Manufacturing Expected To Rebound In Q1

Weak Durable Goods Orders

December durable goods orders report was weak as it signaled there will be weak business investment growth in Q4. We already knew business investment would likely fall. This just reiterates that perspective. Hope is capex recovers in 2020 since the regional Fed manufacturing reports have been strong. Monthly durable goods orders growth was 2.4% which beat estimates for 0.5%. And it was near the high end of the estimate range which was 2.5%.

Despite this seemingly strong reading, this report was weak because airline orders boosted headline growth and it had an easy comp. November new orders growth was revised down from -2% to -3.1%. Monthly transportation equipment orders were up 7.6% as defense aircraft orders were up 168.3% which offset the 74.7% decline in civilian aircraft orders.

Boeing stated it only got 3 commercial aircraft orders which was down from 63 in the previous month. December is usually a strong month for orders. But the delayed Max 737 makes that seasonality irrelevant. If the delays end this spring, we should see a big boost in headline order growth.

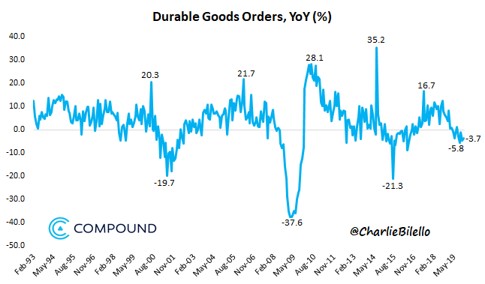

As you can see from the chart above, headline durable goods orders fell 3.7% yearly. That was up from -4.8%, but the comp got easier by 1.7%, so the 2 year growth stack fell slightly. Markets expect further improvement in yearly growth in 2020. January yearly comp will be tough, but the rest of the year will have easy comps. Ex-transportation monthly growth was -0.1% which missed estimates by 3 tenths despite the 4 tenth easier comp (November growth was -0.4%).

Furthermore, core capital goods orders fell 0.9% which missed estimates for 0.2% and dramatically missed the low end of the estimate range by 1%. That’s even though the comp was a very manageable 0.1%. Yearly growth was 0.8%.

Yearly non-defense capital goods orders growth excluding aircraft was 1% which improved from 0.3%. That’s the highest growth since May. That’s what happens when a comp gets much easier. Last year, growth fell from 6.1% to 1.9%. Just because yearly growth improved, doesn’t mean this was a good report.

Very Strong Richmond Fed Index

A run in the regional Fed manufacturing reports is complete. With the huge spike in the Richmond Fed index, all 5 showed improvement. This implies the ISM PMI will rise to the low to mid-50s. Personally, I’m hesitant to predict an above 50 PMI. Especially ince the ISM reading has been lagging the other soft data reports and the flash Markit PMI fell slightly. However, conservatively, I am expecting a rebound to the high 40s. It should rise from 47.2 to about 49.5.

It’s impressive that both the Kansas City and Richmond Fed indexes improved since they have exposure to Boeing’s supply chain. Similar to the Philly Fed index, the Richmond Fed index had a massive spike. It rose from -5 to 20 as it more than doubled the most ambitious projection (9). It beat the consensus of -3, which made for the largest beat since March 2009.

Shipments index rose from -6 to 29 and the volume of new orders index rose 26 points to 13. This was a fantastic reading. A backlog of new orders index rose 20 points to 9 and the local business conditions index was up 22 points to 16. Capex index was up 3 points to 15.

The chart below shows the average of regional Fed indexes’ capex readings to predict the 6 month change in core durable goods shipments. This is the highest the capex tracker has gotten since July 2019. These regional Fed indexes imply the manufacturing recession is almost over. Remember, if the ISM PMI gets above 50, that’s actually bad for equity returns.

Expectations categories in the Richmond Fed report were also strong. Shipments were up 3 points to 41 and volume of new orders were up 8 points to 37. Local business conditions fell 13 points to 14 and capex was up 1 point to 5.

Improved Consumer Confidence

Bloomberg Consumer Comfort index was right. Conference Board consumer confidence index did improve nicely in January. December reading was revised higher by 1.7 points to 128.2 and the January reading beat estimates for 127.8 as it came in at 131.6. It was near the highest estimate which was 132. This was a really strong report.

Present situation index rose from 170.5 to 175.3 and the expectations index rose from 100 to 102.5. Bears who have been saying for months, even years, that high consumer confidence meant a recession is coming have been dead wrong.

Consumers saying current economic conditions are good was up from 39% to 40.8%. Those saying conditions are bad fell from 11.1% to 10.4%. As you can see from the chart below, consumers became even more confident in the current job market. Those saying jobs are plentiful rose from 46.5% to 49% and those saying jobs are hard to get fell from 13% to 11.6%. The chart shows the net difference rose to 37.4%.

Consumers’ outlook on the labor market also got rosier. Ppercentage expecting more jobs in the next few months rose from 15.5% to 17.2%. And the percentage expecting fewer jobs fell 0.5% to 13.4%. Net percentage improved from 1.6% to 3.8%. There weren’t significant changes in expectations for business conditions and short term income.

Conclusion

Durable goods orders report was weak. Clearly investors aren’t concerned with weakness in Q4 as they ignored it during the quarter. Now that it’s over, investors have even less reason to worry about business investment as it should improve in 1H 2020.

Average of the regional Fed manufacturing capex indexes confirms business investment will rise in 2020. Bloomberg Consumer Comfort index was right in its forecast that the Conference Board consumer confidence index would be strong.

Redbook’s same store sales growth in the week of January 25th backs this up, as yearly growth improved from 5.3% to 5.5%. Same store sales growth has been strong this month.

Disclosure: None.