Is AbbVie Stock A Buy In May 2019?

Volatility has returned to the stock market, as a result of escalating trade tensions between the U.S. and certain trading partners such as China. During periods of heightened geopolitical risk, it is a good time for investors to refocus on high-quality dividend growth stocks.

For risk-averse investors looking to reduce portfolio volatility, the Dividend Aristocrats are a great place to seek shelter from the storms. The Dividend Aristocrats are a select group of 57 stocks in the S&P 500 Index, with 25+ years of consecutive dividend increases each year.

They are the ‘best of the best’ dividend growth stocks. The Dividend Aristocrats have a long history of outperforming the market.

The requirements to be a Dividend Aristocrat are:

- Be in the S&P 500

- Have 25+ consecutive years of dividend increases

- Meet certain minimum size & liquidity requirements

There are currently 57 Dividend Aristocrats.

When volatility grips the stock market, investors should seek out quality companies such as AbbVie Inc. (ABBV), which has raised its dividend for over 40 years in a row going back to its days as a subsidiary of Abbott Laboratories (ABT).

AbbVie stock has underperformed the broader market so far this year. Shares of AbbVie have declined ~12% year-to-date, while the S&P 500 Index has gained 13% in 2019 thus far. AbbVie’s significant underperformance likely has investors frustrated, but the long-term direction of the company remains extremely positive.

AbbVie is a highly profitable company, with growth potential and an excellent product portfolio. We believe AbbVie stock is significantly undervalued today. It also pays a hefty dividend yield above 5%, making it one of the most attractive high-yield dividend stocks in our entire database and a buy for May 2019.

Business Overview

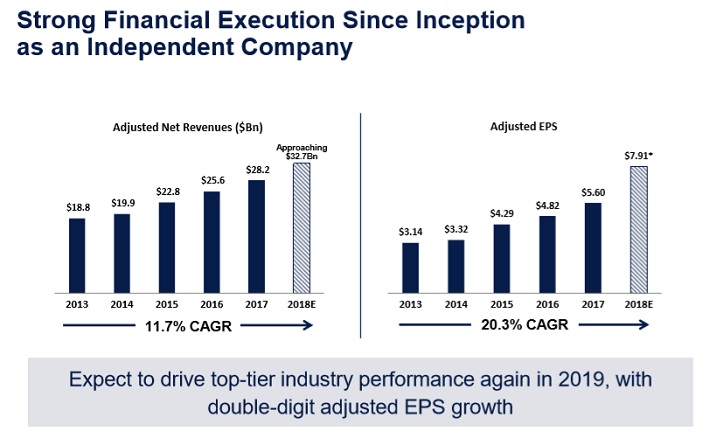

AbbVie is a pharmaceutical company focused on Immunology, Oncology, and Virology. AbbVie was spun off by Abbott Laboratories in 2013. Today, AbbVie generates annual revenue in excess of $32 billion and the stock trades with a market capitalization of ~$119 billion. AbbVie has ~30,000 employees. The company treats over 30 million patients in more than 175 countries each year. AbbVie’s products address over 30 conditions across infant, adolescent, adult, and senior stages of life.

The reason for the spin-off was that Abbott wanted AbbVie to have its own dedicated management team and ability to focus entirely on its own strategic initiatives. Abbott is a diversified conglomerate of pharmaceutical, medical devices, and consumer health care products, while AbbVie is a pharmaceutical pure-play.

The decision has certainly paid off for investors, as AbbVie has generated massive growth since it became an independent company.

Source: Earnings Presentation

AbbVie’s most important product by far is Humira, which by itself represents ~60% of the company’s annual revenue. Humira is a multi-purpose pharmaceutical product, and is the top-selling drug in the world. While this was once a huge advantage, as Humira fueled AbbVie’s amazing growth in recent years, it is risky for a pharmaceutical company to be too dependent on one individual product.

This is especially true if that particular product faces patent risk. For example, investors experienced this when Pfizer (PFE) lost patent protection on cholesterol medication Lipitor, which was once the world’s top-selling drug. A major pharmaceutical company losing its top drug can have a devastating impact if the company has not adequately prepared itself.

Humira is now facing biosimilar competition in Europe, which has had a noticeable impact on the company. AbbVie has noted that discounting in various countries in Europe has been higher than it initially anticipated, but it must take this step to preserve market share. Still, biosimilar competition in Europe has weighed on AbbVie in recent periods.

In late April, AbbVie reported (4/25/19) its 2019 first-quarter earnings results. Revenue of $7.8 billion increased 0.4% on an operational basis (excluding currency). Humira dragged AbbVie down last quarter, with a 5.6% overall sales decline. Sales of Humira in the international markets declined 23% on an operational basis last quarter, which reflects the impact of biosimilar competition abroad. Domestic growth helped offset this, as U.S. sales of Humira increased 7.1% last quarter. However, Humira will face biosimilar competition in the U.S. in 2023, which is why AbbVie investors remain concerned.

Fortunately, AbbVie’s revenues were positively impacted by strong growth from other products last quarter. Imbruvica grossed sales of $1.02 billion, up 34% from the same quarter last year. In all, AbbVie’s hematologic oncology portfolio grew revenue by 43% last quarter. This helped AbbVie grow its adjusted earnings-per-share by 14% for the quarter, to $2.14. It is highly impressive that AbbVie has managed to continue growing adjusted EPS at such a high rate, particularly with such steep international sales declines. Thanks to a robust pipeline, AbbVie has a good chance at maintaining its growth in the years ahead.

Growth Prospects

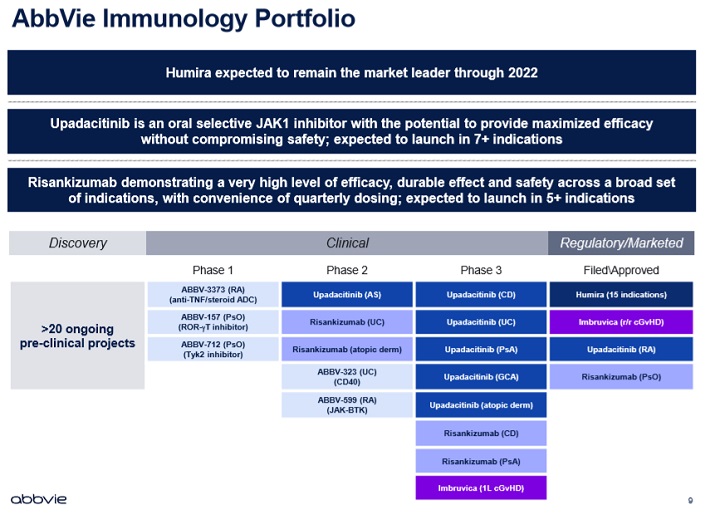

Investors appear to be concerned over AbbVie’s future growth, in light of the threats facing Humira. The good news is that AbbVie continues to perform well overall, and has a plan to pursue growth outside Humira. AbbVie has prepared for a post-Humira world, with huge investments in its pipeline. The most important competitive advantage for AbbVie, and any pharmaceutical company, is its patent portfolio.

AbbVie has a massive global R&D platform, consisting of 14 primary R&D facilities and eight manufacturing facilities around the world. AbbVie’s research and development expense totaled $10.4 billion in 2018, more than double the level from the previous year. Even after excluding a $5.1 billion intangible asset impairment charge related to acquired in-process R&D as part of the 2016 Stemcentrx acquisition, the company still allocated over $5 billion to R&D last year alone. The result of this investment is that AbbVie has built a large pipeline with many potential blockbusters in the coming years.

Its two biggest areas of growth going forward will be hematologic oncology, and next-generation immunology.

Source: Earnings Presentation

Growth in these areas will greatly help offset any losses from biosimilar competition to Humira. Plus, Humira is expected to remain the market leader in the U.S. for the next few years, while AbbVie is working on new and improved drugs that target the same indications as Humira. Two of these drugs, called upa and risa, will likely come to the market in 2019 for their first indications.

AbbVie’s late-stage pipeline continues to deliver for investors. Last quarter, AbbVie received regulatory approval in the U.S. and Japan for Skyrizi. It expects to receive approval in Europe in the near future. AbbVie has high expectations for Skyrizi—it believes the plaque psoriasis medication has potential to be a multi-billion product by annual sales. Skyrizi the 12th new product or major indication approval for AbbVie in the last five years.

It also received Breakthrough Therapy Designation and Priority Review from the FDA for Venclexta in Front Line chronic lymphocytic leukemia. Venclexta has already shown great promise, as sales more than doubled last quarter to $151 million. AbbVie has a balanced portfolio of next-generation products that will lead it into the future.

Source: Earnings Presentation

In all, AbbVie expects non-Humira product sales to exceed $16 billion by 2020, and $35 billion by 2025. Growth will also continue in the near-term. AbbVie expects 2019 to be another year of growth. The company maintains guidance for adjusted EPS in a range of $8.73 to $8.83 for 2019. At the midpoint of guidance, AbbVie’s adjusted EPS is set to increase 11% this year.

Lastly, share repurchases will help boost future EPS growth. When a company buys back its shares, each remaining share receives a higher portion of the company’s profits. With a smaller number of shares outstanding, EPS increases. This is another benefit of being a profitable company with excess cash flow that can be used, in part, to return cash to shareholders.

In December 2018, AbbVie approved a $5 billion share repurchase. This represents slightly over 4% of the company’s current market capitalization, meaning this buyback could be a significant boost to EPS. The other way AbbVie returns cash is through dividends, which will be a big contributor to the future returns of the stock.

Valuation & Expected Returns

The three pillars of expected future returns are earnings growth, changes in the stock valuation multiple, and dividends. AbbVie is an attractive stock on the basis of all three, which is why it is such a unique investment opportunity today. First, as mentioned previously AbbVie has a long runway of growth up ahead, thanks in large part to its innovation and R&D. As a result of its well-stocked pipeline, we believe the company can reasonably grow EPS by 9% to 10% per year through 2024. This will provide satisfactory returns by itself.

In addition, we believe AbbVie stock is considerably undervalued, given its strong business model and future growth potential. Based on expected earnings-per-share of ~$8.78 for 2019, AbbVie stock trades for a price-to-earnings ratio of 9.2x. This is a very low valuation multiple, especially for a highly profitable and growing company like AbbVie. We believe AbbVie deserves a P/E ratio of at least 13x, which represents our fair value estimate for the stock. Even though a P/E of 13x is still a fairly modest valuation, it indicates the stock is significantly undervalued. An expanding P/E multiple to our fair value estimate of 13x would boost shareholder returns by approximately 7.2% per year over the next five years.

Lastly, the stock has a current dividend yield of 5.3%, a very high yield resulting from both a declining share price and the company’s high rate of dividend growth. AbbVie is a Dividend Aristocrat, and its dividend growth has accelerated in recent years. The February 2019 dividend payment was raised 11.5% from the previous level. The previous year, AbbVie raised its May 2018 dividend by 35%, and its February 2018 dividend by 11%. AbbVie has a highly impressive track record of dividend increases. We believe AbbVie’s dividend is highly secure, as discussed in greater detail in the video below.

Since the spin-off from Abbot Laboratories, AbbVie has cumulatively increased its shareholder dividend by 168%. We believe the company will continue to raise its dividend each year going forward, thanks to its expected EPS growth and its modest payout ratio. AbbVie has strong safety metrics. It has an expected dividend payout ratio of 49% for 2019, which indicates a secure dividend with room for continued increases even if earnings stall temporarily.

The company is set to distribute less than half of its EPS this year to shareholders as a dividend. This indicates a sustainable payout, with room for continued growth in the years ahead. In total, we expect annual returns of 22% per year over the next five years, making AbbVie one of our highest-ranking stocks in terms of expected return.

Final Thoughts

Given the heightened volatility in the stock market over the past several weeks, investors are clearly concerned about rising global trade tensions. There is good reason for this, as a protracted trade war between the U.S. and China could be a significant headwind for many multinational companies.

However, this is a good opportunity for investors to focus on high-quality companies with strong profits and cash flow. In addition, investors should give dividend stocks a closer look, as dividends help provide a buffer against falling stock markets. This is why AbbVie deserves a closer look right now.

AbbVie continues to perform well, and its business model is not highly dependent upon China for growth. The company has invested heavily in R&D, which is now paying off in the form of a deep roster of potential blockbuster drugs. AbbVie’s strong pipeline is an attractive growth catalyst over the next several years.

In the meantime, investors have a unique opportunity to purchase shares of this high-quality company at a very attractive valuation level. And, AbbVie pays investors well to be patient, with a high dividend yield above 5%. With expected total returns of 22% per year over the next five years, AbbVie is a stock to buy in May 2019 for the long-term.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more