HeadHunter Could Be Impacted By Lockup Expiration

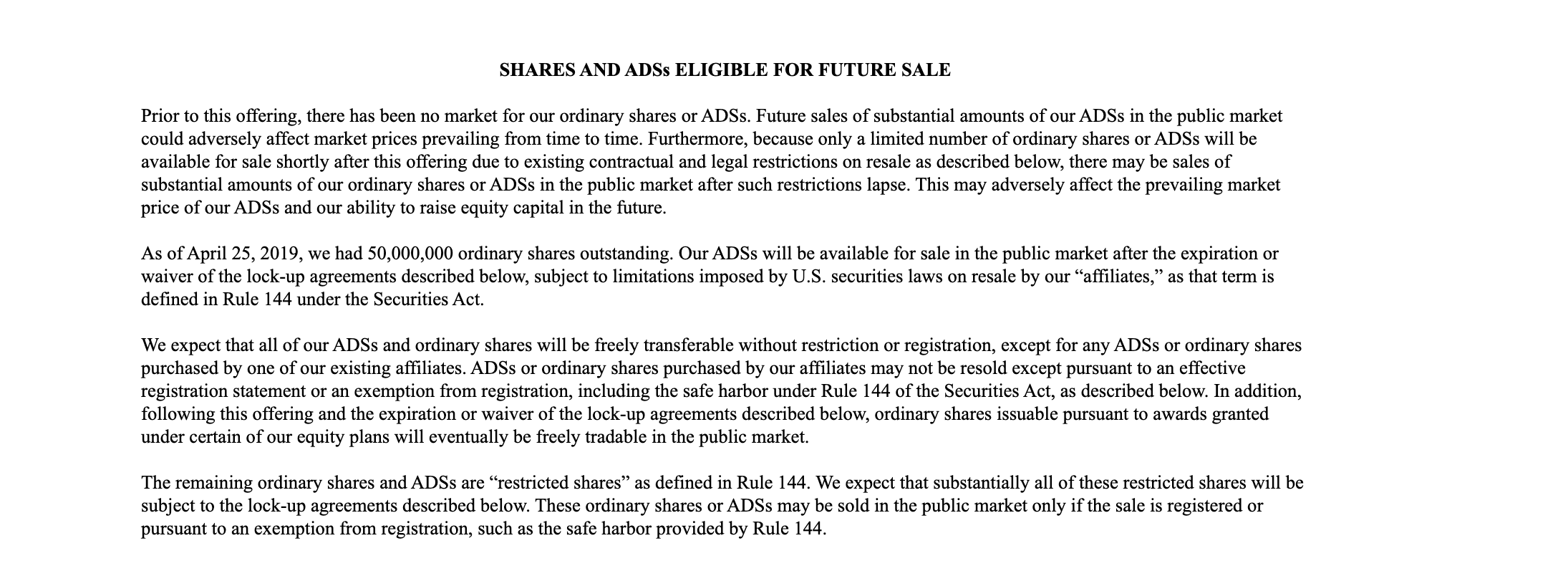

When the lockup period ends for HeadHunter Group (HHR) on November 5th, the company's pre-IPO shareholders and company insiders will be able to sell more than 31 million shares of currently restricted shares. This number dwarfs the 18.75 million shares offered in the IPO.

(Click on image to enlarge)

(Source: F-1/A)

Significant sales of currently-restricted stock could flood the secondary market and send shares sharply lower in the short term when the lockup expires. Aggressive, risk-tolerant investors should consider shorting shares of HHR ahead of the IPO lockup expiration on November 5th.

Currently, HHR trades in the $17 to $18 range and has a return from IPO of 29.3%.

Business Overview: Executive Recruitment Company Based in Moscow, Russia

HeadHunter Group LLC operates an online platform that provides recruitment services to job seekers and employers. Recruiters and employers have paid access to the platform's curriculum vitae (CV) database, which contains resumes from job seekers. The online platform offers a job postings function as well as value-added services for both employers and job seekers.

(Source: Company Website)

The company notes in its SEC filings that 86% of the platform's traffic was free as of November 2018, and its site is the third most visited employment website worldwide as of January 2019. Their CV database contained 36.2 million CVs as of December 2018, and the company acquired Job.ru in January 2018. In December 2018, the platform hosted a daily average of 559,000 job postings, which is a significant increase from 344,000 job postings in 2016. It had 20 million unique visitors per month in 2018, which is an increase from 16.7 million unique visitors per month in 2016. HeadHunter had 253,000 paying customers at the end of December 2018.

HeadHunter Group has mobile applications as well to access the mobile marketplace. Their apps have been downloaded approximately 15.3 million times through December 2018. The company notes that the majority of the website's traffic comes from the mobile apps.

HeadHunter was founded in 2000 and maintains its headquarters in Moscow, Russia. The platform serves markets in Russia and the Commonwealth of Independent States. The majority of services to job seekers are free, while employers and recruiters pay fees to access the database and post jobs. The company has approximately 680 employees and was incorporated in Cyprus.

Company information was sourced from the company's website and F-1/A.

Financial Highlights

HeadHunter Group reported second-quarter financial highlights for the period ending June 30, 2019:

- Revenue increased 25.7% resulting from increased revenue from its Russia segment. That segment increased by 24.7% with growth coming from small to medium accounts.

- Net income decreased to RUB275 million from RUB322 million. The company attributed the negative impact due to expenses related to the IPO.

- Adjusted EBITDA increased 36.0% and Adjusted EBITDA Margin increased to 52% versus 48.1% from the prior year.

- Adjusted Net Income increased 35.8% and Adjusted Net Income Margin increased to 31.1% versus 28.8% from the prior year.

Financial information was sourced from the firm's website.

Management

CEO Mikhail Zhukov has served in his position since February 2008. His previous experience comes from a variety of Russian IT companies including IBS, which is a Russian systems integrator. He earned a Masters in Engineering at the Moscow Aviation Institute. In addition, he holds a diploma from the Plekhanov Russian Academy of Economics.

CFO Grigorii Moiseev has served in his position since February 2008. He previously held senior financial positions at Sputnik Labs and Helios Computer.

Corporate bios were sourced from the firm's website.

Competition: Monster, CareerBuilder, Indeed.com

According to the HeadHunter website, its platform is the top online recruitment site in Russia according to operational and financial measurements. In the global marketplace, HeadHunter faces competition from sites like Idealist, Indeed.com, Monster, and CareerBuilder. In the Russian marketplace, other recruitment sites include Jooble.org, Superjob.ru, and Zarplata.ru.

Early Market Performance

The underwriters priced the IPO at $13.50 per share. The stock closed on the first day of trading at $15.75 for an increase of 16.7%. Shares dipped to $15.33 on June 11. Then they began to climb to reach a high of $21 on September 16. HHR currently has a return from IPO of 29.3%.

Conclusion

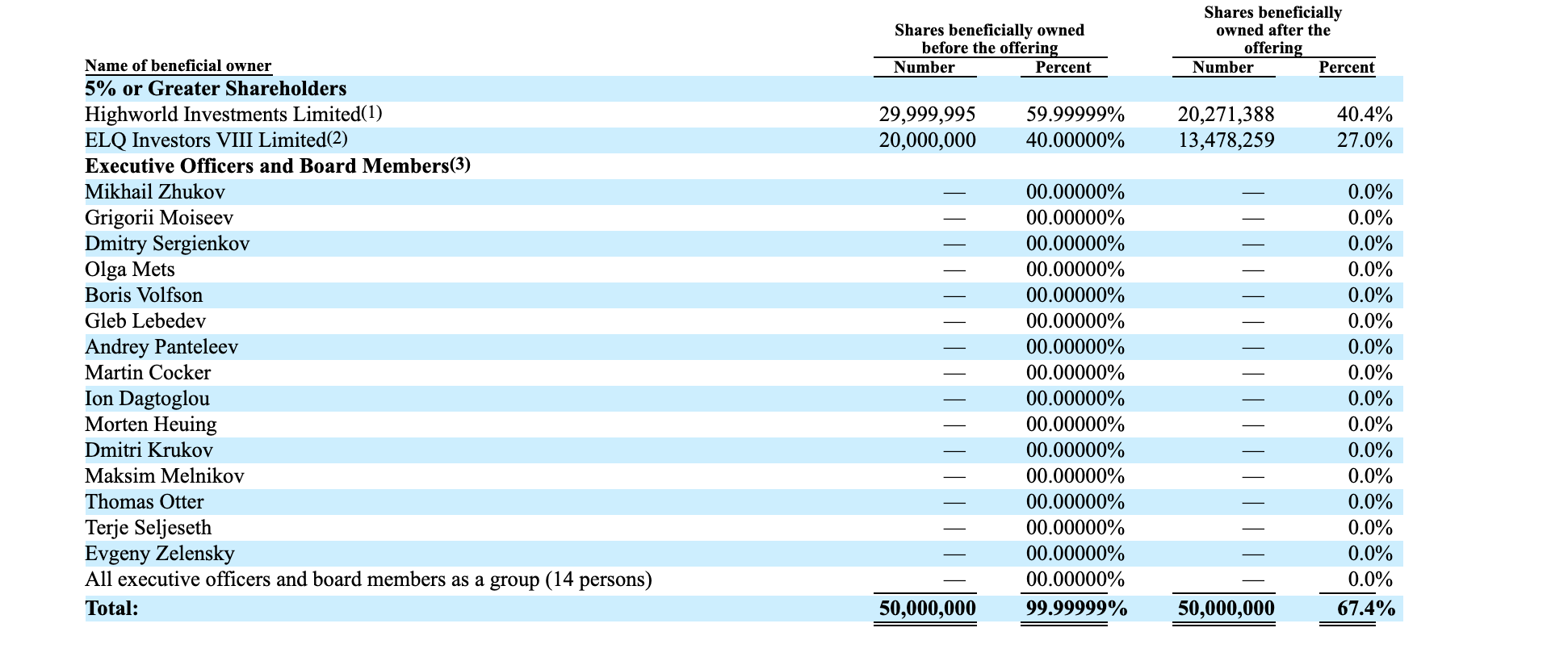

When the HHR IPO lockup expires on November 5th, pre-IPO shareholders and company insiders will be able to sell more than 31 million shares of currently-restricted stock. This group of pre-IPO shareholders and company insiders includes numerous executives and board members along with VC firms.

(Click on image to enlarge)

(Source: S-1/A)

Sales of currently-restricted shares could flood the secondary market when the lockup expires and cause a sharp, short-term downturn in share price. Aggressive, risk-tolerant investors should consider shorting shares of HHR ahead of the November 5th IPO expiration. Interested investors should cover their positions during the November 6th and November 7th trading sessions.

Interested in learning more about IPO Lockup investment opportunities? Check out our subscription service, IPO Insights. We update subscribers with actionable investment opportunities that follow the debut of select companies on U.S. exchanges.

Disclosure: I am/we are short HHR.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more