Jobless Claims Spiked

Jobless Claims Spike

Recent estimates only called for a modest increase in initial claims. I said that was wrong. The economy is weakening. The decline in the prior week was because of Thanksgiving. It’s impossible for the labor market not to slow when states are adding restrictions. The deaths per day are at a record high which is causing people to go out less.

Specifically, seasonally adjusted initial claims rose from 712,000 to 853,000 which beat estimates for 724,000, and the highest estimate which was 800,000. That’s the biggest increase since March. Despite this spike, value stocks didn’t fall on Thursday. Luckily, it also predicted that as stocks likely will ignore the weak economic data in December in anticipation of a virus-free economy.

Non-seasonally adjusted initial claims rose from 719,000 to 948,000 which is the highest since August 1st. This was the biggest weekly increase since the week ending March 28th which was the biggest increase of the recession. Claims aren’t going to increase this much next week. This is backed up data from the previous week.

However, even if claims fall slightly next week, they will be quite high. PUA claims rose 139,000 to 428,000. This caused the total of PUAs plus unadjusted claims to rise 37%.

As you can see from the chart below, that’s the greatest increase in months. Of course, PUA data isn’t reliable. In Nevada, PUAs rose 53,000 which was a 6x increase. Even without that increase, this was the largest number of PUAs since September. Cleary, the labor market is getting worse even if the data is fuzzy. There are 13 million PUAs plus PUECs that will expire on December 26th.

Senators Hawley and Sanders proposed $1,200 checks saying, "We will not leave this town until we have voted, up or down, on direct relief for working people." It shouldn’t be like this, but the political reality is if those checks go out, it’s unlikely we get unemployment benefits extended. This political theater has been going on for months. Luckily, it will end soon and the Senate election is in 25 days. Clarity is coming soon.

Continued Claims End Decline Streak

Even though continued claims data is from the week of Thanksgiving, claims rose from 5.527 million to 5.757 million. We can only imagine how much they will rise next week. This was the first increase since August 29th. In the week of November 21st, the total people on all benefits fell from 20.2 million to 19 million. This sounds good, but that’s before weakness picked up.

Of course, it’s possible that's wrong about the trend as we got 2 small increase in initial claims, a holiday decline, and a post-holiday spike. If initial claims fall more than 40,000 next week, we can say that overhyped the slowdown. However, it's not wrong about benefits ending being a big problem for the economy.

Politicians are only saying they won’t leave Washington until a deal is done because it sounds good. We will see how much they mean it by the end of next week. If nothing gets passed, small cap value stocks will probably fall at least 5%. Some would buy that dip because the vaccines are still coming. On Thursday, FDA advisers voted 17-4 in favor of Pfizer’s vaccine which means approval is imminent.

Dining Out Takes A Huge Dive

Dining out is taking its largest dive since the recovery started in late April. The chart below shows the yearly decline in dining has occurred while confirmed cases have exploded. The 7 day average of yearly dining growth is -63.3%. You can spin this as good news because it means the spread will slow in the next few weeks as long as people don’t gather with their families for the December holidays. One thing is certain: the vaccines are needed now more than ever.

Even though in-person dining is crashing, Bank of America’s data on holiday spending shows this has been a strong season which is better than expected. Between November 1st and December 5th, holiday sales were up 19% on a cumulative basis. There is very strong momentum in goods spending.

On a related note, Lululemon reported 22% sales growth in Q3 as North American sales were up 19%. Its overall sales of $1.12 billion beat estimates by $100 million.

The chart below shows BAC card spending in the core control group in 2020 compared to last year. This excludes groceries. As you can see, sales outperformed in the couple weeks before Black Friday and then have unperformed since. The last major days in this shopping season are the days right before Christmas.

Obviously, you can’t buy gifts online on the 24th like you can in stores because they won’t come in time, so late shoppers will likely buy a couple days earlier.

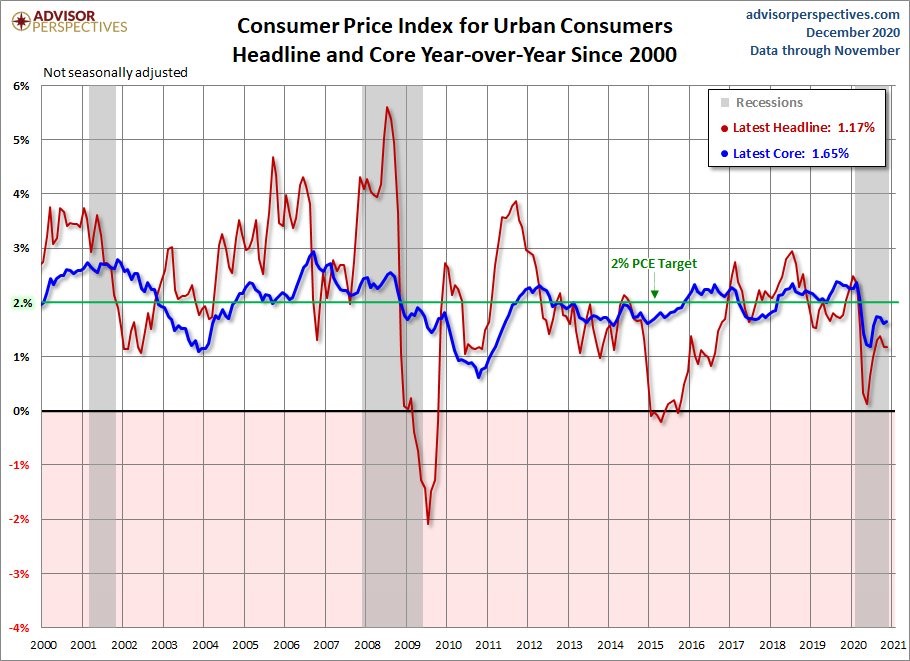

CPI Stable In November

CPI stayed low because of shelter costs. As you can see from the chart below, headline CPI stayed at 1.2% and core CPI stayed at 1.6%. Food prices were up 3.4% and energy prices were down 9.4%. Very soon energy won’t drag headline inflation.

Shelter inflation was 1.9%, medical care services inflation was 3.2%, and transportation services inflation was -3.4%. Medical care services inflation has been falling as fast as it spiked in 2019 and the first half of 2020. It fell from 3.7% in October. This time, the comp didn’t get harder. This is all about sequential weakness. It peaked at 6% in June which was the highest level since the data starts in 2000.

Unfortunate COVID-19 Update

All the updates on COVID-19 have been bad for a couple months excluding the incomplete data around Thanksgiving. There were 214,118 new cases on Thursday. There are no signs of the pandemic letting up in December. There are now 107,248 people in the hospital which is a record high. The 7 day average of deaths is 2,332 which is a record. The 2nd wave wasn’t much of a wave and this wave is by far the worst of the 3.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more