Health Catalyst Could Slump When Lockup Expires

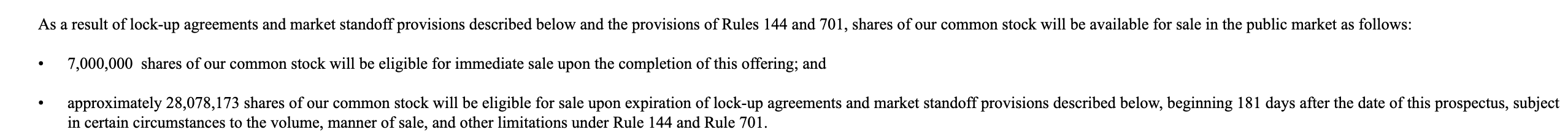

When the 180-day lockup period for Health Catalyst Inc. (HCAT) expires on January 21, 2020, the company's pre-IPO shareholders and insiders may choose to sell more than 28 million shares in the secondary market. The number of currently-restricted shares dwarfs the 8 million shares currently trading pursuant to the IPO. Significant sales of currently-restricted stock could flood the secondary market and cause a sharp, short-term decline in share price.

(Click on image to enlarge)

Source: S-1/A

Trading in Health Catalyst has been somewhat mixed during this six-month period, although the stock still has a return from IPO of more than 35%. The stock was priced at $26 and closed on its first day of trading at $39.17, for an increase of 50.7%. The shares climbed to a high of $48.63 on August 12 but then began a decline reaching $26.44 on October 9. The share price has recovered, and currently, the stock trades around $35-36.

Business Overview: Provider of a Data Operating System for the Healthcare Industry

Health Catalyst provides data and analytics technology products and services to the healthcare industry. Their solution is a cloud-based platform with analytics software. They also provide professional services expertise. They target healthcare providers, which utilize the Health Catalyst solution to manage data, mine for analytical insights, improve operational efficiency, and achieve measurable clinical, operational, and financial benefits.

Source: HCAT website

Health Catalyst uses a four-prong approach to provide these solutions to its clients. They include its data platform, analytics applications, services expertise, and engagement. The company calls this its Health Catalyst Flywheel.

Health Catalyst uses adaptive data architecture, which gives its data model flexibility and agility. Implementation typically takes several weeks versus months or years for conventional approaches to health industry data management. Their solution enables healthcare providers to identify trends, map plans, and make sustainable improvements by making process and organizational changes for greater efficiency.

Some of their clients include Cedars Sinai Medical Center, Kaiser Permanente Thrive, Stanford Hospital and Clinics, Texas Children's Hospital, CHOC Children's, John Muir Health, and St. Luke's.

Company information sourced from the firm's website and S-1/A.

Financial Highlights

Health Catalyst reported the following financial highlights for the end of the third quarter for fiscal 2019 ended September 30, 2018:

- Total revenue was $39.4 million for an increase of 20% over the previous third quarter

- Loss from operations was $(20.7) million versus $(16.4) million for the same period the prior year

- Net loss was $(21.4) million versus $(16.8) million for the same period the prior year

- Total adjusted gross margin was 54% versus 50% over the previous third quarter

- Adjusted EBITDA was $(8.4) million versus $(11.3) million over the previous third quarter

Financial highlights sourced from the firm's website.

Management Team

CEO Daniel Burton has served in his position since October 2012. Prior to joining Health Catalyst, Mr. Burton co-founded HB Ventures, LLC, which was a private investment firm. He earned a B.S. from Brigham Young University and an M.B.A. from Harvard Business School.

CFO Patrick Nelli has served in his position since September 2017. He has held various roles at Health Catalyst since August 2017 including, SVP of Touchstone Product Line, VP of Corporate Analytics, and Manager of Financial Planning and Analysis. He holds a B.A. from Wake Forest University.

Company bios sourced from the firm's website.

Competition: Medidata, Evolent, IBM, and Others

Health Catalyst faces competition from a number of digital platform and software providers that focus on the health care industry. These include Medidata, Signant Health, Change Healthcare (CHNG), Evolent (EVH), and Tredegar Corporation (TG). They also face competition from other data analytics providers including IBM (IBM), HP Enterprise (NYSE: HPE), Teradata (NYSE: TDC), Oracle (ORCL), SAP (SAP), EMC, Amazon (AMZN), Google (GOOG), Microsoft (MSFT), Splunk (NASDAQ: SPLK), VMware (VMW), Cogito, and Alteryx (AYX).

Early Market Performance

The underwriters for Health Catalyst priced its IPO at $26, above its expected price range of $24 to $26 per share. The stock has had a mixed performance. It reached a high of $48.63 on August 12 then began to decline reaching $26.44 on October 9.

Conclusion

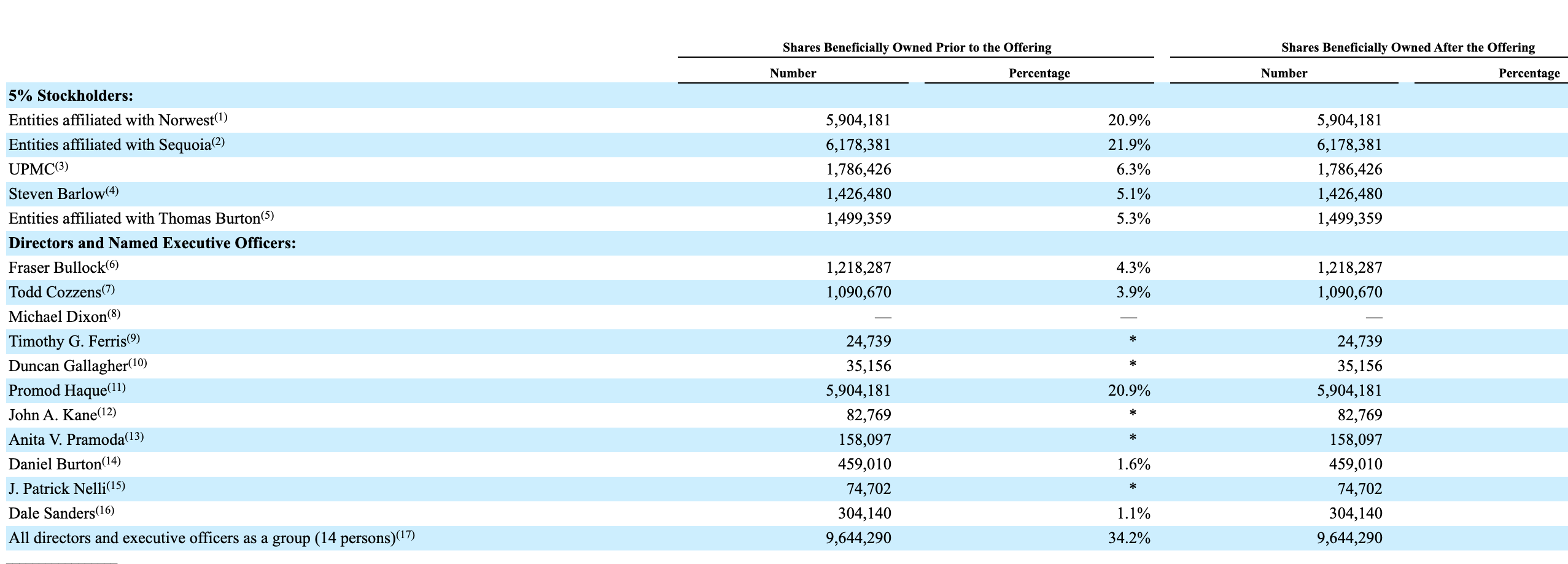

When the IPO lockup for HCAT expires on January 21, pre-IPO shareholders and company insiders will be able to sell over 28 million currently restricted shares and cash in on their gains. Despite mixed trading, we believe they will be eager to do so with HCAT's more than 50% gain from IPO. This group of pre-IPO shareholders and company insiders includes numerous executives and VC firms.

(Click on image to enlarge)

(Source: S-1/A)

With just 8 million shares trading pursuant to the IPO, any significant sales of currently-restricted stock could flood the secondary market for HCAT and cause a sharp, short-term downturn in the share price. Aggressive, risk-tolerant investors should consider shorting shares of HCAT ahead of the IPO lockup expiration. Interested investors should cover short positions during the January 22nd and January 23rd trading sessions.

Disclosure: I am/we are short HCAT.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more