Is It Time To Jump On The High-Yield, Hated Mall REITs?

It may be time to make a high-risk bet on the loathed and downtrodden shopping mall real estate investment trusts (REITs). A record number of retail store closings in 2019 have investors fearing a Retail Apocalypse 2.0 and running away from the mall REITs. I realize that the mall owners face serious challenges, but I also think many malls will survive and thrive. The challenges facing investors are to determine if dividends are secure and if or when share prices will reach a bottom.

The other challenge facing commercial retail real estate is that there is too much of it. According to a recent Barron’s article, there are 1,350 enclosed malls in the U.S., but less than half that number are “needed.” (my emphasis). Developers have overbuilt retail space, and in recent years have been hit by failures of large retailers like Toys-R-Us, JC Penny, and Sears. It’s easy to see why investors are leery of mall owning REITs.

However, there are facts that point to an anti-doomsday scenario for retail and mall REITs. Here are some of the things I think about.

- Have you ever noticed how charts like the one above always show a future that continues to go up? Especially for trends that are new or relatively slow. I would not be surprised if e-commerce sales start to level off.

- According to NAREIT, the retail REIT occupancy level at the end of September was 94.885%. Occupancy has been right around 95% since 2013. REITs appear to be doing fine with replacing lost tenants.

- Of the 1,300 enclosed malls, there are highly profitable malls, malls getting by, and challenged malls. The commercial real estate crowd labels these as A, B, and C malls. The A malls are mostly owned by REITs.

- Mall owners are reacting to growing e-commerce sales. Business models are changing to a combination of brick and mortar and online sales. Mall owners are diversifying their tenant mix, bringing in tenants that have little or no competition from online sellers.

With these facts, my opinion is that the share prices of mall REITs will find a bottom, and as the mall owners react to changing times, they will be again able to grow free cash flow. The challenge is timing the bottom. With the yields now on these three REITs, compared to historical levels, that bottom may be very close.

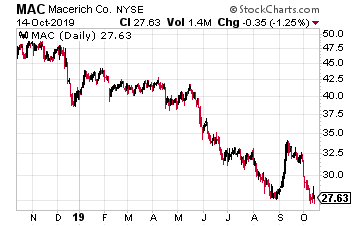

Macerich Company (MAC) is a $4 billion market cap shopping center REIT that has seen its share price drop by 70% over the last three years. Yet, over the same time frame, the company has grown its dividend rate.

Macerich owns 47 Class A “trophy property” shopping centers. The company sold its lower-tier properties in 2015 and 2016. For the company’s tenants, sales have grown from $706 per square foot in 2015 up to $896 for the 2019 second quarter.

The Macerich business is doing well and growing, despite what the share price says.

MAC now yields 10.8% compared to a historical average below 5%.

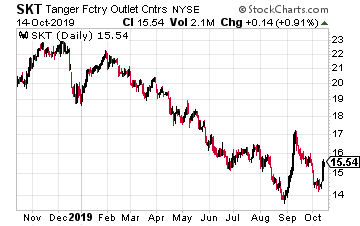

Tanger Factory Outlet Centers (SKT) is a $1.5 billion market cap REIT that is a pure-play owner and operator of 39 upscale outlet style shopping centers. The company has been busy finding new tenants for stores that were closed but has maintained a 96% occupancy rate.

As the company has gone through this process, net operating income has been flat to down 2% for the last couple of years. Tanger is financially very conservative, and the dividend is just 70% of FFO per share.

The dividend has been increased every year since the company went public in 1993. That’s 26 years of dividend growth! Tanger has not opened a new outlet since October 2017.

It needs to get back on a growth trajectory to get the share price moving higher. SKT currently yields 9.9%.

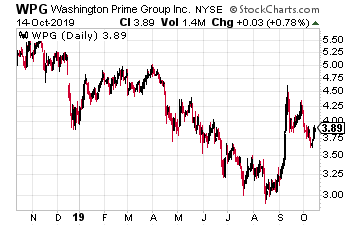

For a very speculative pick, look at Washington Prime Group Inc. (WPG). This shopping center REIT primarily owns Class B malls, and the market has punished it for doing so.

WPG currently yields over 25%. The dividend is covered by cash flow, but the market is afraid the company needs that cash more to redevelop some of its properties, and the dividend will be cut.

This is a stock where a dividend reduction may lead to a sharp gain in the share price. However, the board remains committed to sustaining the dividend.

If things work out for Washington Prime Group, this stock could be a great winner. However, the market is pricing it to fail. As I said, speculative.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more