Long AMERP Thesis

The Q1 2019 issue of Hidden Value Stocks we featured Gate City Capital.

Gate City Capital’s founder, Mike Melby, picked out AMREP Corporation (NYSE: AXR) and Pico Holdings Inc. (PICO) as his two favorite stocks at the time of the interview.

One year on, we asked Mike if he still likes these companies, if Gate City has been adding to its holdings, and what’s changed since our initial interview.

First of all, do you still hold a position in AMREP?

Thank you for reaching out. It is great to touch base again, and I am excited to provide an update on some companies we highlighted a year ago.

Gate City Capital Management still holds a position in AMREP, and we have added to our position over the last twelve months. I would refer you to the amended Form 13G filed on February 14, 2020, showing Gate City Capital Management as the beneficial owner of 15.91% of the outstanding shares.

A few months after we last spoke, AMREP announced the sale of its fulfillment business for $1 million in cash.

Do you think this was the right decision for the company, and how has it changed your estimate of intrinsic value for the business?

The sale of AMREP’s subscription fulfillment business was a significant event for AMREP. The transaction was structured, so the $1 million cash sale price was just a portion of the total consideration. In addition, the buyer continued to operate from AMREP’s two owned buildings in Palm Coast, Florida. The buyer agreed to lease these two buildings for a period of 10-years at an initial rate of $1.9 million/year, escalating to $2.5 million in year 10.

While we would have preferred more of the value recognized in the upfront purchase price, the lease rates are above market value and provide for additional consideration above the $1 million cash price.

In February 2020, AMREP also announced that it had agreed to sell one of the two owned buildings in Palm Coast, Florida, to the buyer of the subscription fulfillment business for $12.5 million.

Should the deal be completed, AMREP will receive an additional $12.5 million in proceeds in addition to the $1 million received in April 2019.

AMREP will also continue to own the second building in Palm Coast, which is currently leased through October 2020 at a rate of $550,000/year.

The transaction is consistent with our initial estimate of intrinsic value.

When we spoke in 2019, we assigned a value of $20 million for AMREP’s subscription fulfillment business, which included both the business operations and the two properties. Should the sale of the first building be completed, AMREP would have received $13.5 million in proceeds for the segment while continuing to own an additional building with a base rent of $550,000/year.

Despite this significant development, the stock has gone nowhere since our original interview. Why do you think this is?

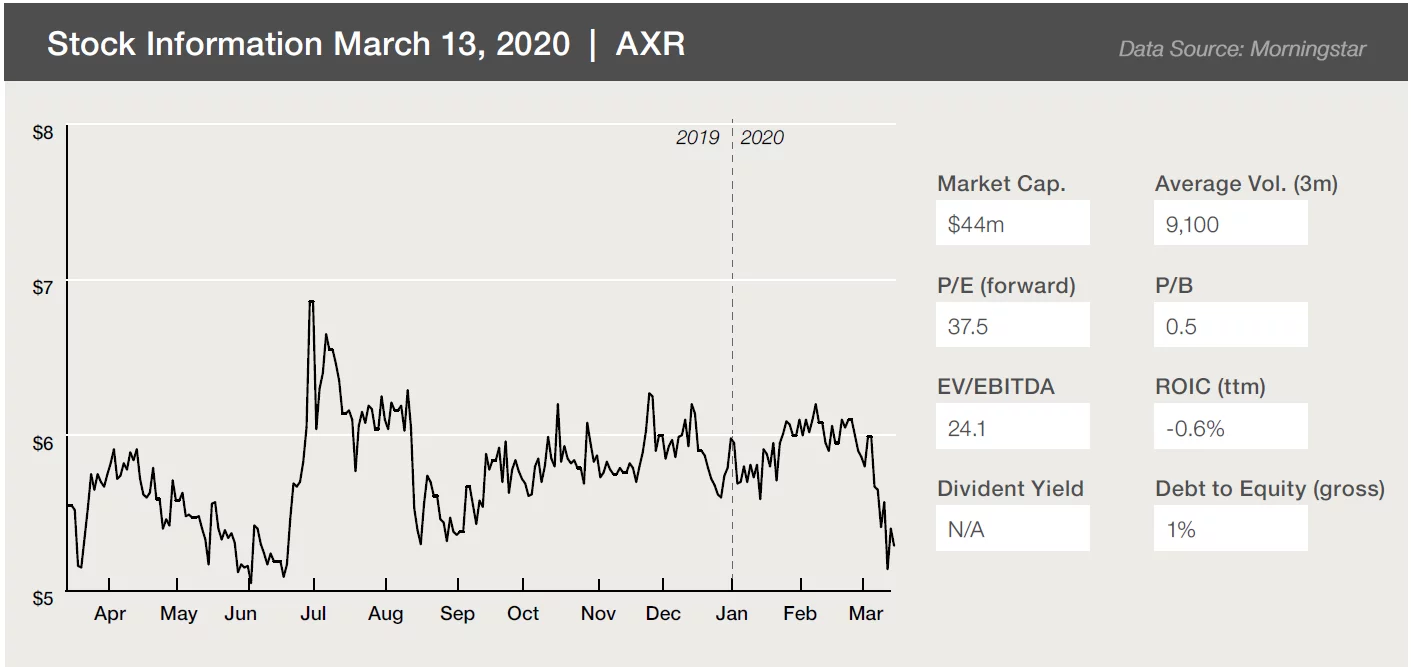

As a brief overview, at AMREP’s current share price, the company has a market capitalization of approximately $46 million and an enterprise value of $34 million.

I do not have a good explanation for why AMREP’s stock continues to trade at levels well below what we consider to be intrinsic value. AMREP is a micro-cap company, with limited trading volume, which I expect limits the potential ownership base.

Moreover, AMREP is not covered by any sellside analysts and does not have a dedicated investor relations program, which likely limits the amount of information the investing public has on the company.

Our investment philosophy at Gate City Capital Management is to own companies trading at a significant discount to the value of their discounted free cash flows and provide a substantial margin of safety.

Since we last spoke, AMREP has performed well and has generated significant operating cash flow. Much of that cash flow generation is not apparent to investors as AMREP has contributed $5.6 million to the company’s pension plans during the last twelve months (this fulfilled a funding requirement following the sale of the subscription fulfillment business). AMREP’s pension liability stood at just $2.7 million as of October 31, 2019, and we do not expect the pension to require meaningful contributions from AMREP going forward.

We expect the company’s real estate operations to continue to generate free cash flow and expect a significant inflow of cash upon the completion of the sale of the company’s first building in Palm Coast, Florida. To that extent, we are happy to continue to own AMREP at current prices and will let other investors make their own decision on the value of those cash flows.

AMREP also owns a large amount of real estate, which the company is trying to monetize. What progress has it made on this front over the past 12 months?

AMREP’s real estate development business continues to perform well. As an overview, AMREP owns 18,000 acres of land in the city of Rio Rancho, New Mexico, and an additional 165 acres of land outside of Denver, Colorado. In Rio Rancho, AMREP develops the company’s land base into lots that are then

sold to homebuilders or other developers. As your readers might recall, there has been a shortage of developable land available for homebuilders across the nation, and AMREP’s broad base of land is a critical strategic asset.

Over the last twelve months, AMREP has sold approximately 33 acres of developed land in Rio Rancho for proceeds of over $13 million or about $400,000/acre. AMREP continues to develop four subdivisions in Rio Rancho actively, and we expect robust sales in the area to continue.

In addition, AMREP is currently constructing a building on one of the company’s commercial lots in Rio Rancho that will be a retail store for Natural Grocers, the health food grocery chain.

The construction costs are approximately $2.8 million, and we expect the value of the building to be worth considerably more than that when construction is completed this summer. This building can either be held for recurring revenue or monetized.

AMREP is also advancing on plans to monetize the company’s land base in Colorado. AMREP owns a 160-acre

subdivision called Mountain View Estates in the Denver suburb of Brighton, Colorado.

Mountain View Estates is surrounded by completed developments but has thus far been restricted from moving forward with development due to water issues encountered by a neighboring subdivision. We believe these issues are being remedied, and AMREP should be able to proceed with either the development or outright sale of Mountain View Estates within the next 12-18 months. AMREP also owns a 4.6-acre commercial tract in the Denver suburb of Parker, Colorado. The land is prime real estate on the corner of Main Street and Jordan Road and is being marketed for sale at $4.4 million. Finally, AMREP also owns mineral rights under the 160 acres of Mountain View Estates. Great Western Energy is drilling in the immediate vicinity, and we are hopeful AMREP will realize some value from the company’s mineral rights in the next few quarters.

In summary, has your estimate of intrinsic value for the business changed at all considering the progress the business has made over the past year?

My estimate of intrinsic value is relatively unchanged. I have a target market capitalization of $92.5 million, equating to $11.40/share and representing over 100% upside to the current share price.

Disclosure: GateCity is long AMREP, the author of this article has no position.

Disclaimer: This article is not an investment recommendation, more