Triple Play Acquiring Triple Play

Exact Sciences (EXAS) announced plans today to acquire another health care company, Genomic Health (GHDX). The two announced that the agreement would combine Exact Sciences with Genomic Health for $72 per share in cash and stock. That acquisition news is not the only thing the two have in common though. Both companies also reported EPS before the open today, and they were both triple plays.

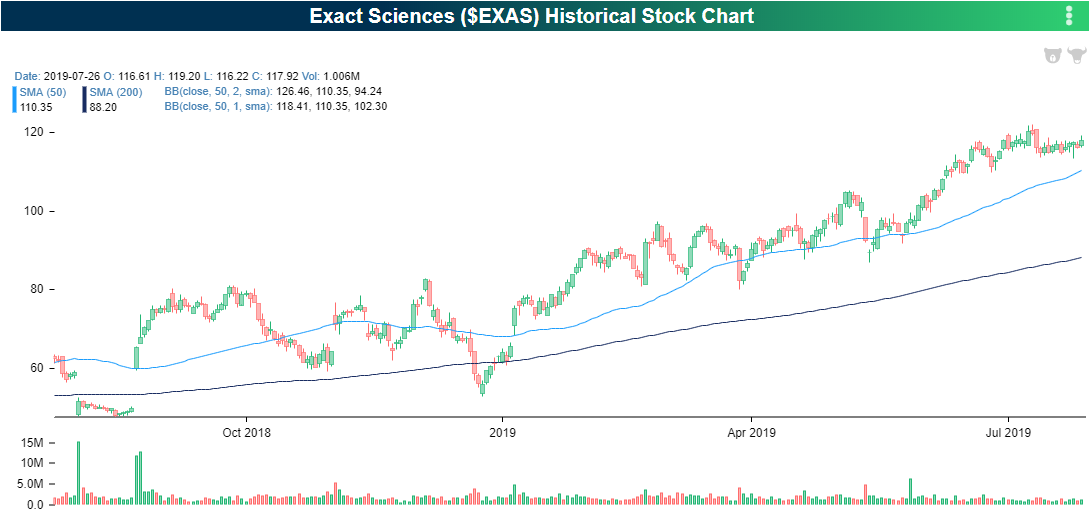

Exact Sciences (EXAS) is a cancer diagnostics company specializing in the detection of colorectal cancer with their signature product Cologuard. This was the company’s fifth triple play with the last one occurring in October 2018. The company is seeing much larger cash flows this year as it grew revenues an astounding 94.3% YoY to $199.87 million versus expectations of $182.18. This was also the 16th straight quarter with sequentially higher revenues. The company is still operating at a loss, though, with EPS at -$0.30, but that was above estimated losses of $0.56 per share. The company has still yet to post a profit for any quarter over the past 34 reports in our Earnings Explorer as costs/expenses have been growing at a high rate, similar to revenues. For example, in this most recent report, total expenses grew 67.5% YoY. Despite the triple play, EXAS is down sharply today, trading more than 10% lower due to the GHDX acquisition. The stock has been in an uptrend over the past year, so this decline brings it below the 50-DMA and near the lower end of this uptrend channel.

(Click on image to enlarge)

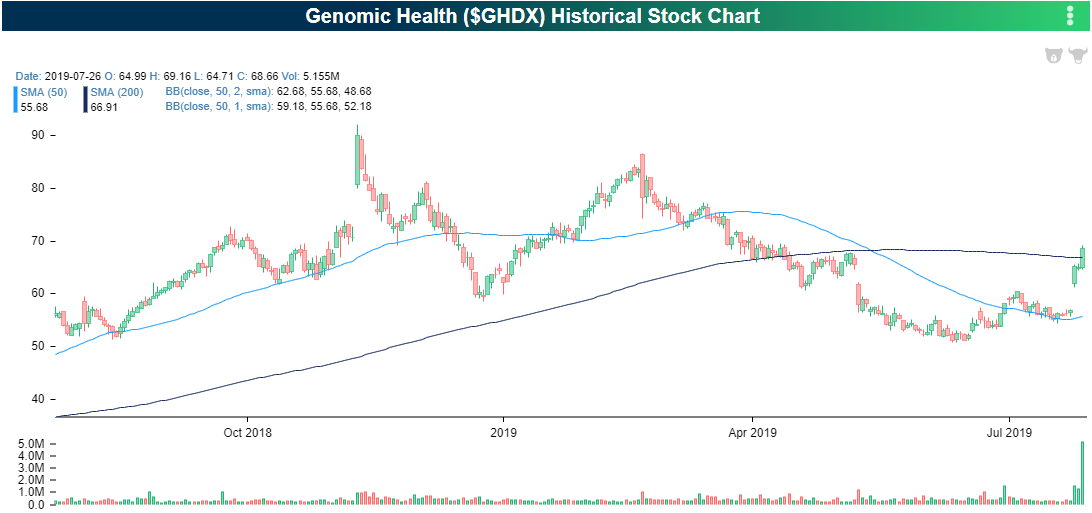

Genomic Health (GHDX) was originally scheduled to release earnings on Thursday (August 1st), but with the merger announcement, they moved up their report. Like Exact Sciences, Genomic Health also specializes in cancer diagnostics. In this earnings report, GHDX reported EPS of $0.42 versus estimates of $0.35.Revenues also came in above estimates at $114.14 million, 19.4% YoY growth. The company reported that each of the key product areas for their main product, Oncotype, saw double-digit growth YoY with the main highlight being a 42.3% growth rate for the prostate test. The stock has risen 3.28% in response today. This is after last week’s massive gains when it was announced the stock would be joining the SmallCap S&P 600 Index.

(Click on image to enlarge)

Disclaimer: Read our full disclaimer here.