Cloudflare Could Burn Out When Lockup Expires

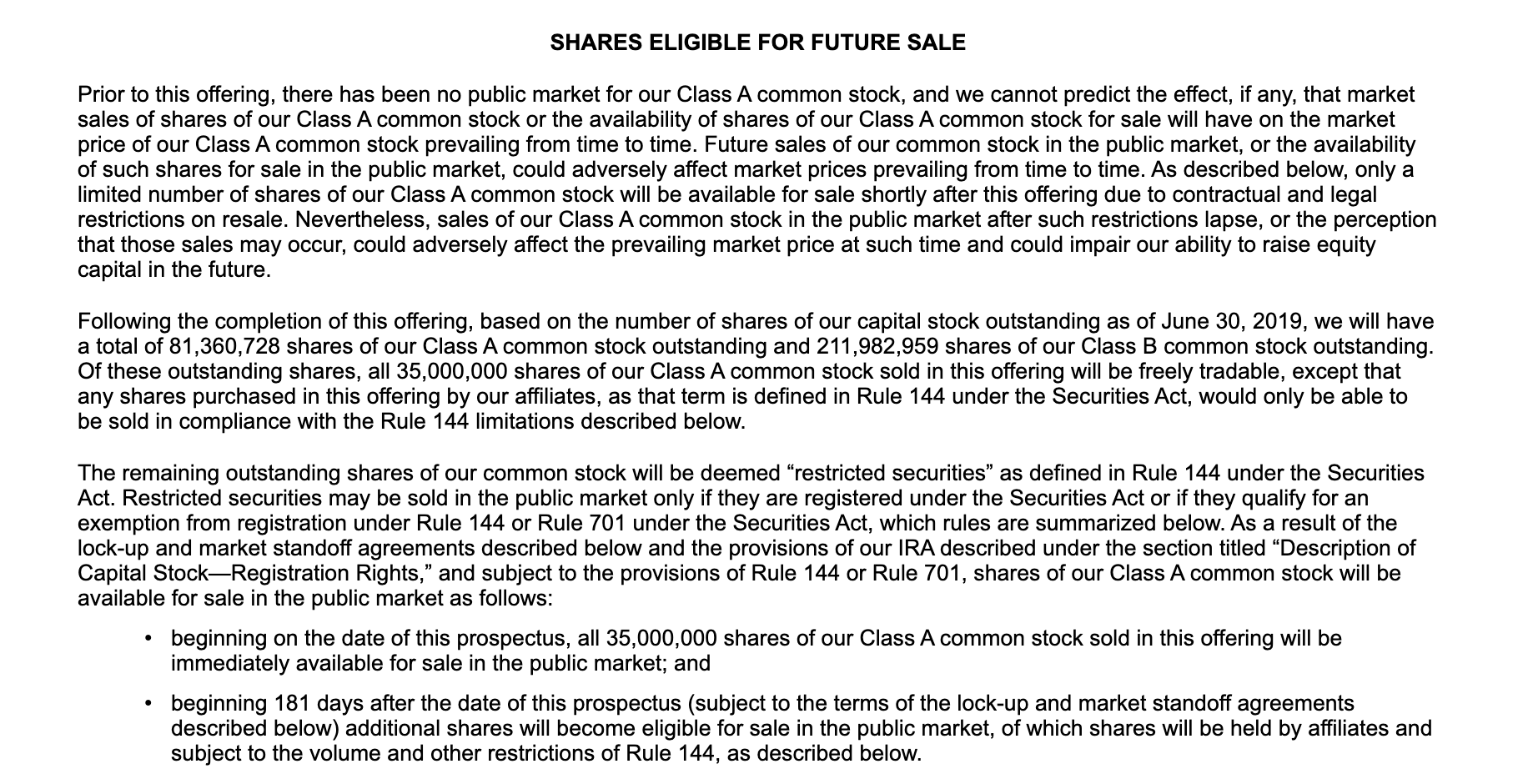

When the 180-day lockup period for Cloudflare Inc. (NET) expires on March 11th, pre-IPO shareholders and company insiders will be able to sell more than 46 million currently-restricted shares for the first time. This number of restricted shares outnumbers the 35 million shares trading pursuant to the IPO.

(Click on image to enlarge)

(Source: S-1/A)

Despite recent market volatility, NET's pre-IPO shareholders and company insiders still have a 55% return from IPO. We believe that this substantial return and ongoing volatility in the market might make at least some of these investors eager to cash in. Significant sales of previously-restricted shares of NET could flood the secondary market and cause a sharp, short-term, downturn when the IPO lockup expires.

Business Overview: Provider of Cloud Services

An increasing number of organizations are shifting their computing capabilities away from onsite servers to providers of cloud services. In its SEC filing, Cloudflare notes that the company is leading this transition.

(Click on image to enlarge)

(Source: company website)

Their proprietary cloud platform delivers a wide array of network services to organizations of all types and sizes. Their client base spans across many countries. Cloudflare states that its services offer greater security while improving the performance of critical systems. In addition, businesses that move to Cloudflare can reduce their expenses related to managing and maintaining private network hardware.

Cloudflare promotes its cloud platform as easy-to-use, easy-to-onboard, and scalable. The platform works across onsite, cloud, or hybrid environments by providing software-as-a-service (SAAS) applications.

As of June 2019, close to 10 percent of the Fortune 1,000 have adopted the Cloudflare platform. In addition, when taking into account the global internet, around 18 percent of the top 10,000 websites, 17 percent of the top 100,000 websites, and around 10 percent of the top one million sites use at least one Cloudflare product or service.

The company began by constructing their scalable network. From that foundation, Cloudflare creates what it calls interconnected flywheels to deliver its products and services. These include its Network Flywheel, which is the scalable, flexible network architecture; and its Product Flywheel, which deploys Cloudflare products.

Cloudflare’s clients include IBM, Marketo, Digital Ocean, Discord, Thomson Reuters, Zendesk, Hubspot, Crunchbase, OkCupid, Box, EuroVision, Montecito Bank & Trust, Findlaw, Upwork, Shopify, and Bidu.

The company has approximately 1,070 employees and keeps its headquarters in San Francisco, California.

Company information was sourced from the firm's S-1/A and website.

Financial Highlights

Cloudflare reported fourth-quarter financial highlights for the period ending December 31, 2019:

- Total revenue reached $83.9 million for a 51% increase year-over-year

- Gross profit totaled $65.7 million for a gross margin of 78.3%

- Loss from operations totaled $29.9 million, which represented 35.7% of total revenue

- Net loss totaled $28.2 million versus $16.7 million for the same period the previous year

- Net cash flow from operations was negative $8.6 million, which was an improvement versus a negative $12.3 million for the same period of 2018

Financial information was sourced from NET's website.

Management

CEO Matthew Prince is a co-founder of Cloudflare, and he has served as Chair of the Board of Directors since 2009. He co-founded Unspam Technologies and continues to serve as its Chair of the Board of Directors since 2001. He earned a B.A., an M.B.A. from Harvard Business School, and a J.D. from the University of Chicago Law School.

CFO Thomas Seifert has served in his position since June 2017. He previously held senior financial positions at Symantec, Brightstar, Advanced Micro Devices, IPG Photonics, and CompuGroup Medical SE. He earned a B.A. and an M.B.A. from Friedrich Alexander University in Germany. In addition, he earned an M.A. in Economics and Mathematics from Wayne State University.

Management bios were sourced from the firm's website.

Competition: Fastly, Imperva, and Akamai

Cloudflare faces direct competition from Imperva, Akamai (AKAM), CDNetworks, AWS, Fastly (FSLY), Limelight (LLNW), Edgecast, Swiftserve, MaxCDN, and Sucuri. They also face competition from service providers such as Amazon (AMZN), Microsoft (MSFT), and Google (GOOG).

Early Market Performance

The underwriters priced the IPO at $15 per share and NET had a first-day return of 20%. The stock rose to $20.96 on September 23 but then began a decline to $14.62 on October 22. The price recovered and stayed in the range of $18 to $19 until February 18 when it began a sharp increase to close at $22.11 on February 26. The stock currently trades in the $22 to $23 range for a return from IPO of 55.7%.

Conclusion

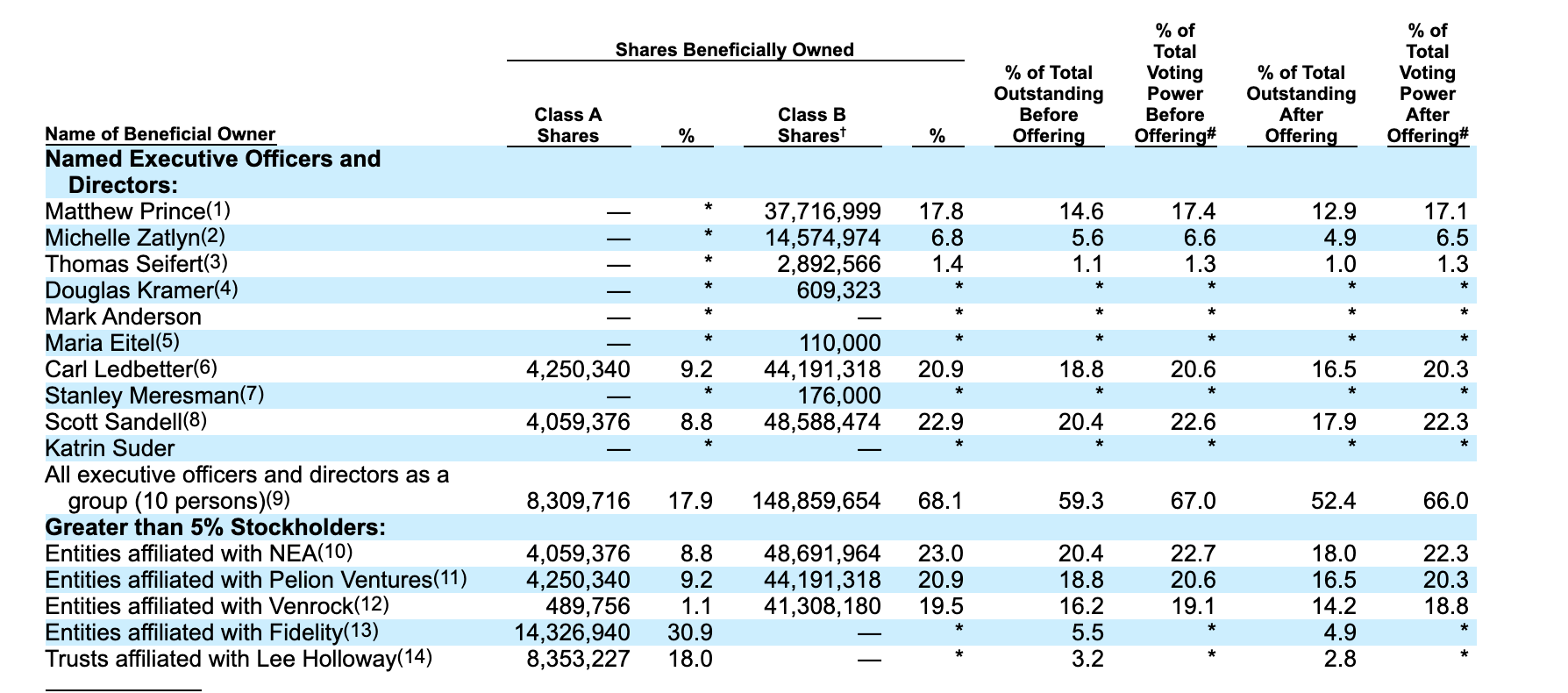

A large number of currently-restricted shares, significant return from IPO and plenty of insider shareholders and VC firms are all factors that could push NET lower when the IPO lockup expires. The list of pre-IPO shareholders and company insiders includes officers, directors, trusts and a number of VC firms.

(Click on image to enlarge)

(Source: S-1/A)

If just some of these currently-restricted shareholders decide to cash in on their gains from IPO, the secondary market for NET could be flooded with shares when the IPO lockup expires and cause a significant short-term downturn.

Aggressive, risk-tolerant investors should consider shorting shares of NET ahead of the IPO lockup expiration on March 11th. Interested investors should cover short positions during the trading sessions on March 12th and March 13th.

Disclosure: I am/we are short NET.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more