Under The Spotlight: Johnson & Johnson

Johnson & Johnson (JNJ) and its subsidiaries have approximately 132,200 employees worldwide engaged in the research and development, manufacture and sale of a broad range of products in the health care field. Johnson & Johnson is a holding company, with more than 265 operating companies conducting business in virtually all countries of the world. The company’s primary focus is products related to human health and well-being. The company is organized into three business segments: Consumer, Pharmaceutical and Medical Devices.

MARKET LEADER

Sixteen-year-old Robert Wood Johnson first became interested in health care during the American Civil War when 720,000 Americans died, the vast majority due to infection and disease. In 1886, he launched Johnson & Johnson to produce the world’s first mass-produced sterile surgical supplies.

From its beginning, the company has been guided by a value system that prioritizes people ahead of profits. Shortly before Johnson & Johnson became a public company in 1944, those values were codified in the Johnson & Johnson Credo, tenets of high ethical behavior that continue to guide the company today.

Johnson & Johnson now sells everything from Band-Aids to hip replacements to pharmaceuticals and boasts more than 265 operating companies employing 132,200 people in virtually every country across the globe.

The company is organized into three segments: Pharmaceutical, Medical Devices and Consumer, which represent 54%, 29% and 17% of sales, respectively, as of March 29, 2020.

With a century-plus history of leading in times of great challenge, JNJ is leveraging its scientific expertise, operational scale and financial strength in its effort to advance the work on its lead COVID-19 vaccine candidate. A vaccine is critical to eradicating the pandemic. Johnson & Johnson is accelerating its R&D and manufacturing to produce one billion doses of the vaccine for emergency use authorization beginning in the first quarter of 2021 on a not-for-profit basis.

In the United States, Johnson & Johnson expects the country to reopen as new infections begin to wane; testing and diagnostics become more available; tracking devices are used; and therapeutics become available to treat the disease. Successful vaccines in 2021 will allow the world to manage COVID-19 and eventually put it behind us.

PROFITABLE OPERATIONS

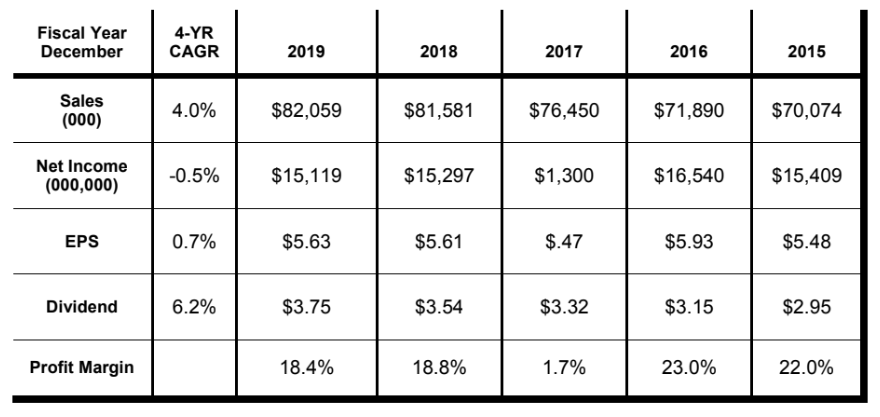

Johnson & Johnson’s after-tax profit margins averaged 16.8% during the past five years despite the impact of tax reform on reported results in 2017. Over the same period, return on shareholders’ equity averaged a profitable 19.6%.

STRONG CASH FLOWS

Strong free cash flow has enabled Johnson & Johnson to invest in acquisitions, innovation and strategic partnerships to accelerate growth in each of its business segments while returning more than $78 billion to shareholders during the past five years through share repurchases of $33 billion and dividends of $45 billion.The company’s capital allocation strategy is to first invest in the company’s organic growth business needs and then use free cash flow to increase its dividend. Johnson & Johnson uses excess cash for share repurchases and mergers and acquisitions to bolster its portfolio and enhance its pipeline.

FIRST QUARTER RESULTS

Johnson & Johnson reported first quarter sales increased 3% to $20.7 billion with net earnings rising to $5.8 billion. Pharmaceutical sales popped 9% to $11.1 billion, consumer health sales were up 9% to $3.6 billion and medical sales decreased 8% to $5.9 billion due to the deferral of medical procedures related to the COVID-19 impact.

During the first quarter, JNJ generated $2.7 billion in free cash flow and increased its dividend 6.3% to $4.04 per share, marking the 58th consecutive year of dividend increases. The dividend currently yields a healthy 2.8%. On 3/29/20, Johnson & Johnson held $18 billion in cash and investments and $25 billion in debt on its AAA-rated balance sheet, one of only two U.S.- based companies remaining with that top credit rating. JNJ expects full year sales in 2020 to decline 2% to 5.5% to a range of $77.5 billion to $80.5 billion. Adjusted EPS is expected to decline 9% to 13.6% to a range of $7.50-$7.90 due to the COVID-19 pandemic impact. Long-term investors should consider buying Johnson & Johnson, a high quality market leader with profitable operations, strong cash flows, a healthy balance sheet and growing dividends. Buy.