Lightning Strikes Twice

The performance of a concentrated portfolio hedged against a >6% decline created last April.

Strong Performance From A Conservative Portfolio

In a post here in April of 2018 (The 6% Solution), I wrote about an alternative approach for conservative investors unwilling to risk declines of more than 6% over six months: a concentrated portfolio of securities hedged against a greater-than-6% decline:

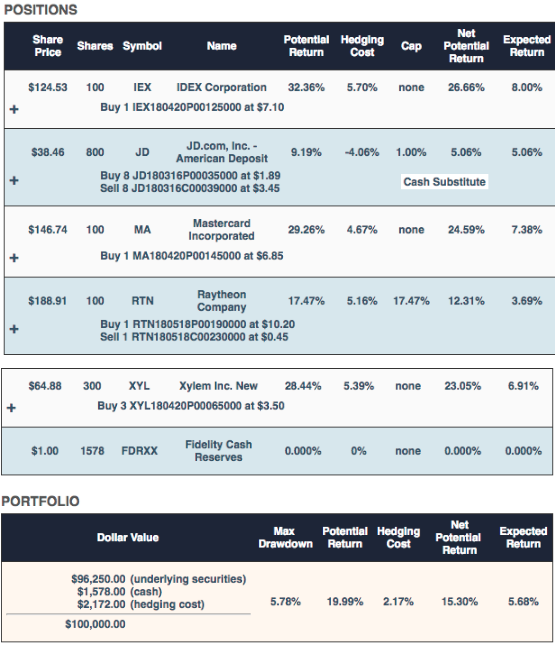

This is the hedged portfolio Portfolio Armor presented on October 12th [2017] for an investor with $100,000 who was unwilling to risk a decline of more than 6% over the next 6 months:

The primary securities here were IDEX (IEX), Mastercard (MA), Raytheon (RTN), and Xylem (XYL). They were selected because they had the highest potential return estimates, net of hedging costs at the time when hedging against a >6% decline, and they had share prices low enough that you could buy a round lot of one of them for less than $25,000. JD.com (JD) was added in a fine-tuning step to absorb leftover cash from rounding down to round lots of the first four names.

The worst-case scenario for this portfolio was a decline of 5.78% (the "Max Drawdown"), and the best-case scenario was a gain of 15.3% (the "Net Potential Return" or aggregate potential return net of hedging cost). The "Expected Return" of 5.68% was a ballpark estimate taking into account that actual returns, historically, have averaged 0.3x Portfolio Armor's potential return estimates.

We time-stamped this portfolio on Twitter in this tweet a few days later.

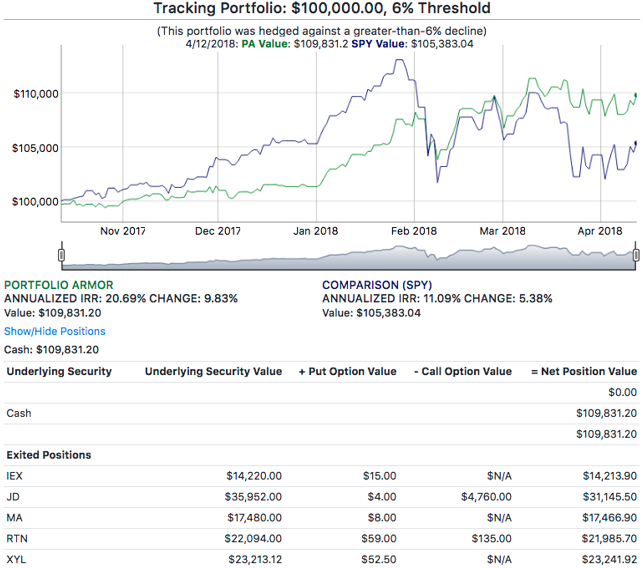

Like all the other hedged portfolios created by my site, that one lasted six months, so I posted its performance in that April 2018 article as well:

This portfolio returned 9.83%, which outperformed its potential return of 5.68%, and outperformed the SPDR S&P 500 ETF (SPY).

Lightning Strikes Twice

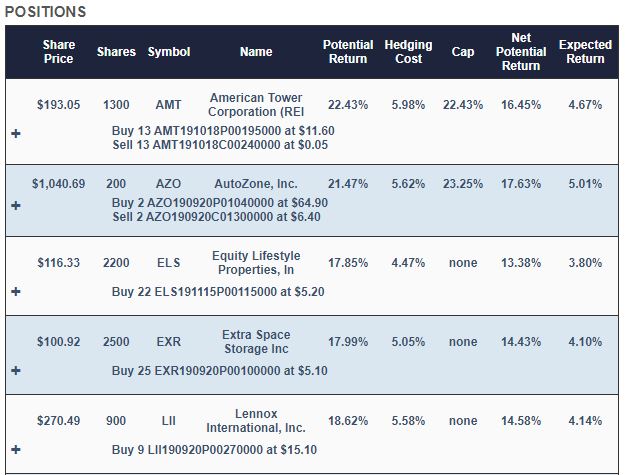

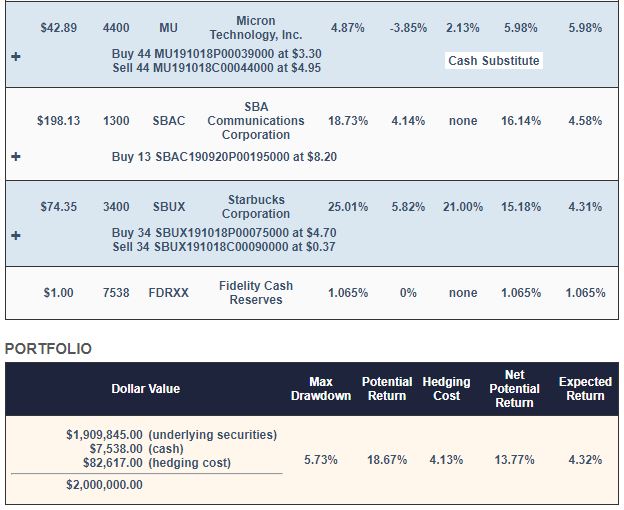

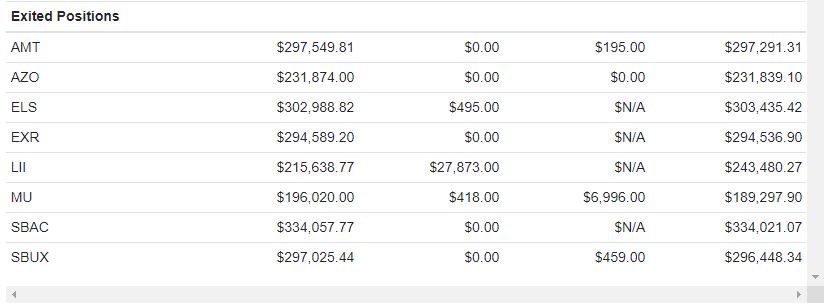

As it happens, I created another portfolio hedged against a >6% decline in April of 2019. This one had a starting value of $2,000,000 and included American Tower (AMT), Autozone (AZO), Equity Lifestyle Properties (ELS), Lennox International (LII), SBA Communications (SBAC), and Starbucks (SBUX) as primary securities. Those names were selected by Portfolio Armor because the site estimated they had the highest return potential over the next six months, net of hedging cost when hedging them against >6% declines. In a fine-tuning step, the site used shares of Micron (MU) used to absorb leftover cash from rounding down equal starting dollar amounts of the primary securities to round lots.

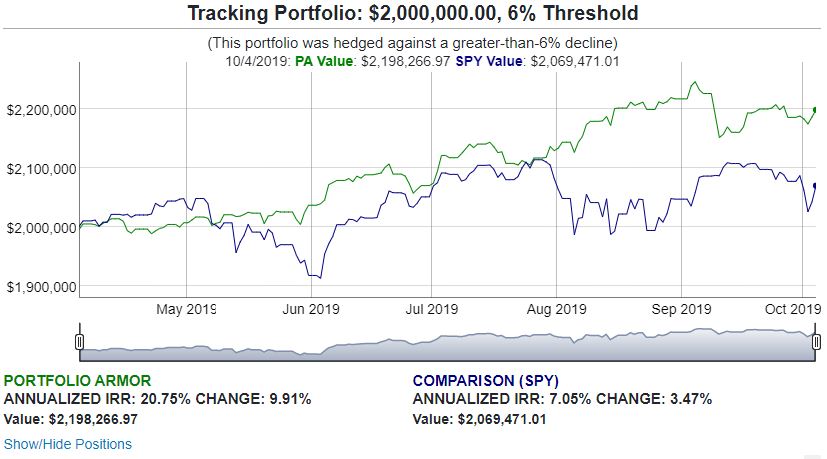

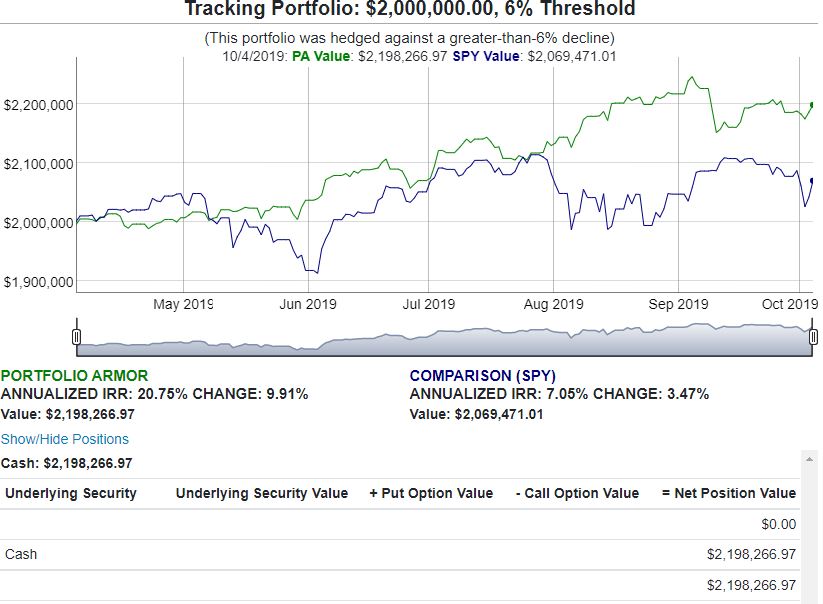

This one had a worst-case scenario of a decline of 5.73% (the "Max Drawdown"), a best-case scenario of 13.77% (the "Net Potential Return", or potential return net of hedging cost), and an expected return (taking into account the hedging cost and the historic ratio of actual returns to potential return estimates) of 4.32%. Here's how that hedged portfolio from April performed over the next 6 months:

This one was up 9.91% over 6 months, net of hedging and trading costs.

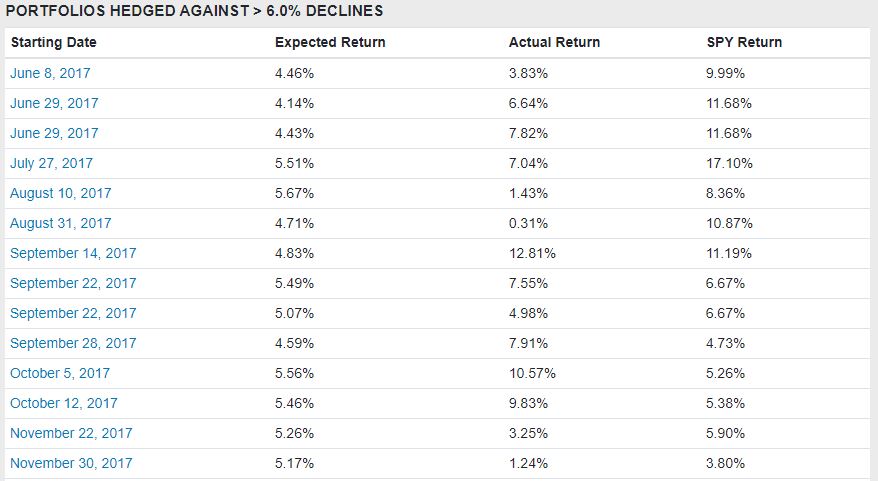

They Don't All Do This Well

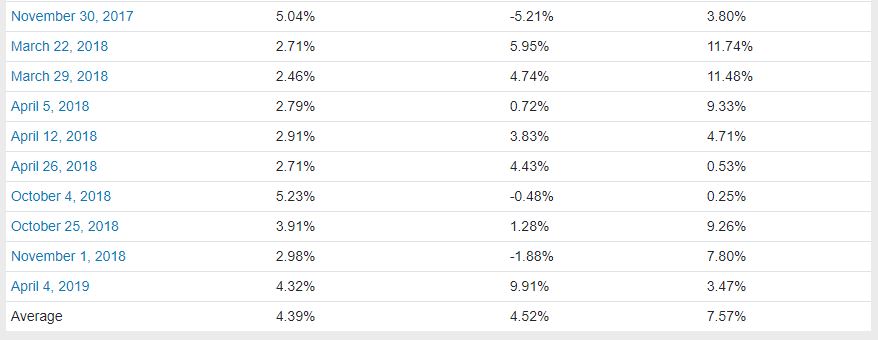

When selecting securities that can be hedged against declines as small as 6%, you often end up eliminating some higher-growth names that are more expensive to hedge. I suspect that the portfolio above benefited from that, as some money rotated out FANGs into its holdings. In any case, I wouldn't expect a portfolio hedged against such as small decline to consistently outperform the SPDR S&P 500 ETF (SPY). On average, they haven't, as you can see below.

Nevertheless, as you can see in the table above, the actual returns have been fairly close to the expected returns estimated by Portfolio Armor upfront. You can find an interactive version of that table here, where you can click on the starting dates and see interactive charts for each portfolio.