The Problem With The Supply Curve

Guest post by Dirk Ehnts, Econoblog101.

The Fallaceous Theory of Marginal Productivity

In his book Debunking Economics: The Naked Emperor of the Social Sciences, Steve Keen uses a 1952 paper to make a very important point about neoclassical economics: There is a problem with the supply curve.

In the paper, the authors asked business people what they thought their supply curve looked like. In neoclassical economics, the theory is quite clear what it should look like:

The supply curve slopes upwards, as a rise in supply can only be effected through an increase in price. The logic is that if you want to sell more of something, you will have to charge a higher price as it marginally gets more expensive to increase production. This is a central “insight" of neoclassical economics: resources are not limited, but rather they can be provided, given that the buyers are willing to pay a higher price.

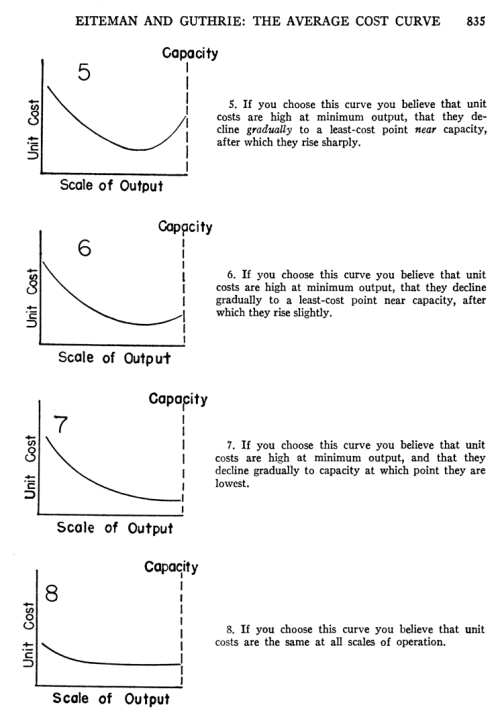

Interestingly, it should not be too hard to see whether this theoretical supply curve is a realistic description of reality. So, Eiteman and Guthrie in their AER paper presented some supply curves to businesspeople and asked them which ones would represent best the situation of their respective business. Here are four proposals (the other four received an insignificant amount of approval, so I did not bother to reproduce them):

All these curves are “far away" from the supply curve presented in neoclassical economics. Maybe number 5 is kind of close, at least at a significant scale of output. The table that the authors present is a nasty surprise for any neoclassical economist:

TABLE II.-CHOICE OF COST CURVE BY COMPANIES WiTHOUT REFERENCE TO NUMDBER OF PRODUCTS

Curve Indicated - Number of Companies

1 - 0

2 - 0

3 - 1

4 - 3

5 - 14

6 - 113

7 - 203

8 - 0

Total - 334

Have a look at curves 6 and 7 above. Number 7 received almost twice as much support as number 6, and that is a DOWNWARD SLOPING supply curve! The authors conclude:

“The replies demonstrate a clear preference of businessmen for curves which do not offer great support to the argument of marginal theorists."

To non-economists this is perhaps not that much of a surprise. If you produce more of something, you can use more machines and hence you will be more efficient. Prices would then be expected to fall. Industrial mass production typically features falling prices, as the expansion of output allows firms to operate at a larger scale, using more resources.

Eiteman and Guthrie conclude their paper with this statement:

“If the beliefs of businessmen in general coincide with those included in this sample, it is obvious that short-run marginal price theory should be revised in the light of reality."

That was in 1952, and microeconomics is still presented to young economists as an insight to build on. Never mind that later on increasing returns to scale are introduced - the whole foundation of modern micro has collapsed decades ago. What would companies like Amazon, Google or facebook say about their supply curves? If you would add another account at facebook, have another user using Google’s search engine or another user buying books at Amazon - would marginal costs increase? Obviously not.

Microeconomics, the behavior of firms and households, is very important. Starting the subject by repeating theories that should have long been discarded blocks more relevant approaches from being taught. These new approaches could provide proper foundations of the behavior of firms and households if they are not based on “economic laws" that are refuted by reality.

In the face of climate change and the fight against it economics needs to be reformed from bottom up. A microeconomic theory that basically says that resources are unlimited - if only buyers accept a rising price - is not a good way to start thinking about our economy. The supply curve should not slope upwards by default. It should be presented as something that is conditional on technology and regulation.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more