Rivian: Why I Want In On This EV IPO

Rivian (RIVN), another highly competent 100% EV manufacturer, is set to go public shortly in an IPO that should value the startup at around $65 billion. I want to own this stock, but first, what makes 100% EV companies "hot" in the first place, and why are they valued like high-growth tech companies rather than traditional automakers?

There are essentially only a handful of prominent "true" EV manufacturers. Holding a trillion-dollar-plus valuation in this space, Tesla (Nasdaq: TSLA) is the current undisputed leader in this sector. However, other players like Lucid (Nasdaq: LCID), NIO Inc (NYSE: NIO), XPeng (NYSE: XPEV), and now Rivian are emerging and should capture significant market share in future years.

These companies trade at 10-20X expected sales because their revenues are exploding and should continue to advance notably higher in the coming years. The EV segment is growing at remarkable speed, and the aging ICE industry could be left in the dust much sooner than many envisioned.

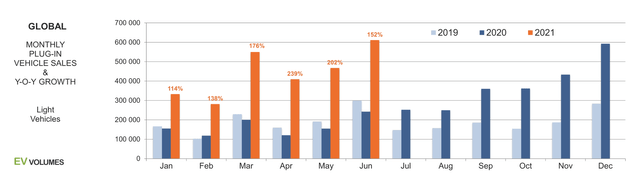

Source: ev-volumes.com - We saw 100-200+% growth YoY in H1, and we should continue to see stellar EV growth in future years.

While traditional automakers are still pivoting toward more robust 100% EV programs, I now consider their ICE segments as future liabilities rather than assets. The EV sector should perpetually take market share away from ICE as we advance. Thus, you're looking at stagnant growth and lower profitability potential with traditional automakers vs. higher profitability and nearly limitless growth potential with high-quality 100% EV manufacturers. That is why we have such a massive disconnect in valuations, as traditional ICE companies and 100% EV manufacturers are two very different segments with significantly different profitability and growth dynamics.

Why Rivian is Different

Rivian initially focuses on two mass-market vehicles, the company's R1T pickup, and the R1S full-size SUV. While there are several full-size 100% EV SUVs on the market now, the R1T should be amongst the first leaders in the ultra-lucrative 100% electric pickup market. Additionally, the company's unique truck design, relative affordability, and remarkable capabilities should make Rivian vehicles amongst the favorites in both classes. Therefore, demand should not be an issue, in my view. Moreover, the company is introducing a 100% EV delivery van, which could unlock a massive new market for Rivian.

Rivian's two primary vehicles for mass commercial production are the R1T and R1S 100% EV pickup and full-size SUV. The company already has around 50,000 preorders for the two vehicles. While these vehicles are not cheap, both starting at approximately $70K for the Explore and $75K for the Adventure version, these automobiles are highly competent. For instance, we're looking at about 800 horsepower, 0-60 times in 3.0 seconds, and ranges of 300 miles. Such specs are comparable to the best and most capable technologies in the ultra-competitive and lucrative EV space. Therefore, Rivian vehicles are engaging and will likely attract significant demand at a notably higher average selling price ("ASP") of $80,000 - 90,000.

Rivian's Amazon Partnership

Rivian has raised roughly $10.5 billion since 2019. Amongst the company's investors are Ford (NYSE: F), Amazon (Nasdaq: AMZN), and other significant backers. These are exciting partners for Rivian. Ford can provide expertise and support relevant in the automotive industry. At the same time, Amazon and Rivian can mutually benefit from their 100% EV delivery van partnership. It's also worth mentioning that since Amazon, Ford, and others have invested directly in Rivian in pre-IPO funding rounds, it's in their financial interests to see Rivian succeed going forward.

Rivian's Delivery Van

Here's another element that differentiates Rivian from other EV startups. While most of Rivian's competitors have opted to go for market share in traditional sedan/SUV/crossover market segments, Rivian is aiming at the delivery van market relatively early. Also, we see Rivian diving into the pickup market early, ahead of Tesla and other 100% EV startups.

Amazon already has preordered 100,000 electric delivery vans from Rivian, and this partnership will likely transition into a powerful and perpetual revenue stream for Rivian in future years. Furthermore, provided that the Rivian/Amazon partnership is successful, other large corporations could approach Rivian with similar orders. Also, consider the marketing that this deal offers Rivian. Can there be a better ad for Rivian than 100,000 Amazon Prime EV deliver vans zipping around the country in a couple of years?

The delivery van is set to start at roughly $53K and will come in three sizes capable of carrying 500, 700, and 900 cubic feet of packaging. Therefore, we can expect the average selling price to be substantially higher than the starting $53K figure. I suspect that, on average, Rivian can charge about 70K for its EV vans. The first 10,000 EV vans are aimed to deliver by year-end 2022.

Rivian's Substantial Capital and Production Capacity

First, I want to mention that after its IPO, Rivian will have substantial capital (roughly $13 billion) to fund future operations. Rivian's initial production should be around 150,000 annual vehicles which should move up to 200,000 vehicles per year capacity by 2023. Therefore, we could see the company produce around 150,000 vehicles in 2022, followed by roughly 200,000 vehicles from its Normal Illinois facility in 2023. Further, Rivian already has a second plant in sight, and the company intends to begin production at its second plant in Q2 2023. Combined with the company's factory in Illinois, Rivian could reach production of roughly 400,000 vehicles in 2024 - 2025.

Production, Revenues, Profitability, and Valuation

To forecast Rivian's production figures, I'm using slightly more modest projections than the company's estimates. As with all production ramp-ups, there could be some setbacks and delays, but this should not push back the timeline significantly, in my view. Also, Rivian is extremely well funded and should absorb any unforeseen costs associated with the launch of its vehicles.

To project revenue figures, I'm using an ASP of $85K (a relatively modest estimate in my view) for the R1T/R1S vehicles and an ASP of $70K for Rivian's delivery van. I anticipate the company can produce about 10,000 delivery vans in 2022, followed by about 10% of production in the following years.

While Rivian expects it can produce around 150,000 at its Normal factory in its first year, I think that this may be optimistic. So, my modest estimate is for 100,000 production/deliveries in 2022. Therefore, revenues should amount to around $7.65 billion for 90,000 R1T/R1S vehicles at an ASP of $85K and roughly $700 million for Rivian's delivery van in 2022. Thus, the full year 2022 revenues could come out to around $8.35 billion. If we apply approximately a medium 15x sales multiple to Rivian, we arrive at a valuation of about $125 billion for Rivian in 2022, roughly double the suggested IPO valuation.

| Year | 2022 | 2023 | 2024 | 2025 |

|

Production |

100,000 | 180,000 | 270,000 | 350,000 |

| Revenues (billions) | $8.35 | $15.03 | $22.55 | $29.23 |

| P/S ratio | 15 | 13 | 12 | 10 |

| Valuation (billions) | $125 | $195 | $270 | $292 |

Source: Author's material

The Bottom Line: Is the Rivian IPO a Buy?

Going by my projections for the company, the short answer is yes. Again, I'm using relatively modest estimates here, in my view. Rivian expects to have production capacity at 400,000 by 2024, but I'm only factoring in sales of about 350,000 vehicles in 2025. Nevertheless, using a valuation of only around 10 times sales, we get to a possible market valuation of nearly $300 billion in 2025, approximately five times the expected IPO value. Therefore, yes, I believe Rivian will be a good investment, and shares are likely to advance much higher in future years.

Risks to Rivian

While I am bullish on Rivian intermediate and longer term, there will likely be a lot of volatility during and following the highly anticipated IPO. I expect Rivian shares to rise substantially on IPO day, but after days/weeks of volatile trading, there should be some downside as the lockout period ends. Additionally, the company could face various challenges that may cause the stock to fall in the future. For instance, Rivian's vehicles may not garner the ultra-high demand that I anticipate. The company's technology could have problems, or the cars may prove to be less reliable than I expect. Moreover, Rivian could face production hurdles, increasing costs, substantial levels of competition, and more. The EV sector, in general, could lose favor, and valuations could decline. The point is that there's a lot that could go wrong, and Rivian is a relatively risky investment, especially given the ultra-high multiples that we currently see in this space. Nevertheless, with increased risk, reward potential rises as well, and market participants should consider the risks carefully before jumping into this investment, in my view.

Disclosure: I/we have a beneficial long position in the shares of NIO either through stock ownership, options, or other derivatives.

Disclaimer: This article expresses solely my opinions, is ...

more