Luckin Coffee Could Stumble When IPO Lockup Expires

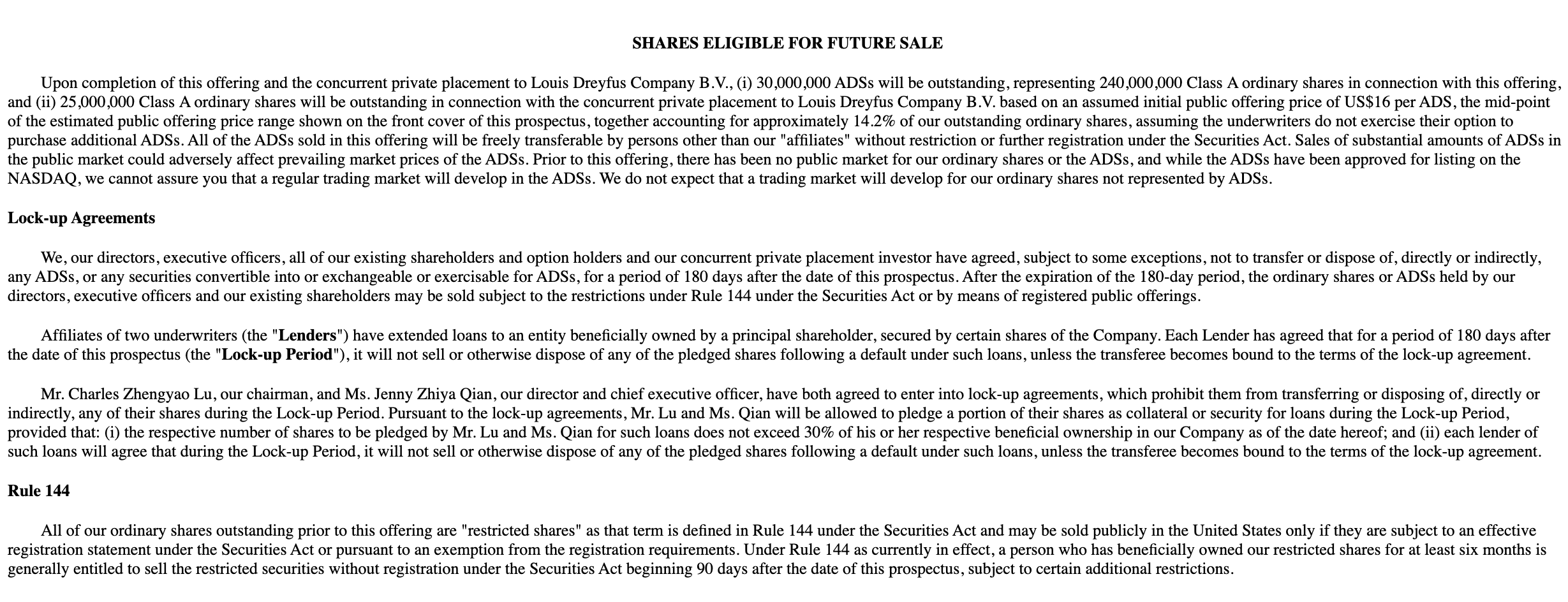

When the lockup period for Luckin Coffee (Nasdaq: LK) ends on November 13th, its pre-IPO shareholders will have the opportunity to sell large blocks of currently-restricted shares.

(Click on image to enlarge)

(Source: S-1/A)

Just 14.2% of LK's outstanding shares are trading pursuant to the IPO, so there could be a large increase in trading volume when the lockup expires. Significant sales of currently restricted shares could flood the secondary market when the LK IPO lockup expires causing a sharp, short-term downturn in LK's share price. Aggressive, risk-tolerant investors should consider shorting shares of LK ahead of the company's lockup expiration.

Business Overview: Retail Coffee Brewer in China

Luckin Coffee is the second largest retail coffee brewer in China in terms of cups of coffee sold and the number of retail outlets. Founded in 2017, Luckin Coffee uses a new retail model that embraces technology to provide its customers with affordable, convenient, and high-quality coffee drinks.

(Source: LK company website)

The company uses its mobile apps to handle the entire customer order and purchasing process. This gives their coffee drinkers a 100% cashier-less experience. In addition, Luckin Coffee notes that it improves their operational efficiency and promotes customer engagement.

The company operates three types of retail outlets. However, as part of the strategy, they focus on outlets called pick-up stores. These outlets have limited seating, and the company locates them in areas that are known for high coffee demand such as university campuses, office buildings, and other commercial areas.

Customers must use the mobile app to order coffee. They select either pick up or delivery and pay online after ordering. A text message is sent to the customer when the coffee drink is ready - typically about three minutes. Delivery takes approximately 30 minutes.

In addition to focusing on using technology to drive the customer experience, the company strives to maintain a high quality of coffee. Their SEC filings note that their coffee won the gold medal in the 2018 IIAC International Coffee Tasting competition.

In the 18 months since launching, Luckin Coffee has gone from one trial outlet in Beijing to 2,963 retail stores across 28 cities in China as of June 30. It has sold over 90 million cups of coffee to more than 16.8 million customers. Their customer repurchase rate is over 54%. In its efforts to surpass Starbucks as the top coffee drink retailer, Luckin Coffee expects to have 4,500 outlets throughout China by the end of 2019. Currently, Starbucks has approximately 3,600 stores, which took them 20 years to open.

Company information was sourced from the firm's S-1/A and company website.

Financial Highlights

Luckin Coffee Inc. reported second-quarter financial highlights for the period ending June 30, 2019:

- Total net revenues were RMB870.0 million (US$126.7 million), for an increase of 698.4% versus the same quarter last year.

- Cumulative number of transacting customers grew to 22.8 million, up from only 2.9 million the same period last year.

- Luckin Coffee added 5.9 million new customers for the second quarter of 2019.

- Average monthly items sold increased by 589.7% for the second quarter of 2019 versus the same period last year.

- The total number of retail outlets was 2,963 for an increase of 374.8%

- Luckin Coffee trimmed its store operating loss to RMB55.8 million (US$8.1 million), versus a loss of RMB81.7 million for the same period last year.

Financial results were sourced from the company's website.

Management

CEO and Director Jenny Zhiya Qian has served in her position since November 2017. She previously served in senior positions at UCAR. She holds a bachelor’s degree from Wuhan Institute of Textile Science. She holds an MBA from Peking University.

COO Jian Liu has served the company since May 2018. He previously held senior positions at UCAR. He earned a bachelor’s degree from the Central University of Finance and Economics.

Management info was sourced from the company's website.

Competition: Starbucks, McDonald’s, and KFC

As noted, Luckin Coffee is currently the second-largest coffee drink retailer in China. Starbucks (SBUX) holds the top position. Other fast-food restaurants pose competition to Luckin Coffee including McDonald’s (MCD), KFC, FamilyMart, Coffee Box, and other Chinese fast-food restaurants.

Early Market Performance

The underwriters priced the IPO at $17 per share. The stock closed on the first day of trading at $20.38 for an increase of 19.9%. Shares dipped to $14.75 on May 22. Then, they began to climb to reach a high of $26.58 on July 29. LK currently has a return from IPO of 10.4%.

Conclusion

When the Luckin Coffee IPO lockup expires on November 13th, pre-IPO shareholders and company insiders will be allowed to cash in on their gains and sell large blocks of currently-restricted shares for the first time. With just 14.2% of LK's outstanding shares trading pursuant to the IPO, there is a significant chance that trading volume could dramatically increase when the lockup expires. Significant sales of currently-restricted shares could flood the secondary market and push LK's share price sharply lower in the short term.

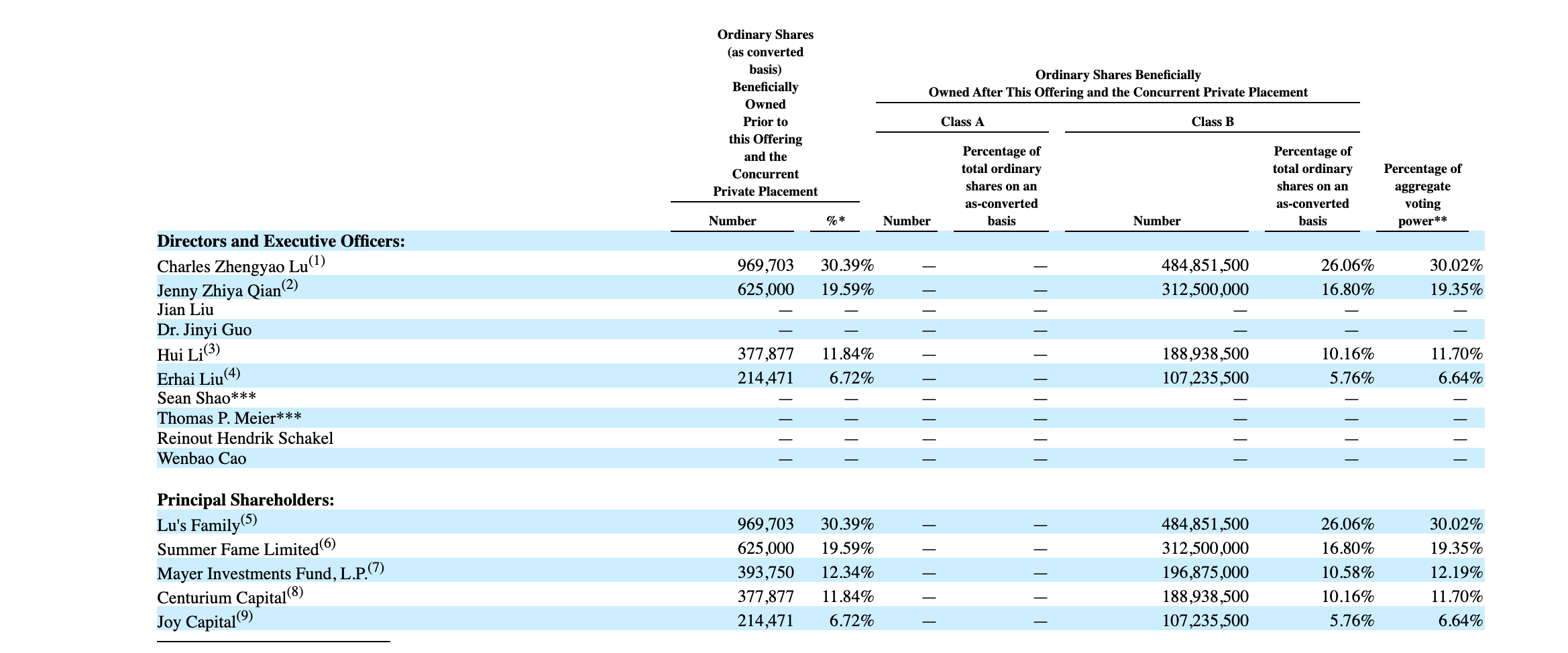

LK's pre-IPO shareholders and company insiders include numerous directors and VC firms.

(Click on image to enlarge)

(Source: S-1/A)

Aggressive, risk-tolerant investors should consider shorting shares of LK ahead of the firm's IPO lockup expiration on November 13th. Interested investors should cover shares of LK during the November 14th and November 15th trading sessions.

Disclosure: I am/we are short LK.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more