Last Stocks Above Their Moving Averages

The massive declines over the past few weeks have left conditions extremely oversold. As we highlighted in yesterday’s Sector Snapshot, breadth has been awful while there is no longer a single stock in the S&P 500 that is overbought (1 or more standard deviations above its 50-DMA). In fact, after yesterday’s absolute washout, there is only a small handful of stocks that are above their 50 and 200-DMAs. In regards to the 50-DMA, less than 1% of stocks in the S&P 500 are above this average which is the first time that has happened since 2011. The only time in between that saw a similarly weak reading, although not quite hitting that under 1% requirement was back in December of 2018 when 1.19% of stocks were above their 50-DMA. As for the 200-DMA, only 5.59% are above that level. That is the lowest reading since March of 2009.

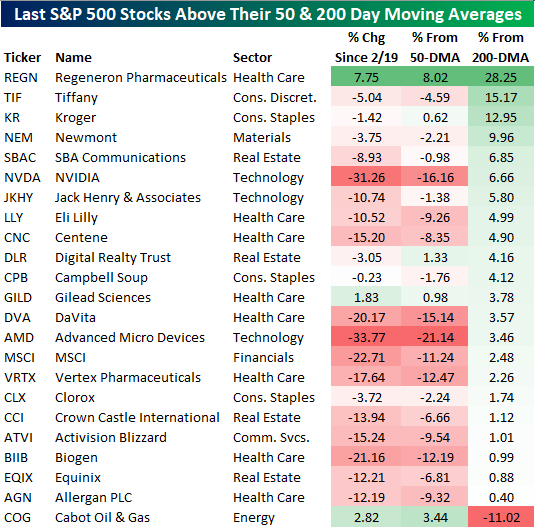

The average stock is now 26.56% below its 50-day and 24.5% below its 200-day. The table below shows those 22 remaining stocks that are still above their 200-DMAs as of yesterday’s close and the few that are also below their 50-DMA. Of these, only Regeneron (REGN), Kroger (KR), Digital Realty Trust (DLR), and Gilead Sciences (GILD) are also above their 50-DMAs. The only other stock in the index that is also above its 50-DMA is Cabot Oil and Gas (COG), though it is 11% below its 200-DMA. While these stocks have all held above their long term moving average recently, only GILD and REGN have risen since the index’s high on 2/19.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more