Key Events This Week: All Eyes On CPI

When summarizing the rising reflationary risks facing the market earlier today, JPM told clients to "keep an eye on Wednesday’s CPI number, specifically the core CPI number. An in-line or lower number may be the better outcome for equities".

In his weekly preview, DB's Jim Reid picks up on this and writes that while the week after payrolls tends to be a quieter week for data, January’s CPI print on Wednesday will be "most interesting given that inflationary pressures are popping up everywhere".

Elsewhere there are various sentiment surveys from the US, along with industrial production results for many of Europe’s largest economies.

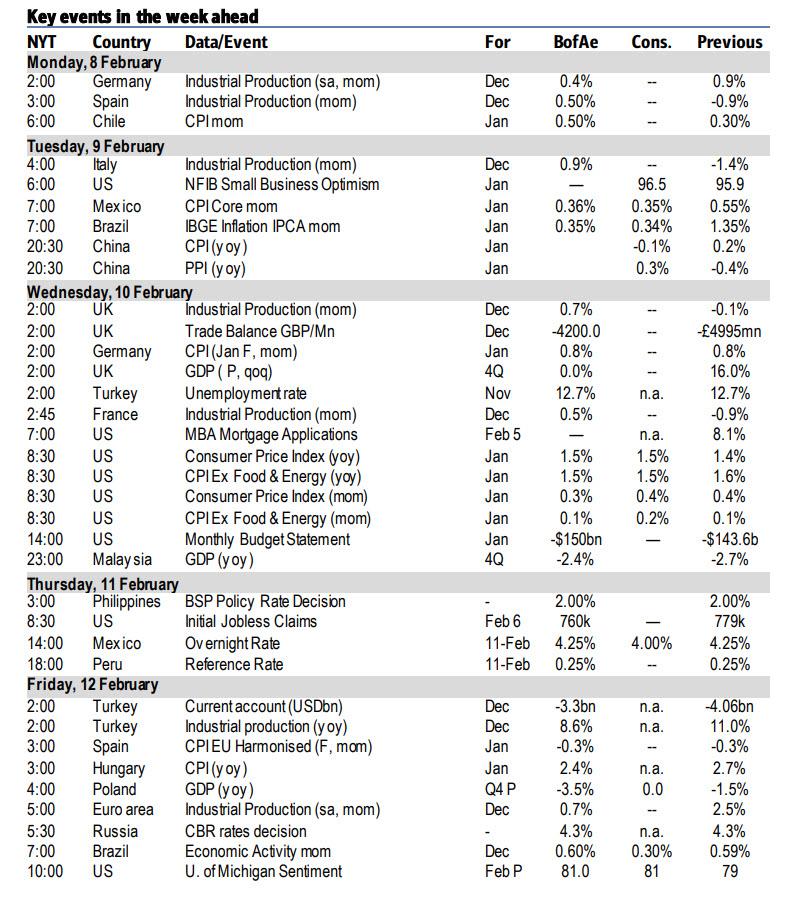

(Click on image to enlarge)

Additionally, while it is a relatively slow week for central banks, we expect to hear from both ECB President Lagarde (today) and Fed Chair Powell (Wednesday) this week. Finally, we are past the earnings season hump but with 82 S&P 500 and 84 Stoxx 600 companies reporting still.

(Click on image to enlarge)

Today we’ll hear from Chegg and Simon Property Group, then tomorrow Cisco Systems, Dupont de Nemours, Twitter, and Fiserv. Wednesday brings releases from Toyota, Coca-Cola Co., Uber, General Motors, Equinix, Deutsche Boerse, MGM Resorts, Vestas and AP Moller-Maersk. Then on Thursday, we’ll hear from Disney, PepsiCo, L’Oreal, AstraZeneca, Duke Energy, Illumina, Kraft Heinz, and Credit Agricole.

Elsewhere we could see Draghi become the next Italian PM this week as Bloomberg has reported overnight that Draghi has been able to secure support from parties across the political divide including from the Five Star Movement and Matteo Salvini’s League. Currently, it appears that only the far-right Brothers of Italy party may end up staying out of the coalition. Indicating the popular support for Draghi, La Repubblica published a poll yesterday that showed more than half of Italians would like Draghi to remain in power until 2023 when the next general election is due. In terms of the timetable ahead, Draghi will start a second round of talks with parties today and is expected to meet trade unions and business lobbies. If all goes well then Draghi could announce his cabinet picks this week before facing confidence votes in both houses of parliament.

Courtesy of Deutsche Bank here is a day-by-day calendar of global events:

Monday, February 8

- Data: Japan December labor and real cash earnings, Euro Area February Sentix investor confidence, Germany and Spain December industrial production

- Central Banks: ECB's Lagarde and Villeroy and Fed’s Mester speak

- Earnings: Softbank, Global Payments, Simon Property Group, Loews

- Politics: US Senate begins former President Donald Trump’s second impeachment trial

Tuesday, February 9

- Data: Japan preliminary January machine tool orders, Germany December trade balance and current account balance, Italy December industrial production, US January NFIB small business optimism survey and December JOLTS job openings, Japan January PPI (23:50)

- Central Banks: ECB Chief Economist Philip Lane speaks

- Earnings: Cisco Systems, Dupont de Nemours, Twitter, Fiserv

Wednesday, February 10

- Data: China January CPI and PPI, UK December industrial and manufacturing production, construction output, December trade balance, preliminary 4Q GDP, monthly GDP, private consumption and total business investment, Germany final January CPI, France December industrial and manufacturing production, US January CPI, January MBA mortgage applications, January real hourly earnings, wholesale trade sales and monthly budget statement

- Central Banks: Fed Chair Powell, ECB's Panetta speak

- Earnings: Toyota, Coca-Cola Co., Uber, General Motors, Equinix, Deutsche Boerse, MGM Resorts, Vestas, AP Moller-Maersk

Thursday, February 11

- Data: US weekly initial jobless claims and continuing claims

- Central Banks: ECB Villeroy and Knot speak, Bank of Mexico policy decision

- Earnings: Disney, PepsiCo, L’Oreal, AstraZeneca, Duke Energy, Illumina, Kraft Heinz, Credit Agricole

- Other: European Commission publishes Economic Forecasts, Lunar New Year begins

Friday, February 12

- Data: Spain final January CPI, Euro Area December industrial production, US preliminary February U. of Mich. Sentiment survey

Finally, focusing on just the US, Goldman also agrees that the key economic data releases this week will be the CPI report on Wednesday, while the jobless claims report on Thursday will also be closely watched for support for the Biden stimulus package. There are two speaking engagements from Fed officials this week, including Chair Powell on Wednesday.

Monday, February 8

- 12:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will discuss the economy during a virtual event hosted by the Rotary Club of Toledo. Audience Q&A is expected.

Tuesday, February 9

- 06:00 AM NFIB small business optimism, January (consensus 97.5, last 95.9)

- 10:00 AM JOLTS Job Openings, December (consensus 6,400k, last 6,527k)

Wednesday, February 10

- 08:30 AM CPI (mom), January (GS +0.31%, consensus +0.3%, last +0.4%); Core CPI (mom), January (GS +0.16%, consensus +0.2%, last +0.1%); CPI (yoy), January (GS +1.54%, consensus +1.5%, last +1.4%); Core CPI (yoy), January (GS +1.53%, consensus +1.5%, last +1.6%): We estimate a 0.16% increase in January core CPI (mom sa), which would lower the year-on-year rate by a tenth to +1.5% on a rounded basis. Our monthly core inflation forecast reflects a rebound in airfares and a boost from residual seasonality in apparel, household furnishings, and personal care. On the negative side, we expect further normalization in used car prices off of elevated levels, and we expect another decline in the health insurance component. We expect a roughly 0.1% gain in rent and OER, as our shelter tracker has stabilized and we believe the sequential drag from rent forgiveness is mostly behind us. We estimate a 0.31% increase in headline CPI (mom sa) due to higher oil prices.

- 02:00 PM Fed Chair Powell (FOMC voter) speaks: Fed Chair Jerome Powell will speak to the Economic Club of New York on the state of the U.S. labor market. Prepared text and a moderated Q&A are expected.

Thursday, February 11

- 08:30 AM Initial jobless claims, week ended February 6 (GS 740k, consensus 760k, last 779k); Continuing jobless claims, week ended January 30 (consensus 4,410k, last 4,592k): We estimate initial jobless claims declined to 740k in the week ended February 6.

Friday, February 12

- 10:00 AM University of Michigan consumer sentiment, February preliminary (GS 81.0, consensus 80.9, last 79.0): We expect the University of Michigan consumer sentiment index increased by 2.0pt to 81.0 in the preliminary February reading, as the improving virus situation could boost sentiment.

Source: Deutsche Bank, Goldman, BofA

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more