Fastly Could Be Impacted By IPO Lockup Expiration

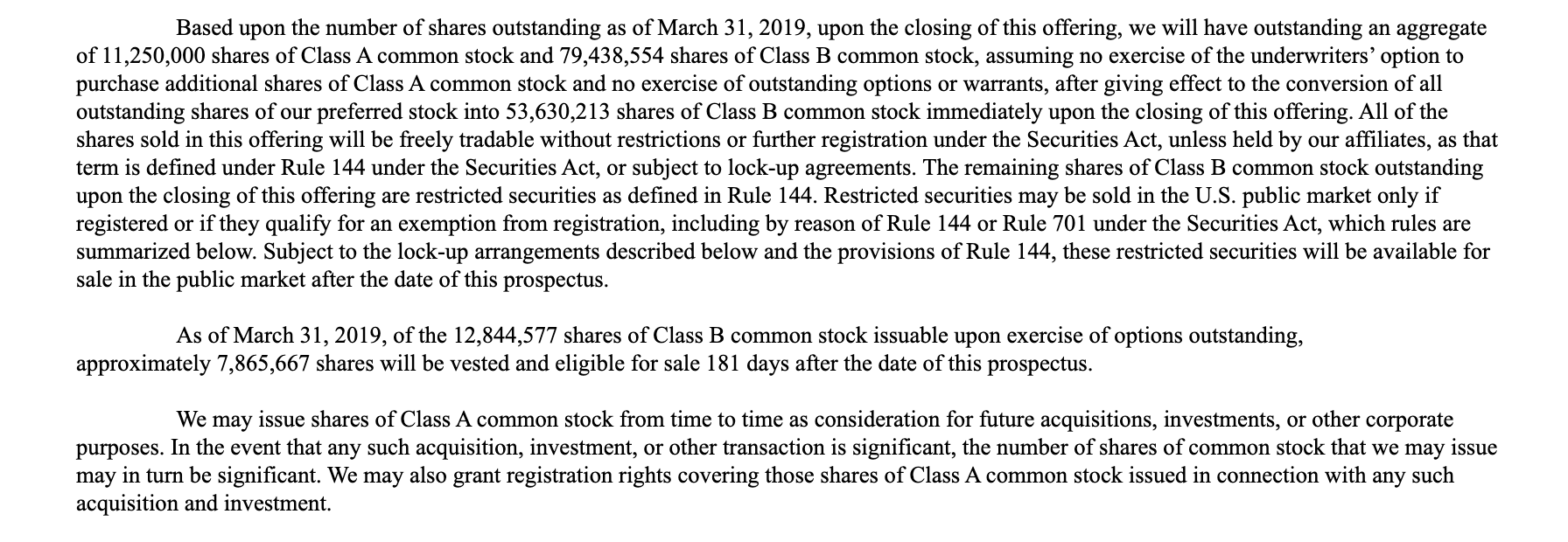

When the IPO lockup period ends for Fastly, Inc. (NYSE: FSLY) on November 13th, the company's insiders and pre-IPO shareholders will have the opportunity to sell large blocks of currently-restricted shares, including 7.8 million Class B shares that will have vested on that date.

(Click on image to enlarge)

(Source: S-1/A)

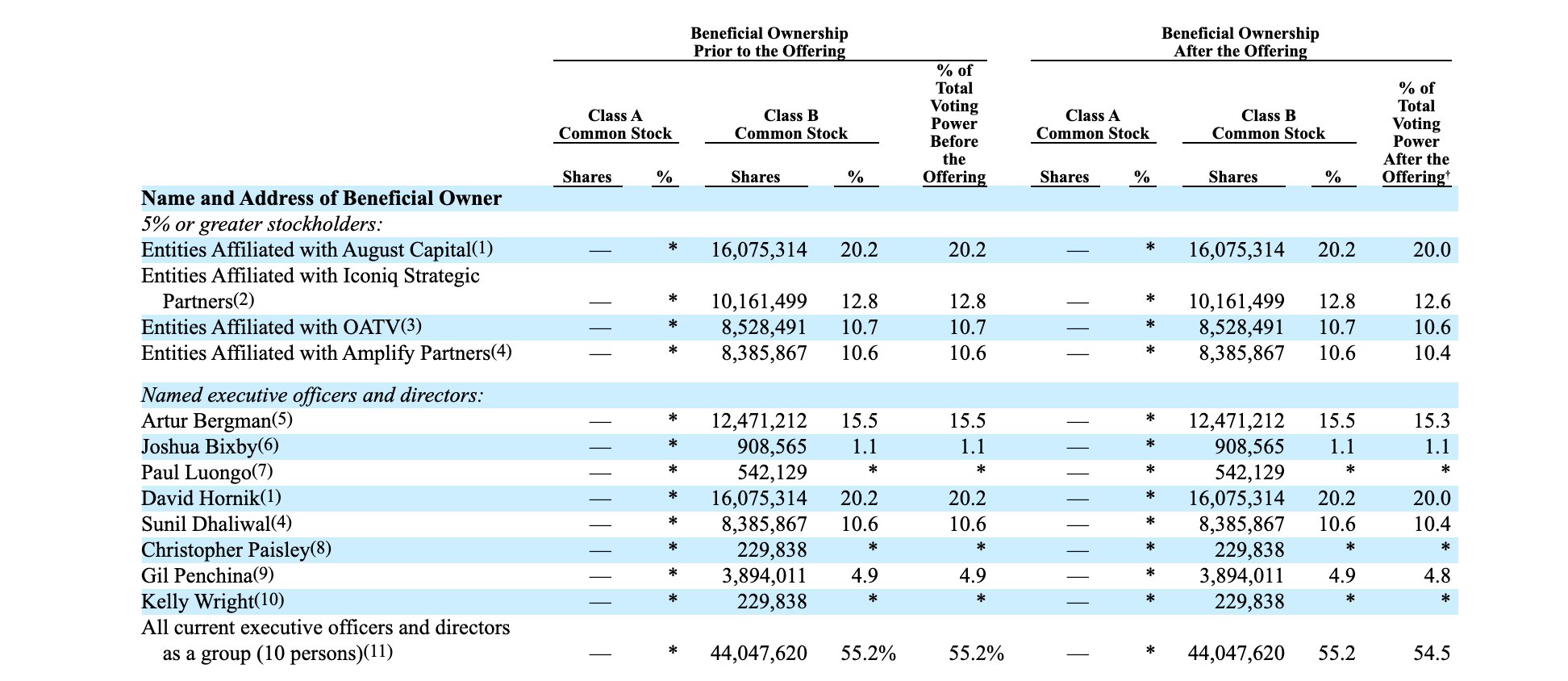

This group of pre-IPO shareholders and company insiders includes numerous executives and VC firms.

(Click on image to enlarge)

(Source: S-1/A)

We believe that FSLY's insiders and pre-IPO shareholders will be eager to cash in on some of their gains - FSLY has a return from IPO of more than 21%. Any significant sales of currently-restricted stock could flood the secondary market when FSLY's IPO lockup expires and send shares sharply lower in the short term. Aggressive, risk-tolerant investors should consider shorting FSLY ahead of the IPO lockup expiration.

Note: FSLY shares may be hard to borrow and experienced investors might consider gaining short exposure via an options strategy.

Business Overview: Provider of Infrastructure as a Service (IaaS)

Fastly Inc. is a provider of infrastructure software. It offers cloud computing, security, streaming, image optimization, and computer technology solutions. Their services are offered to customers in the United States.

(Source: Fastly website)

The company’s SEC filings note that their IaaS allows developers to create, secure, and market digital products at the “edge of the internet.” They describe this area as the Content Delivery Network (CDN) that has functionalities typically delivered by hardware rather than software. These functions include Distributed Denial of Service (DDoS) solutions, Bot Detection, Web Application Firewalls (WAF), and Application Delivery Controllers (ADC).

Fastly’s solutions aim to move computing power and logic towards the end-user. It does this by utilizing the cloud computing serverless paradigm. This trend enables the cloud provider to run the server while allocating machine resources in real-time. The edge cloud enhances central cloud, data center, and hybrid solutions.

The Fastly platform has three primary components: a software-defined modern network, a programmable edge, and a commitment to customer empowerment. Developers work with real-time visibility to create and deploy code. The company operates across the following industries: digital publishing, eCommerce, online video and audio, Software as a Service, travel and hospitality, financial services,

The company utilizes approximately 60 technology products and services including Google Tag Manager (NASDAQ: GOOG) (NASDAQ: GOOGL), Vimeo, and Google Analytics. Its platform is built on Varnish, which is an open-source HTTP accelerator.

Fastly’s clients include Gov.uk, Reddit, GoFundMe, Shopify (NYSE: SHOP), Alaska Airlines (NYSE: ALK), The New York Times (NYT), Ticketmaster, Vimeo, Pinterest (NYSE: PINS), Airbnb, Buzzfeed, Pantheon, Kayak, Yelp (YELP), Stripe, and Conde Nast.

Their edge network has 45 terabits and works across 60 points-of-presence worldwide. Fastly is headquartered in San Francisco, California and has approximately 490 employees. It earns approximately $185 million in annual revenue. Fastly keeps additional offices in Tokyo, London, Portland, New York, and Denver.

Company information was sourced from the firm's S-1/A and website.

Financial Highlights

Fastly Inc. reported second-quarter financial highlights for the period ending June 30, 2019:

- Revenue increased by 34% to $46 million

- Dollar-Based Net Expansion Rate was 132% versus 130% in the first quarter of 2019

- Enterprise customer count reached 262 versus 190 for the second quarter of 2018

- Total customer count reached 1,627 versus 1,529 for the same period last year

- Gross margin was 55%

- GAAP operating loss was $12 million, while the non-GAAP operating loss reached $9 million

Financial highlights were sourced from the firm's website.

Management

CEO Artur Bergman has served the company and acted as a board member since March 2011. His previous experience includes senior positions at Wikia, SixApart, and Fotango.

CFO Adriel Lares has served in his position since May 2016. His previous experience comes from positions at Lookout, Inc. and 3PAR Inc. Mr. Lares holds a B.A. in Economics from Stanford University.

Management bios sourced from the company's website.

Competition: Google Cloud Platform, Cisco (NASDAQ: CSCO), and Amazon’s CloudFront (NASDAQ: AMZN)

Fastly faces competition in four key categories. These are (1) legacy CDNs such as Imperva (NASDAQ: IMPV), Level 3, EdgeCast, Limelight (NASDAQ: LLNW), and Akamai (NASDAQ: AKAM); (2) small business-focused CDNs like Section.io, StackPath, Cloudflare, and InStart; (3) Cloud providers offering edge cloud functions such as Google Cloud Platform, AWS Lambda, and Amazon’s CloudFront; and (4) conventional hardware providers such as Arbor, Cisco, Citrix (CTXS), and Imperva.

Early Market Performance

The underwriters priced the IPO at $16 per share. The stock closed on the first day of trading at $23.99 for an increase of 49.9%. Shares dipped to $14.85 on August 14. Then, they began to climb to reach a high of $33.81 on September 5. Shares of FSLY currently have a return from IPO of 21.4%.

Conclusion

When FSLY's IPO lockup expires on November 13th, pre-IPO shareholders and company insiders will be able to sell large blocks of currently-restricted shares for the first time. The large number of currently-restricted shares includes 7.8 million Class B shares that will be vested when the lockup expires.

Any significant sales of currently-restricted shares could flood the secondary market for FSLY and cause a sharp, short-term downturn in share price when the IPO lockup expires. Aggressive, risk-tolerant investors should consider shorting shares of FSLY - or gaining short exposure to FSLY via an options strategy - before the IPO lockup expires on November 13th. Interested investors should cover short positions during the trading sessions on November 14th and November 15th.

Interested in learning more about IPO Lockup investment opportunities? Check out our subscription service, IPO Insights. We update subscribers with actionable investment opportunities that follow the debut of select companies on U.S. exchanges.

Disclosure: I am/we are short FSLY.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more