Lowest Job Cuts Since June 2000

The labor market is tightening quickly. Do not fall into the trap of thinking we are too early in the business cycle to have worker shortages. Wage inflation will be a problem as early as this summer. Many industries are already having problems finding workers. They might not be used to raising wages as much as they will have to. This environment is the polar opposite as 1 year ago when the labor market had plenty of excess workers. Companies that treated their workers fairly last spring will be rewarded by high employee retention. It’s not hard to remember how you were treated 1 year prior.

Source: Challenger, Gray, & Christmas

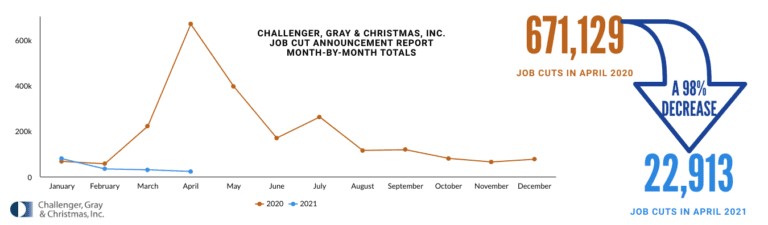

The April Challenger job cuts report supports this scenario. As you can see from the chart below, job cuts actually fell 96.6% from last April. This is one of the most remarkable turnarounds in economic history. From the 2nd half of March to the 1st half of April, many economists were predicting a depression. Not only did we avoid a depression, we also avoided a long recession. This potentially was the quickest recession ever if economists decide to say it ended once economic activity started to rebound. Of course, data has been weak up until recently, but it has mostly been getting better since last spring.

Job cuts fell from 30,603 to 22,913 which was the lowest monthly total since June 2000. There is a labor shortage. Cutting jobs is reserved for businesses going bust. Cuts are less than half the that of February. The most cuts were in services which experienced 5,382 of them. Any restaurants cutting jobs are making a big mistake unless they are about to go bust. The restaurant industry is experiencing a reversal of fortunes.

The weakest part of this report was hiring announcements. They fell from 97,767 to 76,345 which is the lowest reading since last June. Lowe’s announced it would hire 50,000 workers this spring and summer. Luckily, job creation is not correlated with hiring announcements. The labor market created hundreds of thousands of jobs in April.

CPI Should Rise Soon

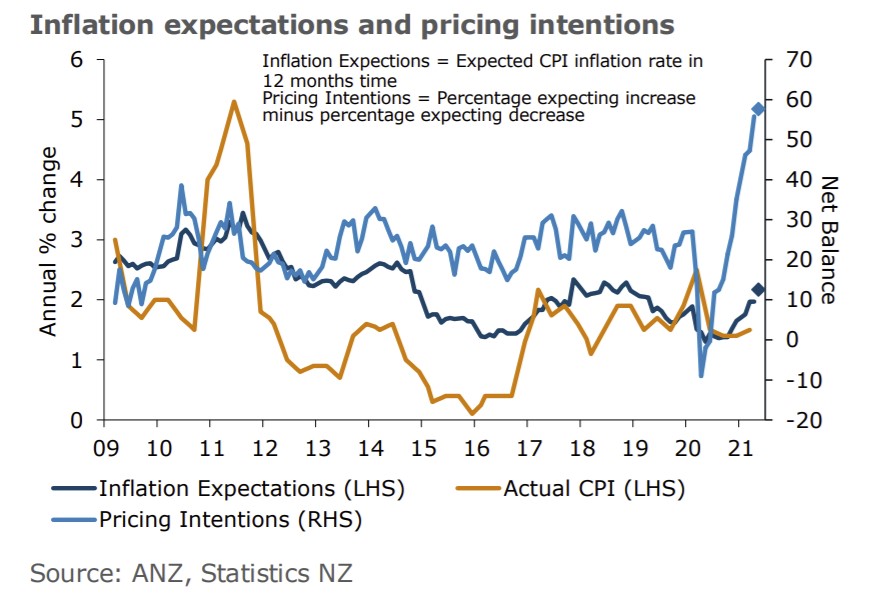

The April CPI report will be released on May 12th. This will show the first significant signs of prices going up. We won’t say inflation will start because that happened awhile ago. This is just the CPI report catching up to what we already see. As you can see from the chart below, inflation expectations are consistent with CPI above 2% and pricing intentions are consistent with CPI above 5%. CPI will peak somewhere in between that (towards the low end). These dual axis charts can be misleading which is why you can’t expect pinpoint accuracy. However, this chart should be directionally accurate.

Jobless Claims Fall Sharply

As we projected, jobless claims fell again. In the week of May 1st, seasonally adjusted claims fell from 590,000 to 498,000 which was below estimates for 533,000, and the lowest estimate which was 522,000. As you can see below, non-seasonally adjusted claims plus PUAs fell from 733,000 to 606,000. That’s by far the lowest reading since the pandemic started. This isn’t a good reading yet, but we are inching our way there.

UI claims dropped sharply last week, falling to 606K (505K UI initial claims NSA + 101K PUA claims) & reaching a new intra-crisis low.

— Daniel Zhao (@DanielBZhao) May 6, 2021

Claims have improved significantly over the last 2 months, though initial claims are still 2-3x pre-pandemic levels.#joblessclaims 1/ pic.twitter.com/2uNz8KV9Ip

Continuing claims in the week of April 24th rose again. They were up from 3.653 million to 3.69 million. Continuing claims are still well over double pre-pandemic levels. We don’t want them to stop falling yet. The overall number of people on benefits programs fell again in the week of April 17th, but its still way too high. They fell 405,000 to 16.157 million. This data is from 3 weeks ago, but it’s still not consistent with anywhere near a tight labor market. Some of this data could be wrong.

Furthermore, it’s notable that we can simultaneously have worker shortages and millions without jobs. These people need to re-entered into the labor market to avoid unnecessarily sharp wage inflation. Maybe we will see workers re-enter the labor market in earnest when the extra federal jobless benefits go away. Last year, the data showed people were not staying on benefits instead of working. That could change this year. We will know for sure once the US reaches a 60% vaccination rate. At that point, most jobs should be back and weekly jobless claims should fall below 300,000. That threshold should be reached in June.

Population Growth Bust

Population is easy to predict because you can just look at the births each year. The pandemic really hurt births. 2020 births were the lowest since 1979 in the US. There was a 4% year over year drop which is much worse than the yearly declines of between 1% and 2% from 2015-2019. The population bust could end up hampering long term economic growth. It’s probably the biggest long term issue facing the country.

US population isn't shrinking... yet. But it's getting close: pic.twitter.com/kD4D3J7Hur

— James Picerno (@jpicerno) May 6, 2021

Once the pandemic is over, the government needs to find a way to encourage more births (or remove policy that discourages it). In December, January, and February, births fell 6.5%, 9.3%, and 10% yearly. It’s pretty likely that there will be at least a modest recovery following the pandemic, but that shouldn’t be relied upon to solve the country’s long term problems. As you can see from the chart above, year over year population growth has been declining since the early 1990s. This is a long term issue that’s being accentuated by the pandemic. We expect Biden to propose more support for families. The more news stories there are about other countries’ populations peaking, the likelier the US government is to do something about it.

Conclusion

Job cuts were the lowest since June 2000. Prices are rising causing people to expect higher inflation. The CPI report should show early signs of an increase in the April reading. Jobless claims fell sharply. They are still elevated. US births crashed in 2020. Furthermore, the decline accelerated into February. That was before the vaccination rate increased enough to significantly hamper the pandemic. Hopefully, the decline is over. However, the government shouldn’t rely on a post-pandemic baby boom to solve this long term issue.

Disclaimer: The content in this article is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more