Under The Spotlight: Genuine Parts Company

Genuine Parts Company (GPC), 2999 Wildwood Pkwy, Atlanta, GA 30339 www.genpt.com

Genuine Parts Company is a distributor of automotive replacement parts in the U.S., Canada, Europe, Mexico, Australasia, France, the U.K., Germany, Poland, the Netherlands and Belgium. The Company also distributes industrial replacement parts in the U.S., Canada, Mexico and Australasia through its Industrial Parts Group. S.P. Richards Company, the Business Products Group, distributes a variety of business products in the U.S.

CONSISTENT GROWTH

Genuine Parts was founded by Carlyle Fraser in 1928 when Fraser bought a small auto parts store in Atlanta. With six employees and capital of $40,000, sales reached $75,000 the first year. After 92 years of steady progress, Genuine Parts’ sales motored ahead to more than $19 billion this year. With over half of the company’s revenues coming from auto replacement parts, Genuine Parts boasts the largest auto parts network in the world. The company provides parts to thousands of National Auto Parts Association (NAPA) stores across the United States and Canada. The auto parts business has also expanded through acquisitions in Mexico, Australasia and most recently in Europe.

After selling only auto parts for almost 50 years, Genuine Parts diversified its product lines into other large and fragmented end-markets, including industrial replacement parts and office supplies in the 1970s and electrical materials in the 1990s. In 2019, the Automotive Group accounted for 57% of sales, the Industrial Group represented 34% of sales, the Office Products Group accounted for 9% of sales and the Electrical Group, which was divested in 2019 as part of GPC’s ongoing portfolio optimization efforts, made up 3% of total sales.

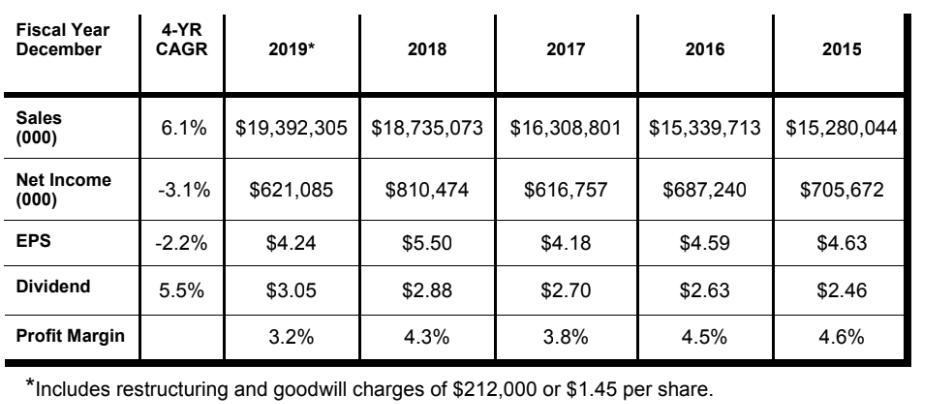

A hallmark of Genuine Parts has been the company’s consistent growth in sales, earnings and dividends. Sales have grown in 87 of the last 92 years while profits have risen in 75. Genuine Parts has paid dividends to shareholders every year since going public in 1948. In February 2020, the company increased the dividend by 4% to an annual rate of $3.16, marking the 64th consecutive year of increased dividends, a record matched by few other companies. The dividend currently yields an attractive 3.6%.

SMART CAPITAL ALLOCATION

Management is committed to creating shareholder value through a disciplined capital allocation strategy. With the business generating robust free cash flow, priorities for cash are to reinvest in existing businesses, make acquisitions to spur future growth, steadily increase the dividend as they have done for more than six decades and repurchase shares. Over the last five years, the company has returned $2.9 billion to shareholders through dividends and share repurchases. Genuine Parts targets acquisitions with returns on invested capital over 15%. Most of the acquisitions have been small bolt-on acquisitions for its various divisions, but in 2017, GPC made a $1.5 billion acquisition of U.K.-based Alliance Automotive Group which provided the vehicle to expand into Europe.

LONG-TERM GROWTH GOALS

Management aims to increase sales by 6%-8%, expand the operating margin, grow EPS by 7%-10%, generate solid cash flows and maintain a strong balance sheet. Genuine Parts is a high quality firm with a long track record of consistent growth in sales, earnings and dividends, a disciplined capital allocation strategy and solid long-term growth goals which should power future value for investors hopping on for the ride. We are adding to our position. Buy.