LTC/USD: Is A Renewed Push To The Upside Pending?

Litecoin has suffered together with other major cryptocurrencies and saw its hashrate contract to 2019 lows, followed by price action. This raised concerns about a potential 51%-Attack, especially after a dust attack continues to plague the LTC/USD. Developers continue to evolve the network, and Litecoin may be headed into the privacy coin sub-category of the cryptocurrency market. This will have an impact on volume, as exchanges that favor regulation will be forced to delist Litecoin. One short-term bullish fundamental factor is provided by the code of Litecoin, which lower the mining difficulty once the hashrate drops below a certain threshold, enticing miners to re-enter the network. An extension of the breakout sequence is favored.

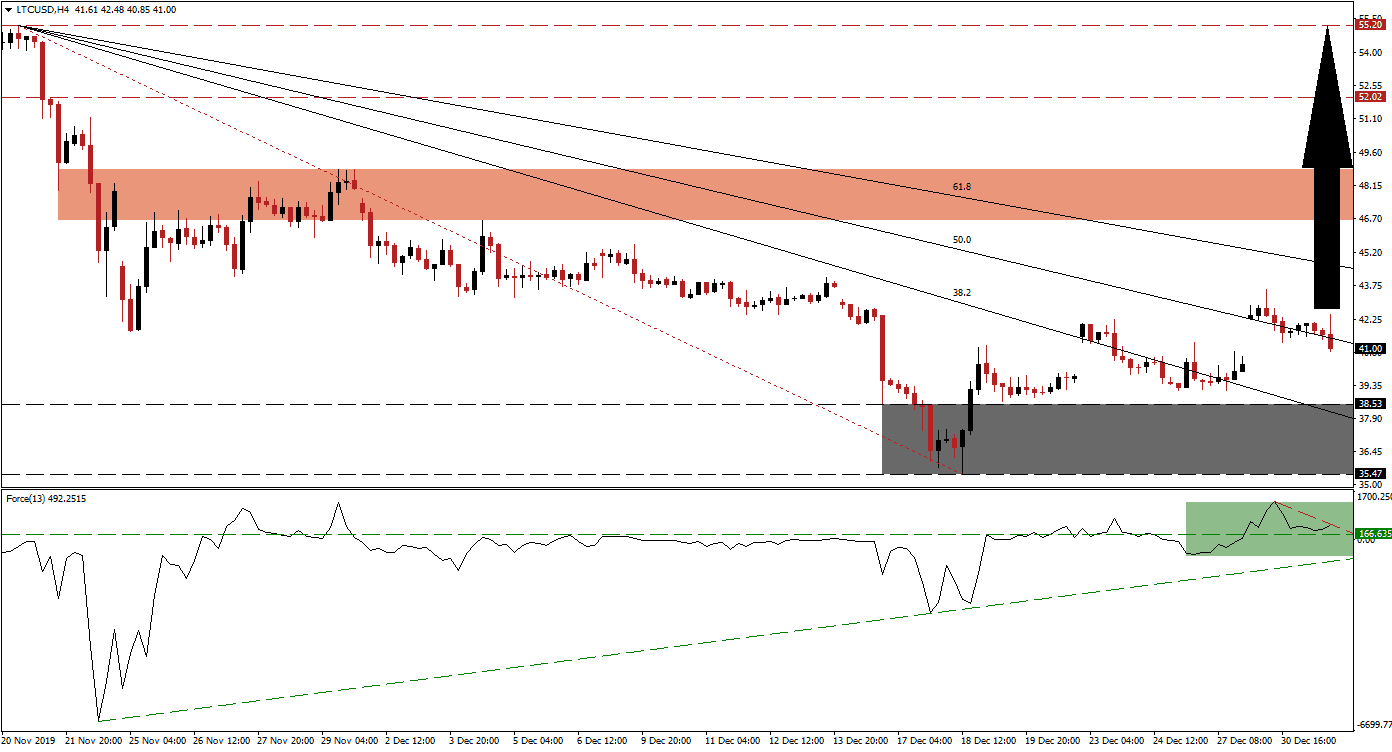

The Force Index, a next-generation technical indicator, shows the gradual recovery in bullish momentum and pushed it to a fresh multi-month high. An ascending support level formed, enhancing upside pressures. After the Force Index reached a fresh high, it retreated slightly but maintained its positions above the horizontal support level. A small descending resistance level emerged, as marked by the green rectangle, but bullish momentum is dominant. This technical indicator remains in positive territory with bulls firmly in control of the LTC/USD. You can learn more about the Force Index here.

Confirming the return of miners and dominance of bullish factors are two price gaps to the upside after this cryptocurrency pair elevated above its support zone. This zone is located between 35.47 and 38.53, as marked by the grey rectangle. The first gap took price action above its descending 38.2 Fibonacci Retracement Fan Resistance Level, which now acts as support. The second gap pushed the LTC/USD above its 50.0 Fibonacci Retracement Fan Resistance Level. An extension of this sequence is favored to lead to more upside. You can learn more about a price gap here.

Volatility is anticipated to increase as the 2020 trading year commences full operational mode from next Monday. Traders are recommended to monitor the intra-day high of 43.59, the peak of the current breakout, as a move above this level is favored to invite the next wave of net buy orders in the LTC/USD. A breakout above its short-term resistance zone located between 46.62 and 48.88, as marked by the red rectangle, should follow. The long-term resistance zone awaits this cryptocurrency pair between 52.02 and 55.20, more upside will require a fresh catalyst but remains an option.

LTC/USD Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 41.00

- Take Profit @ 55.20

- Stop Loss @ 37.00

- Upside Potential: 1,420 pips

- Downside Risk: 400 pips

- Risk/Reward Ratio: 3.55

In the event of a double breakdown in the Force Index, which will take it below its ascending support level, the LTC/USD is anticipated to follow with a breakdown attempt of its own. The long-term fundamental outlook for this cryptocurrency pair is increasingly bullish, but short-term fluctuations are likely to accompany the anticipated advance. The next support zone is located between 29.99 and 32.85, and traders should view this as an excellent buying opportunity.

LTC/USD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 35.00

- Take Profit @ 30.00

- Stop Loss @ 37.00

- Downside Potential: 500 pips

- Upside Risk: 200 pips

- Risk/Reward Ratio: 2.50

(Click on image to enlarge)

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more