Is The Consumer In Trouble?

Consumer Running On Empty?

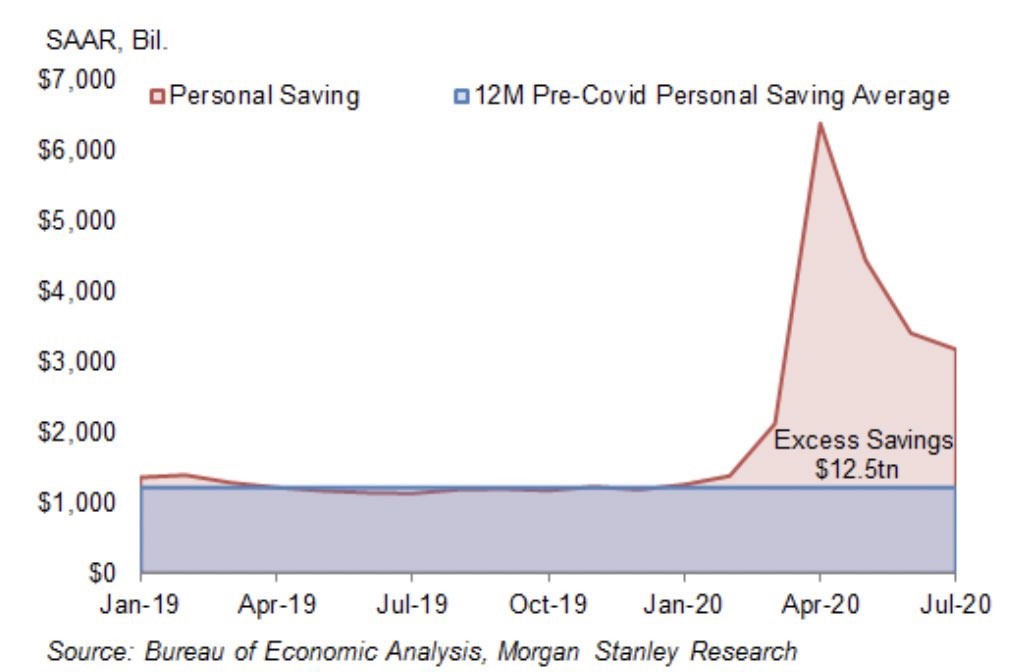

Morgan Stanley came out with a new note that makes the point that the consumer is running out of savings to keep up its current spending. The consumer is about to be running on empty according to the chart below. As you can see, the personal savings rate has been dropping quickly after peaking in April because of the stimulus checks. Some disagree with this sentiment. Savings rate dropping is a return to normalcy.

There are some people who are about to be running on empty (the unemployed) and others who are simply spending closer to normal as businesses reopen (the employed). We knew the savings rate would fall. It falls when there is less stimulus because people save money given them by the government at a higher rate because they feel it’s uncertain. No one knows when the next stimulus is coming, but people know they will get paid when they have a job. For example, a few months ago, more people thought a stimulus was coming than do now.

(Click on image to enlarge)

A key point Morgan Stanley is missing is job creation. Investors will rescind their optimism if job creation is weak in September or if non-seasonally adjusted jobless claims increase for 3 weeks straight. People who don’t have jobs were hit hard by the decline in benefits, while the people who do have jobs are spending slightly more than last year. As more people get jobs, the problem eases.

COVID-19 Positive Rate Increases In Europe

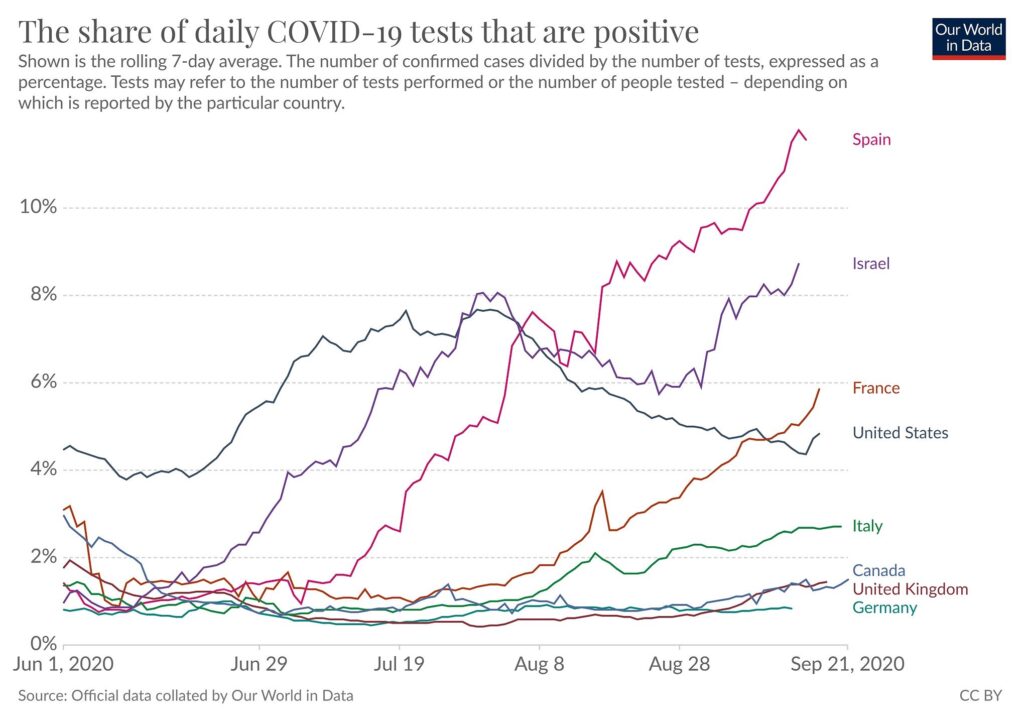

Morgan Stanley added that a lack of fiscal support combined with a 2nd wave of COVID-19 will cause trouble for the consumer. It's arguable that America already had its 2nd wave. As you can see from the chart below, America’s COVID-19 positive rate spiked in July and has since fallen.

If it rises again, it would be a 3rd wave. Maybe that’s semantics, but America’s positive rate is looking a lot better than some of Europe which is still dealing with its 2nd wave.

(Click on image to enlarge)

To be clear, if America sees another spike in COVID-19, it will be problematic. Final impacts will depend on whether there are lockdowns like there are in Spain right now. If there are lockdowns, we could see another round of stimulus. This upcoming election will bring another stimulus. After a party wins, they like to spend money to make it look like their election spurred growth.

President Trump is talking about another tax cut. And Biden would try to help support the middle and lower class. For cyclical investors, this is a win/win situation. We can expect the rate of change of job creation to slow, but not future job losses. A declining unemployment rate paired with a stimulus is a win. One of the main gripes with Morgan Stanley is that if their bearishness on COVID-19 is correct, they are wrong to not expect a stimulus.

Congestion Falls

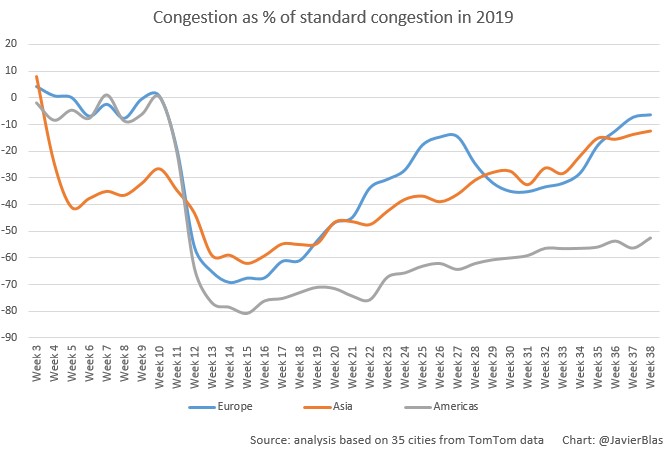

Some of the most up to date non-traditional data has been weak. A driving congestion rate bucks that trend. As you can see from the chart below, the congestion rate in Asia and Europe is close to normal, while the rate is still down by half in the Americas.

All trends are positive. This analysis is based on 35 cities using TomTom. Some contend that the road layouts are different. For example, if cities have some streets closed for walking or for eating outside, then it takes fewer cars/trucks to get traffic.

(Click on image to enlarge)

On the other hand, road usage in the U.K. is up. People are driving more. We also have data on subway turnstile usage which shows more people are using the MTA than prior weeks, but the improvement is modest. A decline in public transportation usage caused demand for used cars to increase.

It's likely temporary. There will be an inverse relationship between used car prices and MTA usage. There might even be an oversupply of used cars, causing prices to drop once COVID-19 stops impacting the consumer behavior and government policy.

August Chicago Fed Activity Index

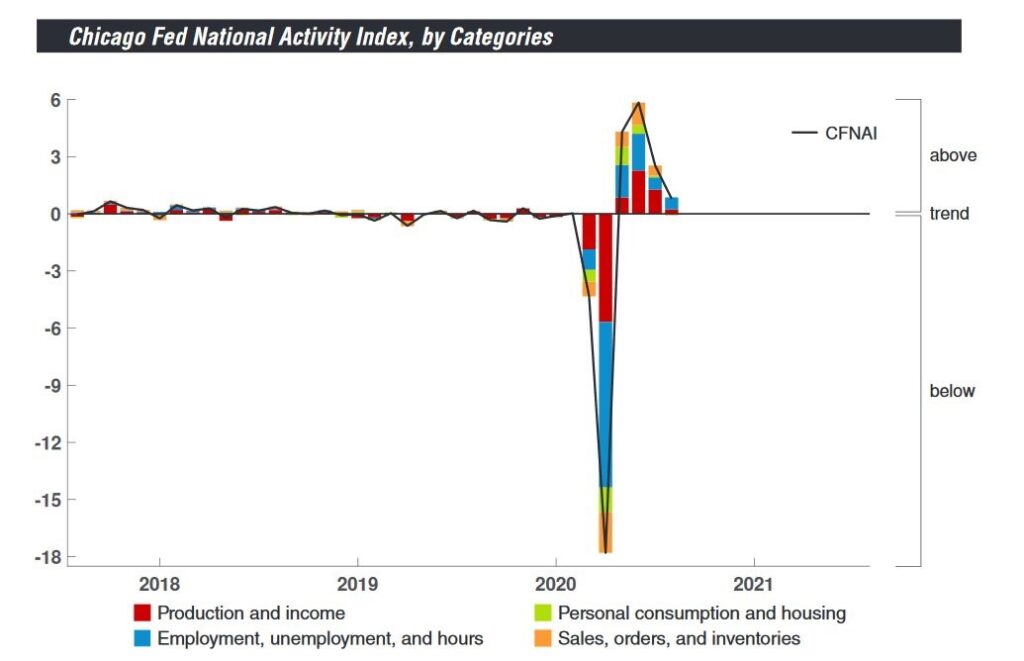

August Chicago Fed national activity index fell from 2.54 to 0.79 which missed estimates for 1.88 and the lowest estimate of 1.18. The good news is July’s reading was revised up from 1.18. As you can see from the chart below, the initial spike is wearing off. However, the index is still above where it was in the prior 2 years.

(Click on image to enlarge)

45 of the 85 indicators made positive contributions to the index in August and 40 hurt it. 29 indicators improved and 56 got worse from July. This index is always tough because it gives you partial information in the latest month. That being said, because it’s a diffusion index, we can be confident that the metric fell in August. As growth improves the comp gets tougher. Industrial production was weak and monthly retail sales growth fell from July.

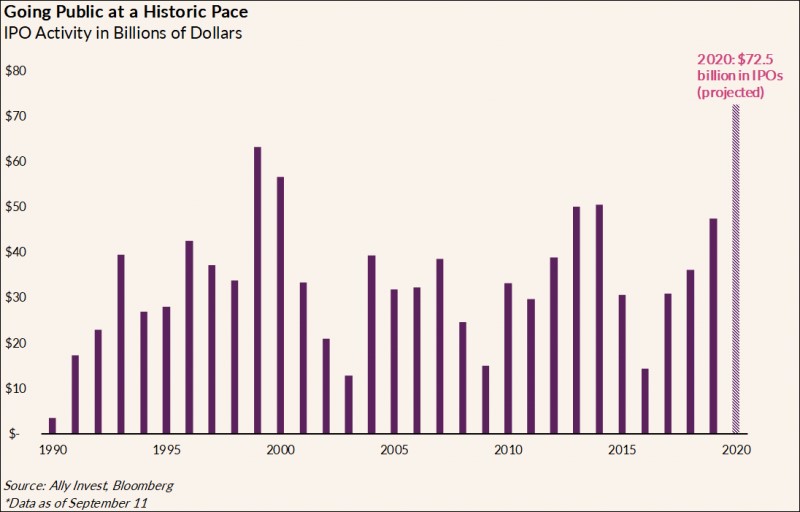

Hot IPOs

The IPO market quickly went from non-existent in the spring to very hot. That’s because the private sector is excited to cash out because public stocks are expensive. They are capitalizing on the arbitrage opportunity that is the difference between private sector valuations and public sector ones.

As you can see from the chart below, IPOs are expected to raise $72.5 billion this year which is a new record. Obviously, with the size of the stock market increasing, it’s going to be higher than the peak in 1999. However, it’s still notable how much higher it is than 2019 which was a great market.

(Click on image to enlarge)

IPOs have done really well on their first day because many occurred from April to August which was one of the market’s best runs ever. 73% of IPOs have risen on their first day which is the highest percentage ever. Every single IPO larger than $1 billion was up.

On the one hand, the peak was only about 60% in 2000 and it was about 20% in 1999. On the other hand, it has been high in the past few years; in 2019 it was only a few points lower. This also doesn’t look at the size of the jumps in the first few days of trading which were likely higher in the late 1990s.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more