Understanding Momentum Investing

Momentum, the tendency of past winner stocks to outperform past loser stocks over the next several months, is one of the most well-documented and well-researched asset pricing anomalies. In our book, “Your Complete Guide to Factor-Based Investing,” Andrew Berkin and I present the evidence of a premium that has been persistent across long periods of time, pervasive around the globe and across asset classes, robust to various definitions, and survives transactions costs.

Bryan Kelly, Tobias Moskowitz, and Seth Pruitt contribute to the momentum literature and our understanding of the role momentum plays in portfolio performance with their February 2021 study “Understanding Momentum and Reversals” published in the June 2021 issue of the Journal of Financial Economics. They began by noting: “Despite its widespread influence on the finance profession, momentum remains a mysterious phenomenon. A variety of positive theories, both behavioral and rational, have been proposed to explain momentum, but none are widely accepted.” The objective of their study was to “reevaluate the momentum anomaly through the lens of conditional empirical asset pricing models. How much of the momentum premium can be explained by conditional risk exposure?” To answer the question, they used the method of instrumented principal components analysis (IPCA) to estimate latent factors and factor exposures. Their data sample covers the period 1966-2014 and 36 return characteristics.

Following is a summary of their findings:

- Momentum is a strong forecaster of future realized betas on the market return itself, as well as other popular asset pricing factors (such as the Fama and French five-factor model), over the subsequent year—the predictive power of the momentum characteristic for future betas is strong statistically and economically. For example, the estimated predictive coefficient for market beta indicates that when a stock moves from the 10th percentile of the momentum characteristic to the 90th percentile, its market beta increases by 0.20.

- Long-term reversal, another past return characteristic, has similar predictive power for betas, but short-term reversal has substantially weaker power to predict betas.

- Variation in stocks’ conditional risk premia is strongly linked to momentum through varying factor exposures, which dominate variation in risk premia due to momentum— the identities of stocks with the highest and lowest conditional expected returns are changing (rapidly) over time.

- The classic momentum strategy (top quintile minus bottom quintile of stocks sorted on past t−2 to t–12-month raw returns) yields a significant annualized return of 8.3 percent. However, sorting stocks on the predicted component of their returns coming from the conditional models yields momentum profits that were three to four times larger.

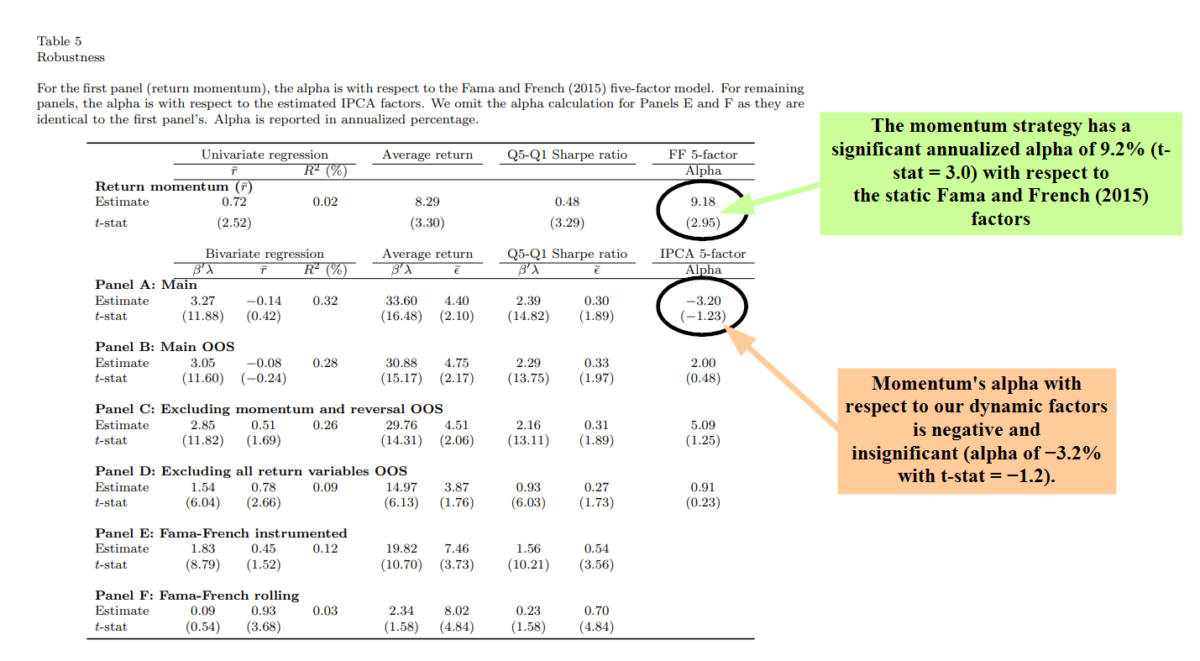

- The contribution of momentum to understanding time-varying stock expected returns was negligible after accounting for conditional factor risk compensation—whereas the momentum strategy had a significant annualized alpha of 9.2 percent (t-stat = 3.0) with respect to the static Fama and French (2015) factors, its alpha with respect to their dynamic factors was negative and insignificant (alpha of −3.2 percent with t-stat = −1.2).

- While traditional momentum strategies have shown to be prone to “crashes” (such as occurred in March 2009), crashes are essentially absent from the IPCA strategy. For example, while traditional momentum lost about 56 percent from March through May 2009, the IPCA strategy lost about 7 percent, and the largest loss was about 12 percent (around the unwinding of the tech bubble in March 2000). The IPCA strategy’s performance is only mildly affected by a momentum crash because it combines many strategies, some of which performed exceedingly well during the during crashes, and leverages their dynamic hedging behavior.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Their findings led Kelly, Moskowitz, and Pruitt to conclude:

“By carefully constructing factors that more accurately represent the conditional risk-return tradeoff, and with proper specification for time-varying conditional betas on these factors, we show that momentum returns exhibit large exposure to common risks.”

They added that the:

“main model-based strategy requires three times as much turnover as raw momentum [which has very high turnover which prevents the raw returns shown in the research from being realizable]. Hence, the gross performance we have reported is unlikely to be realized net of trading costs.”

However, they added that their:

“model-based strategy continues to achieve large Sharpe ratio improvements over momentum even after we constrain its turnover. For example, by dropping all return variables, we have turnover that is 10% lower than that of the momentum strategy. Yet this version of the model-based optimal strategy still returns, on average, 15% per annum with a Sharpe ratio of 0.9—much greater than that afforded by momentum. In short, there is scope for optimizing the three-way tradeoff between risk, return, and trading costs that makes the IPCA-implied strategy attractive for practical investment strategies.”

Their findings are consistent with those of Tarun Gupta and Bryan Kelly, authors of the 2019 paper “ Factor Momentum Everywhere,” (Summary) and those of Sina Ehsani and Juhani Linnainmaa, authors of the 2020 paper “ Factor Momentum and the Momentum Factor,” (Summary) who found that momentum in individual stock returns emanates from momentum in factor returns—a factor’s prior returns are informative about its future returns. They are also consistent with the findings of Erik Theissen and Can Yilanci, authors of the January 2021 paper, “Momentum? What Momentum?” who also found that momentum’s excess returns could be explained by time-varying factor exposures.

Investor Takeaway

The findings from these recent papers have important implications as they document that the apparent profitability of momentum strategies is, to a large extent, compensation for factor exposures (or risk). These strategies may thus be delivering risk premiums rather than abnormal returns.

The main takeaway for investors is that Kelly, Moskowitz, and Pruitt demonstrated that past return characteristics are strongly predictive of a stock’s realized exposures to common risk factors, providing direct evidence that price trend strategies are in part explainable as compensation for common factor exposures—past returns predict betas on factors and those factors have high average returns. With that said, it’s important to note that their findings do not necessarily imply that there is momentum in factors themselves as the benefits come from the shifting betas themselves. They also provided some new insights into how to improve return predictability. Their findings are consistent with prior research which has demonstrated that momentum in individual stock returns emanates mainly from momentum in factor returns—a factor’s prior returns are informative about its future returns. Thus, it seems likely that part of the momentum premium is explained by past returns predicting future betas, while another part of the momentum premium is due to momentum in factor returns.

Disclaimer: Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only. Past ...

more