The Global Defense Industry - Here Are The Best To Buy

The Macro View

The Congressional-Military-Industrial Complex is alive and flourishing. This applies not just to the USA but to nearly every other republican democracy.

If your nation is an autocracy or oligarchy or mercantilist combination of the two, you don’t need to feed your draftees well. You don’t need to provide them housing comparable to the standards outside the military. You may or may not offer them health care during their time of service (perhaps only enough to keep them working for the time of their enlistment). You may not even need to train them to the highest standards or equip them with the tools to best protect them in combat. (An example: the Chinese draftees in the Korean War, only some of whom were issued rifles. The rest were to pick up the rifles of the dead or dying and continue the assault. The Chinese soldiers were following Mao Zhedong's theory of "man over weapons.")

If, on the other hand, you live in Israel, Canada, the United States, the UK, Australia, France or any of the other democracies of the world where the population is thought of as individuals rather than masses or classes, you need to spend the money to ensure your people are the best trained they can be and have the tools to defend themselves as capably as is possible. Equipment costs, in other words, begin at a higher baseline when each human life is considered precious. Is it “worth” $25,000 an hour to have a fast-burner respond to a surrounded SOF team on the ground? If you are one of those team members or their family, it sure as hell is.

The second factor in making democracies with parliaments and such spend more than they would absent their congresses: the Congressional-Military-Industrial Complex, with the emphasis on “Congressional.”

I wish I could take credit for the term “Congressional-Military-Industrial Complex,” but I have merely juxtaposed the original wording. It is the most accurate term that well describes how most nations and armed movements defend their sovereignty or make war on their neighbors and those unwilling to submit to them.

The author is former president Dwight David Eisenhower. It is most often the warrior who hates war the most. Ike was no different. He understood the necessity for a strong military, but he detested the waste he saw in the inefficient acquisition process.

One of President Eisenhower’s early biographers, Geoffrey Perret, reported that an earlier draft of his Farewell Speech to the nation used the phrase "military-industrial-congressional complex," but the word "congressional" was dropped from the final version to appease members of Congress that his successors would have to deal with. If that draft had remained, it would be a far more accurate reflection of the reality of defense spending. Here’s why, using a hypothetical example.

Let’s say the U.S. military would like to have a certain capability, for instance, a long loiter-time robotic de-mining capability without putting human beings in harm’s way. The various companies within the defense industry see they could do well by doing good and they bid on the contract, detailing why their particular vision and capabilities to deliver the best product should win out. So far, so good. The Congress intervenes. The members’ basic question, no matter how cleverly they phrase it (or try to conceal it) is, “How much pork can I bring home to my district so I can get re-elected?”

A capability deemed desirable by the military and able to be designed, prototyped, accepted and built by industry - with an eye on their bottom line - suddenly finds itself held hostage to the demands that function “x” or part “y” be made by a sub-contractor, not because the original bidder can’t do it themselves but because the sub-contractor is located in Congress critter “Z's” home district.

The result is pretty much a certainty that the de-mining robot will be built overbudget and delivered late. Don’t get me wrong! Cutting-edge technologies requested by materiel acquisitions officers may already be rife with too many conflicting add-ons. For instance, industry may already recognize that their bid was so low that cost over-runs are necessary to finish the production, but they are confident the prototype will wow the audience enough to get a little extra funding. But it is members of Congress’ insistence that pork be larded to their districts that puts the whole thing over the edge.

The combination of all the above leads to the following sort of budgeting. I am using the US as an example, but it is similar around what Vladimir Putin sneeringly calls “the liberal world.”

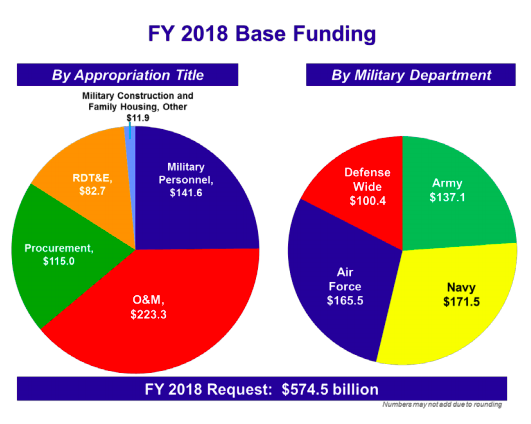

(Source: Defense.gov)

As you can see, in fiscal year 2018, American taxpayers paid $115 billion for Procurement - that is where the “defense industry,” Congress and the military primarily intersect. Yet, because the US and like-minded nations must always stay on the cutting edge of defending against threats from some quarters, that figure is just ("just," as if this were a minuscule amount!) $32 billion more than the nation spent on RDT&E (Research, Development, Test & Evaluation). It is $27 billion less than the nation spends on its personnel. (This includes education, housing, health care, student loan forgiveness, the Forever GI Bill and many other benefits offered to retain the best and compete with civilian employers.) And of course, all are dwarfed by O&M (Operation and Maintenance), as they should be.

I have no doubt there is room for cost savings in each of these areas. I am also ever mindful, however, of then US ambassador to the UN Madeleine Albright screaming at then Chairman of the Joint Chiefs of Staff, “What's the point of having this superb military you're always talking about if we can't use it?” In his memoirs, Powell recalled that he told Albright that GIs were "not toy soldiers to be moved around on some sort of global game board."

My own answer to her rebuke would be, “So we never have to use it.” A nation with a powerful defense capability is more likely to walk the dark streets of the neighborhood without harm than a nation that hollows out its forces solely in the name of donating more dollars to the “mandatory” portion of the national budget. In the example of the USA, that total federal budget looks like this:

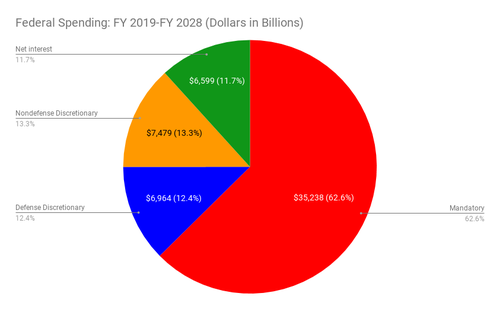

(Source: FreedomWorks.org)

So-called “mandatory spending” - Medicare, Social Security, Medicaid, Income Security, etc. - is taking about 63% of all tax and other federal revenues and is expected to continue to do so. Next comes “non-defense discretionary” at 13.3%. I would argue that the fraud, waste, abuse and bureaucracy in the biggest portion of the pie alone could easily fund far more of the “non-defense discretionary” spending (education, health, housing, transportation, etc.), but that is beyond the purview of this topic.

What we see next is quite germane, however. Defense is projected to average 12.4% over the coming decade, but our government has so indebted itself by borrowing too heavily that net interest on our debt is expected to average 11.7%! That is the biggest travesty, I believe. All we would have to do in order to fund all non-mandatory programs to a much higher degree is to live closer to our means and we could see that $650 billion bogey begin to shrink. Or we could continue to spend, spend, spend and borrow, borrow, borrow and watch interest alone overtake defense spending!

Now Let's Talk Investments

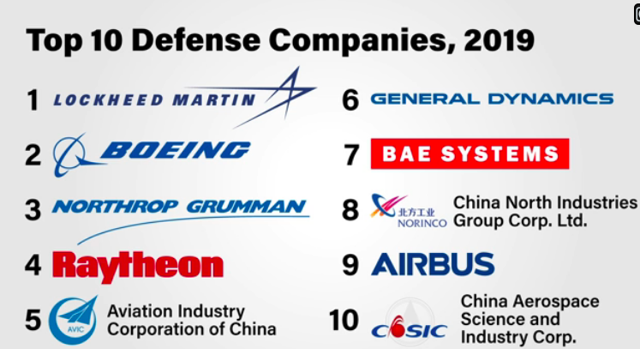

We now delve into that portion of the defense budget inhabited by the “defense contractors.” Of course, this does not just mean armament, airplane, aircraft carrier, submarine etc. builders. It includes those firms that supply services to personnel, adjunct health providers, researchers, and so on. In fact, many of the firms we think of as hardware providers also do many of these things as well. Here is a list of the world’s 10 biggest defense contractors by defense-related revenue:

(Source: Defense News)

You might be surprised to see that only five of these firms are U.S. companies. Three are Chinese firms, BAE Systems (OTCPK:BAESY) is British and Airbus (OTCPK:EADSY) is an EU firm. Most of the time, the free world defense contractors are competitors, but even at the biggest of the big, they sometimes cooperate with each other when one has a skill-set or technology the other needs. Case in point: just this week, it was announced that BAE, as a global leader in electronic warfare, was awarded a contract by primary F-35 contractor Lockheed Martin (LMT) to enhance the offensive and defensive EW (electronic warfare) capabilities of the fifth-generation fighter aircraft.

During my service in the military, it would have been inappropriate for me to own any defense firm. At various times in my investing career since retirement, however, I have owned the first four on this list as well as BAE. I would not buy any of them at today’s prices.

However, I most certainly would buy Raytheon (RTN) on any pullback to the $160s or so. In fact, I owned shares in our Investors Edge Growth & Value Portfolio (available to our Marketplace subscribers) until very recently. Late in a bull market, as I perceive we are today, I tend to use a lot of trailing stops. My RTN position was sold for a tidy profit, but I have not yet re-entered the position.

Why Raytheon? I have made money on it every time I have purchased. But that is no reason to buy today. Today RTN is simply, in my opinion, the preeminent provider of integrated net-centric defense systems and missile systems of any free-world competitor. In addition, it is superb in the intelligence and information domain and, more and more, in airborne and space systems. This last might well turn out to be the company's biggest revenue producer over the coming years. Raytheon “might” also become the #2 aerospace and defense firm on the planet if its planned merger with United Technologies (UTX) - also a former holding of mine - is completed.

Not bad for a company founded in 1922 as the American Appliance Company. What we now call Raytheon became an important government contractor during World War II, when it manufactured hardware that pushed the envelope in essential radar technology - and, like so many defense projects, laid the groundwork for the invention of the microwave oven. (It was a Raytheon engineer, Percy Spencer, who, while working in the magnetron labs in 1945, noticed that microwaves from an active radar set he was working on started to melt a chocolate bar he had in his pocket. The first food deliberately cooked with Spencer's microwave was popcorn, and the second was an egg, which exploded in the face of one of the experimenters. Not so much has changed, has it?!)

Fast forward to Raytheon today. Among its better-known proprietary or jointly developed products are the Patriot air- and missile-defense system; the AMRAAM, Sidewinder and Maverick missiles; the Common Ground Control System; the Global Hawk integrated sensor suite; Iron Dome and David’s Sling systems; the Paveway laser-guided bomb; and Tomahawk cruise missiles.

All this just barely scratches the surface. Raytheon is a leader in ISR (Intelligence, Surveillance and Reconnaissance), C5I (Command, Control, Communications, Computers, Cyber, and Intelligence), navigation, communications and space systems and integration.

Patriot Missile

(Source: Raytheon website)

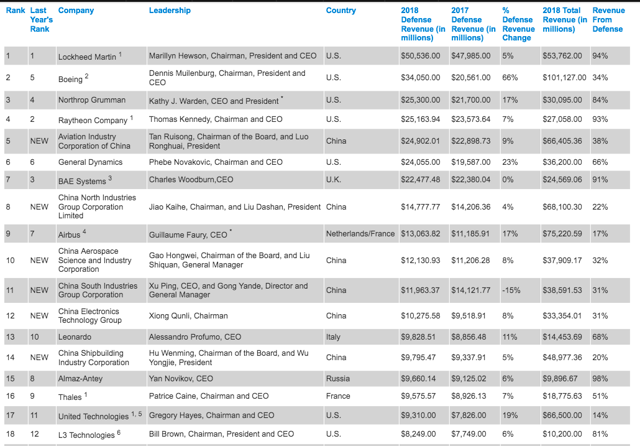

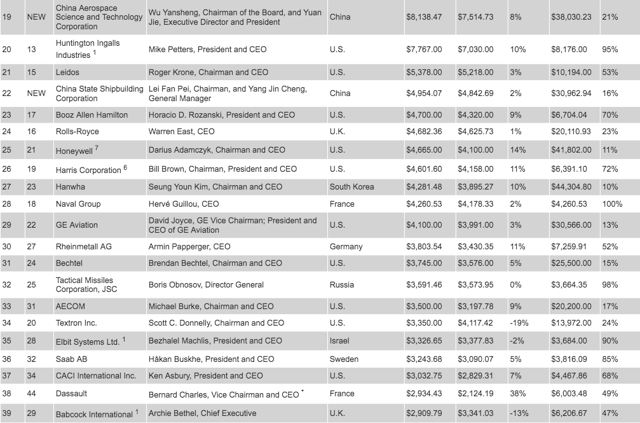

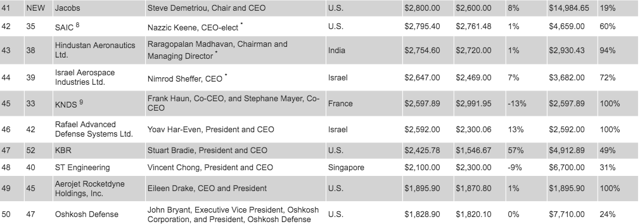

Here are the top 50 companies in terms of defense-related revenues:

(Source: Defense News)

I have shown only the Top 50 from the Top 100 for this article. However, my favorite ETF in the Defense Sector is primarily concerned with the next 50 and beyond. What makes this ETF a smart choice is that, if you are in this business, you need to be very big to get the big contracts or relatively small to placate all the members of Congress. The middle-of-the-pack firms tend to be trying to break out, usually by a merger of equals, while the smaller firms are happy with their profitable niche.

I will point out a couple items of interest regarding the Top 100 list:

- Of the top 5 US companies, 3 are run by very capable women. Just sayin’.

- Of the next 10 companies ranked from 11-20, #11, #12, #14, and #19 are all People’s Republic of China companies. Add that to the #5, #8, and #10 company - in case you were wondering how your consumer goods dollars for Chinese products are being spent!

- Some familiar names actually didn’t even penetrate the top 20 - Honeywell (HON), Harris Corp., L3 (LLL), CACI International (CACI) and SAIC, for instance. However, the merger between L3 and Harris (#s 18 and 26) (LHX) will now catapult them into the Top 10. This is a good example of the "merger of equals" I mentioned above.

- Also, you’ll notice there are only 2 Russian companies in the Top 50. No matter the saber-rattling and cyber-hacking, the Russian defense industry simply doesn’t have the clout it once did. It seems to be cutting corners to stay relevant. After Putin’s boast about their hypersonic weapons that can evade any US or free-world defenses, it seems one flew 35 miles, 2 others apparently did not fire and the most recent one blew up, emitting radiation (it is nuclear-powered) at 16 times the normal level and killing five scientists outright.

On the other hand, three excellent Israeli companies punch through to the top 50 – Elbit Systems (ESLT) at #35, Israel Aerospace Industries (privately held) at #44, and Rafael Advanced Defense Systems (also private) at #46.

So this article does not become a book-length analysis, let me cut to the chase: Elbit is my favorite defense company, even at today’s price. I say at today’s price because I bought it in February for my clients and subscribers’ model portfolio at $123.95. After the carnage on Friday, Elbit still closed at $159.37.

Why Elbit? After all, Raytheon is also at the top of my list and sells at a lower P/E. My concern is that there are bound to be speed bumps on the way to RTN and UTX merging. I will place an opportunistic below-market buy on Raytheon. I am willing to buy ESLT at its current price.

Elbit Systems, like Raytheon, has expertise in all the important cutting-edge technologies in the aerospace and defense world: EW, SIGINT (Signals Intelligence), electro-optics, C5I, Land and Naval systems, unmanned aircraft, artillery, airborne electronics, communications and navigation systems, and so much more. It is, at its heart, an intelligence and information company, ensuring that information flows across the entire battlespace, no matter the vehicle, sender or receiver.

ESLT may be an Israel-based company, but its reach is global. It is, in fact, becoming a major supplier to US, EU and other nations and international agencies. The company is well-diversified across the battlespace spectrum but also diversified well geographically. I believe Elbit’s best growth is yet ahead of it.

Elbit has one other thing going for it, as well. While it also must deal with conflicting opinions and designs in the Knesset, must satisfy the requirements and demands of the military and must strive to make a profit, ESLT has one strong advantage over most defense contractors around the world. If the company's systems fail to deliver what it promises, it may be an existential mistake. Israel is always besieged on all sides, sometimes physically and violently, always with probing assaults and attacks in both the physical and cyber domains. This is a company that innovates for the survival of its workforce and fellow citizens - and is tested regularly.

How About a Mutual Fund or ETF?

If you are more a mutual fund or ETF buyer, there is only one fund/ETF I would buy in the global defense sector. Most of them are "me-too" and market-cap weighted, which means they buy the biggest of the big that have already appreciated beyond what I think they are worth. I see little growth in share price from these firms.

I cannot do justice to the one fund/ETF I see as generating future outsized returns without spending at least a full page or two - and I have already run on long enough! Instead, I promise to discuss that one early next month, certainly for subscribers and perhaps for all SA readers thereafter.

Good investing.

Disclosure: I am long ESLT. Stovepipes are dangerous to your wealth.If you buy only tech, only defense, only REITs, or only anything, it will add both volatility and risk.At Investor's ...

more