notice that properly built structures generally survived the storm.

At the same time most humans got out of the way, knowing better than have a bit of faith in the 'center-line' of a Hurricane 'cone' projection, from which storm impacts have almost always deviated a bit in the last hours (like counting on a 'median' in the market to actual control exactly where the S&P lands).

Finally, with all empathy for the struggling, the real story out of this is Tampa. That was the earlier landfall target, and would have been (by far) America's biggest catastrophe ever. So to simply say they 'dodged a bullet' is obviously true, but also the biggest understatement of the year.

Postscript: the Jewish faith marks the end of the Holy Days with Yom Kippur, on Oct. 4-5, followed by the week-long festival of Sukkot. During this time we are likely to get a washout and rebound that's unsustainable, just because of the 'old adage' (sell Rosh Hashanah and buy Yom Kippur), but let's not rely on that to any extent. I give thanks that all Florida friends made it safely through a storm that was truly an historical horror show.

News Update Supplement:By now you've heard OPEC+ may reduce Oil output at the coming week's meeting, you know that Ukraine continues their advances into Russian-occupied territory, and everyone debates whether or not Putin would actually use nuclear weapons, or if his underlings would obey any such order (considering how many civilians they killed, it's a tough call). l know there is speculation regarding the Fed and a possible pivot. I have two sources suggesting an Emergency Fed Meeting 'tomorrow' (Monday) will be held, and two others who say it's a rumor. There is also a report suggest that a Fed pivot would not be sufficient to turn the market and stabilize matters. I have also taken note of the initialized gas delivery to Poland, which benefits Poland, Denmark and Norway particularly, via the brand-new Baltic Pipeline. |

|

|

|

I will dispute that one: if the Fed does pivot and change plans in a QE sort of way (remember, they avoided kicking the Mortgage Backed Securities market sort of telling you their bark was worse than some of their bites). In line with a 'don't fight the Fed mantra' (that worked so well in calling the "Inger Bottom" in March 2020, I'll say here the same: if the Fed pivots (and I have doubt they'll do so, but if there's an FOMC Meeting, that would likely be the mechanism for it).. if they pivot, and the market rallies to then sell-off, favor the upside again with a bias to believing the S&P would favorably respond to such a move. I'm not saying it's wise, or anything else, merely how things would probably go. |

|

|

|

This is not only a continuation of the 'Great Reset', but a great miscalculation by the Fed, behind the curve for so long and recently ahead of reality. A sober pause in their veracity would be welcome. |

More By This Author:

Market Briefing For Thursday, Sept. 29

Market Briefing For Wednesday, Sept. 28

Market Briefing For Monday, Sept. 26

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.